Feeling Overwhelmed by Money Worries? Here’s How to Take Back Control

Money worries can feel like a heavy weight on your shoulders. Whether it’s mounting bills, job uncertainty, or a dwindling savings account, the stress can be all-consuming. You might even feel like there’s no way out, but take a deep breath—there are steps you can take. Let’s explore practical ways to navigate these stormy financial waters and help you regain control and confidence over your money.

Acknowledge Your Feelings and Take a Pause

First things first: worrying about money is normal. Many of us have been there at some point, staring at our bank balance, feeling overwhelmed. Acknowledge those feelings without judgement. It’s okay to feel anxious or scared. But remember, emotions can cloud judgement, so taking a pause is important. A quick walk, some deep breaths, or even journaling about your fears can help clear your mind, giving you the space to think more logically.

Know Where You Stand Financially

Once you’re in a calmer state, it’s time to take stock of your current situation. This may feel daunting, but knowledge is power. Create a list of your assets, debts, income, and expenses. You can do this with a simple pen and paper, a spreadsheet, or by using one of the many budgeting apps available like SNOOP. Seeing everything in black and white will help you better understand where the pressure points are and what needs to change.

Here’s what you can include:

- Assets: Cash in bank accounts, any valuable items you could sell, investments, etc.

- Debts: Credit card balances, loans, overdrafts.

- Income: Salary, side hustle income, any government benefits.

- Expenses: Rent, utilities, food, entertainment, subscriptions, and so on.

This process, while uncomfortable, often has a calming effect. It turns vague fears into concrete numbers that you can begin to work with.

Identify the Immediate Problem

If you’re worried about money, there’s probably a specific issue causing it. Are you struggling to pay bills, or are you just generally anxious about the future? Identifying the core problem will help you figure out the best solution. Common money worries often fall into categories like:

- Not Enough Income: Your job isn’t paying enough to meet your monthly needs.

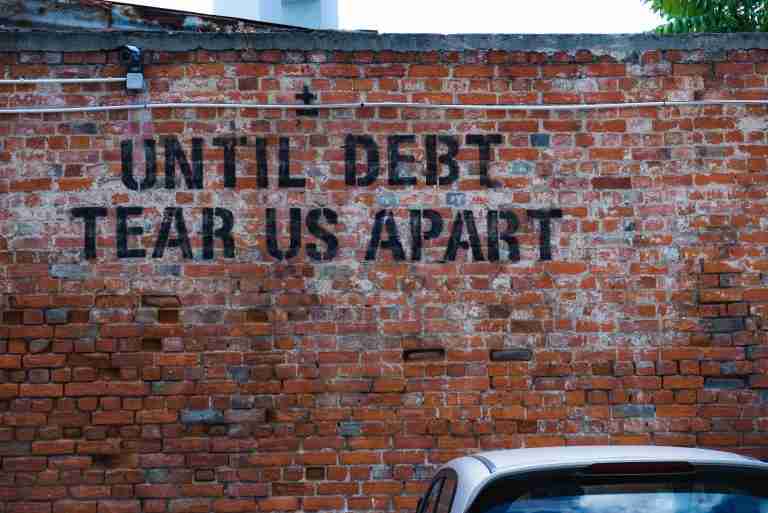

- Too Much Debt: Interest and repayments are eating away at your income.

- Unexpected Expenses: Something like car trouble or medical bills has thrown off your financial balance.

Create a Budget That Reflects Your Reality

A budget can sound like a scary word, but it’s really just a plan for your money. A realistic budget helps you see how much is coming in, what’s going out, and where you might be able to make changes. A few budgeting tips to help you out:

- Categorise Your Spending: Split your spending into essentials (like rent, bills, and groceries) and non-essentials (like dining out and entertainment).

- Identify Areas to Cut Back: Could you switch to a cheaper phone plan, reduce your takeaway coffee habit, or cancel unused subscriptions? Small changes add up.

- Prioritise Needs Over Wants: This may involve difficult decisions. Needs come first, and anything left over can be allocated to wants—or, ideally, to savings.

Build an Emergency Fund, Even If It’s Small

An emergency fund can be a financial lifesaver. It’s there to cover unexpected expenses without the stress of wondering how you’ll pay. If money is tight, building a substantial emergency fund might feel impossible—but it doesn’t need to be huge to make a difference. Start small, even if it’s just £20 a month. The key is to make saving a habit. Over time, those small amounts will add up, and your peace of mind will grow alongside them.

Contact Creditors or Seek Financial Help

If you find yourself falling behind on bills or loan repayments, ignoring the issue is not the answer. Most creditors would rather help you figure out a way to pay than see you default entirely. Contact them and explain your situation—they may offer you a reduced payment plan or a temporary freeze.

There are also many charities and organisations that offer free financial advice. In the UK, groups like StepChange, Citizens Advice, and National Debtline can provide support, often at no cost.

Increase Your Income if Possible

If your expenses far exceed your income, reducing spending alone may not be enough. It could be time to think about ways to boost your income. This might be a side hustle, selling unused items on platforms like eBay or Facebook Marketplace, or even asking for more hours at work. Even small boosts in income can make a significant difference when dealing with money worries.

Here are some ideas for increasing income:

- Freelancing: Use skills you already have, such as writing, graphic design, or tutoring.

- Gig Economy Jobs: Apps like Uber, Deliveroo, or TaskRabbit can provide flexible work options.

- Online Surveys and Testing: Websites like Swagbucks and UserTesting won’t make you rich, but they can provide a little extra cash to cover small expenses.

Seek Support—You Don’t Have to Do It Alone

Money worries can be isolating, but remember that you don’t have to face them alone. Talking about money, especially when things are tough, isn’t easy. But confiding in a trusted friend or family member can reduce the burden. They may have ideas or simply provide the emotional support you need to tackle your situation.

If speaking with someone close feels too awkward, a financial coach or advisor can provide a non-judgemental ear and actionable advice to help you move forward.

Set Small, Achievable Goals

When you’re stressed about money, big goals like “paying off all my debt” or “having a huge savings pot” can feel impossible. Instead, break these larger goals into small, achievable steps. For instance, aim to save £50 this month, or reduce your grocery bill by £10. Small wins lead to momentum, and momentum leads to progress.

Remember to Care for Your Mental Health

Financial stress can take a toll on your mental health. It’s essential to care for yourself in this challenging time. Practice self-care techniques, whether it’s through exercise, meditation, or simply spending time doing something you love. Also, if your anxiety feels overwhelming, consider seeking professional help from a counsellor or therapist—they can provide coping mechanisms to manage stress and support you as you work on improving your financial situation.

Educate Yourself About Money Management

Knowledge is a powerful antidote to financial worry. The more you understand money, the better equipped you’ll be to make smart decisions. There are numerous resources out there—from books to podcasts to online courses—that can help you boost your financial literacy.

Consider these books and podcasts:

- Books: Your Money or Your Life by Vicki Robin provides some great insights.

- Podcasts: The Meaningful Money Podcast and The Martin Lewis Podcast offer relatable and practical advice that’s particularly suited to the UK audience.

Focus on What You Can Control

Some money worries stem from things beyond your control, such as economic downturns, market crashes, or a sudden job loss. Try to focus your energy on what you can control—your spending, your saving, and how you manage stress. Worrying about things you can’t change will only add to your stress, whereas concentrating on actionable steps can bring you a sense of empowerment.

Plan for the Future, But Be Flexible

When times are tough, it can be hard to think about the future—but having a financial plan can give you a sense of direction. Even a basic plan can help, including paying down debts, building an emergency fund, and setting achievable savings goals. However, remember that life is unpredictable. Plans might need to change, and that’s okay. Flexibility is key in managing both finances and the stress that often comes with them.

Celebrate Your Progress

When you’re worried about money, it’s easy to focus on what’s still wrong. But take time to recognise any positive steps you’ve taken—even small ones. Did you manage to reduce your grocery bill this week? Celebrate that. Did you pay off a small portion of your debt? Give yourself credit. Progress, no matter how small, is still progress, and celebrating it will keep you motivated to continue improving.

FAQ: What to do about money worries

1. What should I do if I can’t pay my bills this month?

If you’re unable to pay your bills, the most important thing is to communicate with your creditors. Contact them as soon as possible to explain your situation—they may offer options like a reduced payment plan or a payment holiday. You can also reach out to organisations like Citizens Advice or StepChange for guidance and support.

2. How can I budget when my income is inconsistent?

When dealing with irregular income, focus on your average monthly income over the past few months and budget conservatively. Prioritise essential expenses first, such as rent and utilities. Create a list of variable expenses and identify where you can cut back during lean months. Having an emergency fund can also help smooth out the ups and downs.

3. Should I pay off debt or save money first?

This depends on your situation. Generally, it’s wise to have a small emergency fund (e.g., £500) to cover unexpected expenses before focusing on paying down high-interest debt. Once high-interest debt is under control, you can balance both saving and paying off remaining debts.

4. How do I stop feeling overwhelmed by money worries?

Feeling overwhelmed is common, but taking action can help you regain a sense of control. Break tasks into small, manageable steps—like creating a budget, setting a savings goal, or reaching out for support. Remember to celebrate small wins and take care of your mental health through self-care and, if needed, counselling.

5. Where can I get help if I need financial advice?

There are many organisations that provide free financial advice in the UK. StepChange, Citizens Advice, and National Debtline are all excellent resources that can offer support and guidance tailored to your situation.

Final Thoughts

Worrying about money can feel like a never-ending cycle, but remember, you are not alone, and there are ways to alleviate that stress. Acknowledge your feelings, get a clear understanding of your situation, create a budget that works for you, and set realistic goals. Seek support if needed, and above all, be kind to yourself—financial well-being is a journey, not a destination.

Take it one step at a time, and remember that every little action adds up. The weight of money worries doesn’t need to define your life, and with some practical steps and support, you can find a way to feel financially secure and happy again.

If you would like some help with your money worries