Starting over with nothing after divorce (rebuilding financially after divorce)

Starting over with nothing after divorce. OK, so it happened. It’s all over. As it turned out, she, he, or they was not the one. They were a bit of a **** (fill in the blank).

We’ll take it as read that the lawyers or councillors have done what they need to do, and you have got what your share is.

Of course, it could mean you got half or even more of everything. But half of nothing is still nothing. Divorce, when you are broke, means you are broke on your own now.

Divorce can be one of the most challenging life experiences that a person goes through. For some, starting over after divorce can seem impossible – especially if you have no money and nowhere to go. But it is possible to rebuild your life, even if it feels like everything is against you. Here are some tips for starting over after divorce when you have nothing.

Take this marriage thing seriously – it has to last all the way to the divorce.

-Roseanne Barr

Table of Contents

How to start over after divorce with no money

If you’ve recently been through a divorce and find yourself without much money, don’t despair. It may seem challenging to start over, but it’s possible. Here are some tips on how to make it happen:

1. Evaluate your finances and create a budget.

The first step is to sit down and figure out exactly where you stand financially. Consider your income and expenses, including alimony or child support if applicable. Once you have a clear picture of your financial situation, you can create a budget to help you stay on track going forward.

2. Consider downsizing your lifestyle.

If your income has decreased significantly or your expenses are too high, it may be necessary to change your lifestyle. This could include selling your home and moving to a smaller one, getting rid of your car or cutting back on other expenses like vacations or entertainment.

3. Build up an emergency fund.

One of the best things you can do for yourself financially after a divorce is to build up an emergency fund. This will help you cover unexpected expenses in the future so that you don’t have to rely on credit cards or loans. Try to save at least 3-6 months’ worth of living expenses to prepare for anything.

4. Invest in yourself.

Don’t forget to invest in yourself. This may include taking classes or getting training to improve your job prospects. It can also mean taking care of your physical and mental health so that you’re in the best possible shape to take on the challenges ahead.

Divorce can be difficult and stressful, but it doesn’t have to ruin your financial future. By taking some proactive steps, you can make sure that you’re on solid footing moving forward.

5. Get help from a financial planner.

If you’re not sure where to start or how to move forward after a divorce, consider talking to a financial planner. They can help you assess your situation and create a plan for moving forward that makes sense for your unique circumstances.

No matter your financial situation after a divorce, know that it’s possible to get back on track. By taking some simple steps and getting help when needed, you can make a fresh start financially and create a bright future for yourself.

What does a good life look like after divorce?

If you’re trying to get somewhere, it’s generally good to know where it is your trying to get to. You need to have a vision of what a good life looks like. With this, you can then start building towards it.

What would a basic, leisurely and luxury lifestyle look like?

What would you be living in and on? What would you be eating? Where would you be going on holiday? Who would you be mixing with, and what would you be doing with them? What would your hobbies be?

And what might all of this cost?

Can you estimate or guess or guesstimate?

Don’t forget, though when you are pricing this up the difference between needs and wants. You need food, water, shelter and the occasional break, but you don’t need long-haul holidays, latest gadgets and a new car. These are just things you want.

Distinguishing between needs and wants might be the difference between reaching and not reaching your goals.

| Basic | Leisurely | Luxury | |

| Accommodation | |||

| Holidays | |||

| Hobbies | |||

| Working | |||

| Income | |||

| Travel | |||

| Add lines | |||

| Add lines |

Once you have these figures, you know where you are trying to get to. You have a target.

Now it’s time to figure out where you are starting from, how far you might be from it, and what you need to do to get there asap.

“You know why divorces are so expensive? Because they’re worth it.”

Henry Youngman

How do you survive financially after divorce?

Well, it’s probably a good time to review where you are. Are you really at zero a bit above or even below zero with debt?

If you are struggling financially after divorce, it’s probably best to steady the ship and see where you are taking in water, if you are expecting any rough seas ahead – enough of the sailing metaphors.

You need to figure out where you are right now. What are you currently worth? How much money is coming and going out? Paint a picture of what a good life looks like now and use all this info to figure out how to afford life after divorce.

My mother always said, don’t marry for money, divorce for money.

-Wendy Liebman

Starting over with nothing after divorce: Obviously, we are breaking up, right?

How do I rebuild after divorce?

Take stock of where you are financially right now.

Gather the data to see how good, bad or ugly it is.

List all your assets (I know, you said you had nothing) and all your liabilities (or debts).

Assets will be any savings, investments, or pensions if you own a house or part-own one now and add all these up.

If you have debts, list them in terms of which ones are the most expensive like to be those with the highest interest rates. This will probably be debts like credit cards, store cards and car loans.

Now you have your assets and debts listed you can see where you are starting from.

Get yourself a paper or online file to list and detail your financial position.

“Instead of getting married again, I’m just going to find a woman I don’t like and give her a house.”

Lewis Grizzard

Draft a getting out of debt plan

Having a plan to get out of debt is like to be a good idea.

Two common ways to deal with debt are the snowball or avalanche methods. Both involved making the minimum payments on all debts but then:

For the snowball method, you pick the smallest debt and pay it off quickly. Then moving on to the next smallest debt and so on.

For the avalanche, you pick the one with the highest interest rate, pay that down as fast as you can, then move on to the next highest until they are all gone.

If you are in a debt crisis, you might need specific advice. Free support can be found at Stepchange and the money advice service.

“The happiest time of anyone’s life is just after the first divorce.”

John Kenneth Galbraith

Credit repair after divorce

Repairing your credit score after divorce can be complicated, but it’s not impossible. Here are a few tips to help you get started:

- Check your credit report for errors.

- Dispute any inaccurate information on your report.

- Pay down your debt as much as possible.

- Make on-time payments every month.

- Keep your credit utilization low (try to keep your balances below 30% of your total limit).

- Don’t open any new accounts until your credit score has improved.

- Seek professional help if you need assistance repairing your credit score.

Do you know where your money goes?

Yep, I know you probably don’t want to hear it, but you probably need a budget. You need to understand where all your money is going.

Where your money comes from could be relatively simple, a job or some maintenance if you are lucky.

It’s where your money is going that provides a more detailed picture of what you are currently prioritising and how quickly you might run out of it.

You can do it old school by writing down everything you spend and or collecting your receipts and entering into spreadsheets, or you can use a banking app.

After a bit of setting up, lots of banking apps help you analyse where your money is going in almost real-time.

“The only time my wife and I had a simultaneous orgasm was when the judge signed the divorce papers.”

Woody Allen

How to afford life after divorce

Well if you want to avoid poverty after divorce, you might need to tighten your belt for a while.

Frugality aye? That sounds like fun.

It’s a lot more fun than further financial problems after divorce due to overspending.

Now there is only one income you might find you need to be a little more frugal in the way you use your money.

Set up a spending plan (a cunning way to avoid saying BUDGET), where you detail where you want your money to go, track it and review it every day, week month to see if things are under control and on track.

Living within your means is a lot more fun than creating even more debt after divorce. OK, creating debt might be fun, but like any party, the actual or moral hangover causes the pain.

Probably better to stop digging while you are already in a hole.

“Marriage is the chief cause of divorce.”

Groucho Marx

How to recover financially after a divorce: build an emergency fund

Maybe you need to hold back on everything “you” really wanted while recovering after the separation.

Start rebuilding your finances with an emergency fund. 3 to 6 months’ worth of expenses to ride out any storm, car or house repairs, loss of job and global pandemic’s those sorts of things.

This emergency fund will help prevent you from going into debt, and trying to cover the costs of something going wrong.

Remember an emergency fund is an emergency. Get on with building one

“When you’re a monk, you’re not allowed to have sex with anyone. When you’re married, it’s one person. That’s one more than a monk. It’s not that different.”

Russell Brand

What should I update after divorce?

Here are a few ideas for you to think through. Think of it as a divorce checklist. A bit like a Christmas list but potentially a lot darker or brighter depending on your outlook.

If you’re changing your name or trying to decouple financially, you might need to inform or change a few of the things below.

Here are a few things to think about

- Driver’s license

- Passport

- Phones, utilities, internet and other subscription services.

- Updating all your banks and other financial accounts

- Credit cards – yep they still want their money back

- Mortgages and other debts

- Student loans – from when you were young and full of hope

- Insurance policies – so they cover the right person

- Your work – especially any benefits you had like death in service that you don’t want going to a certain you know who now!

- Your will, who do you want your WHAM posters to go to now?

- Voter registration

- Your local council for local taxes etc.

If you have a more complicated setup, i.e. kids, joint assets and liabilities etc. it’s probably a good idea to get professional advice.

You may also want to look at your credit score and determine if or how you want to separate yourself financially in the eyes of the credit agencies.

“He taught me housekeeping; when I divorce, I keep the house.”

Zsa Zsa Gabor

how to start over after divorce with no money

Starting over with nothing after divorce: summary table

| Aspect | Description |

|---|---|

| Assess your financial situation | Evaluate your current financial status, including income, assets, debts, and expenses, to understand your financial starting point. |

| Create a new budget | Develop a budget that reflects your post-divorce income and expenses, ensuring it aligns with your new financial circumstances. |

| Separate financial accounts | Establish individual bank accounts and separate your finances from your ex-spouse to gain financial independence and control. |

| Seek legal advice | Consult with a divorce attorney to understand your legal rights and obligations, especially regarding property, assets, and support. |

| Secure housing | Determine your housing needs and explore options such as renting, downsizing, or seeking assistance from local housing programs. |

| Establish an emergency fund | Start building an emergency fund to provide a financial safety net for unexpected expenses or emergencies that may arise. |

| Update important documents | Review and update legal documents such as wills, insurance policies, and beneficiary designations to reflect your new circumstances. |

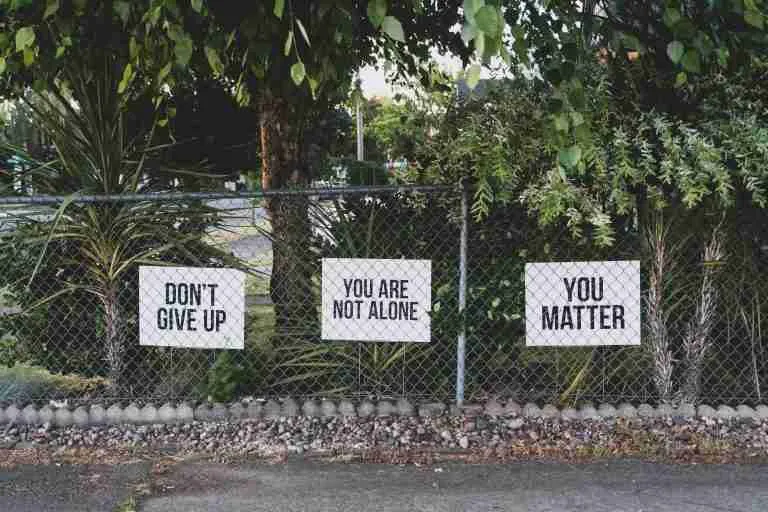

| Seek emotional support | Reach out to family, friends, or support groups to find emotional support during this challenging time of starting over. |

| Pursue new employment | Assess your skills and explore job opportunities to secure employment that aligns with your goals and provides financial stability. |

| Focus on self-care | Prioritize self-care and well-being by engaging in activities that promote physical and emotional health as you rebuild your life. |

FAQ: Starting over after divorce with no money

How do I cope financially after divorce?

First, it’s important to remember that you are not alone. According to the latest statistics, one in every four marriages ends in divorce. So you’re not the only person who’s going through this.

There are a lot of things you can do to cope financially after divorce. Here are a few tips:

1)Get financially organised and take control of your money

2) Review your budget and make adjustments.

3) Reach out to family and friends for help and support.

4) Take advantage of free or low-cost counselling and financial planning services.

5) Take some time to be clear on what good looks like now

6) Automate as much of your savings and investing as much as you can

How long does it take to financially recover from divorce?

This is a tricky question to answer. The financial recovery process after divorce will vary depending on several factors, such as the couple’s overall financial situation, the division of assets, and each individual’s circumstances. However, some general guidelines can provide a framework for understanding how long it may take to recover financially from a divorce.

For instance, if a couple has significant assets and/or property to divide, the financial recovery process may take longer than if the couple has fewer assets. Additionally, if either party experiences problems with employment or income after the divorce, this can also prolong the financial recovery process. Most experts agree that it generally takes two to five years to reach some level of financial stability.

What is the usual financial split in a divorce?

The financial split in a divorce is typically 50/50. This means that each person gets half the marital assets and half the marital debts. There are some exceptions to this rule, such as when one spouse is awarded sole custody of the children or when one spouse earns significantly more than the other. But in general, the 50/50 split is pretty standard.

How do you leave your husband when you can’t afford it?

If you’re considering leaving your husband but can’t afford it, there are a few things you need to do first. Get a handle on your finances. This will help you determine how much money you’ll need to support yourself. Then, start saving as much money as you can. It will add up over time, even if it’s just a little bit each week. Think about ways to increase your income. Can you get a better paying job? Start a side hustle? Lastly seek the advice of professional counsellors to help you in your situation.

What financial help can I get after separation?

Many different types of financial assistance are available to those who have recently separated from their spouses. The best way to find out what help you may be eligible for is to speak with an experienced family law attorney or accountant. Some of the most common forms of financial assistance after separation include

-Spousal support/maintenance: This is generally paid by the higher-earning spouse to the lower-earning spouse and is meant to help them maintain their standard of living. The amount and duration of spousal support is determined based on a number of factors, including each spouse’s income, earning potential, health, and custody arrangement.

-Child support: This is paid by the non-custodial parent to the custodial parent and is meant to help cover the costs of raising the child. The amount of child support is determined based on a number of factors, including each parent’s income, the number of children, and the custody arrangement.

-Property division: In many separations, the biggest financial issue is dividing upthe couple’s assets and debts. This can be a very complex process, especially if the couple has a lot of property or if there is disagreement about who should get what.

-Taxes: Separating couples often have to deal with a number of tax-related issues, such as who will claim the children as dependents and how to file taxes if they are now living in different locations.

– Insurance: Health insurance is often one of the biggest concerns for separating couples. If you were dependent on your spouse’s health insurance, you may be able to continue coverage under their plan for a period of time. Alternatively, you may be eligible for government-sponsored health insurance, such as Medicaid or CHIP.

In most of these cases, you will need to speak with an experienced attorney/accountant or lawyer/attorney to find out what options are available.

Who pays the mortgage during a separation?

Both parties are usually still liable for the mortgage during and even after divorce. If one spouse doesn’t make the payments, the other spouse will still be held responsible.

Sometimes, however, the court may order one spouse to pay the entire mortgage if the other spouse can’t afford it or if there is a large income disparity. If you’re facing this situation, you must speak with an experienced attorney who can help you understand your rights and options.

Starting over after divorce at 50

Starting over after divorce at 50 can be daunting, but it’s not impossible.

Here are a few tips to help make the process a little bit easier:

-Give yourself time to mourn the end of your marriage. It’s natural to feel sad and angry after a divorce, and allowing yourself time to grieve is essential.

-Lean on your friends and family for support. They will be there for you during this difficult time.

-Take care of yourself both mentally and physically. Exercise and eat healthy foods to help keep your mind and body strong.

-Don’t be afraid to start over again. You’re not alone in this journey – many people have gone down this path before and created a brighter future for themselves.

How to survive a divorce financially.

Unless you have a solid grasp on your finances, divorce can be a very costly and emotionally devastating experience. Here are some tips to help you survive financially after a divorce:

1. Get organized. Before you can understand your financial situation, you need to get organized. Gather all your financial documents—bank statements, investment records, credit card bills, etc.—and put them in one place. This will give you a good starting point to develop a plan.

2. Understand your income and expenses. Take some time to sit down and track your monthly income and expenses. This will help you determine where your money is going and what adjustments need to be made to free up some cash flow.

3. Make a budget. Once you understand your income and expenses, you can begin to develop a budget. A budget will help you track your spending and ensure that your bills are paid on time. It is also an excellent tool when negotiating with your ex-spouse on financial matters.

4. Consider selling some assets. Sometimes, selling some of your assets may make sense to free up cash. This could include selling your home, car, or other property. However, you should always consult a financial planner before making significant decisions.

5. Get help from a financial planner. If you are having trouble understanding your finances or developing a plan, consider seeking out the help of a financial planner. A good financial planner can help you create a budget, invest your money wisely, and make sound financial decisions.

Divorce is never easy, but following these tips can help ensure that it doesn’t destroy your finances. With some planning and effort, you can survive divorce financially and move on to a better future.

How do you restart your life after divorce?

After a divorce, it can be challenging to know where to begin and how to move forward. Here are some tips on restarting your life after divorce:

Give yourself time to grieve: Divorce can be emotionally draining, and it’s okay to take time to process your feelings and emotions.

Focus on self-care: Take care of yourself physically and mentally by eating well, exercising, and seeking support from friends and family.

Rediscover your passions: Use this opportunity to explore your interests and hobbies and to find new ones that bring you joy and fulfilment.

Set goals for yourself: Create short-term and long-term goals for your personal and professional life, and work towards achieving them.

Seek professional help if needed: If you’re struggling to cope with the emotional aftermath of divorce, consider seeking professional counselling or therapy.

Be open to new experiences: Try new things, meet new people, and be open to new opportunities that come your way.

Remember that restarting your life after divorce is a process that takes time. Be patient with yourself and don’t be afraid to seek help when you need it.

How to survive a divorce with no money

Divorce is difficult and can be incredibly challenging when you have no money. Here are some tips on how to survive a divorce with no money:

Seek legal aid: Look for free or low-cost legal aid services. They can provide legal advice and help you navigate the divorce process.

Create a budget: Make a budget that outlines your expenses and income. Try to reduce your costs as much as possible and reduce unnecessary spending.

Seek financial assistance: If you’re struggling financially, consider applying for government assistance programs like food stamps or housing assistance.

Find a support system: Lean on your friends and family for emotional support. Consider joining a support group for people going through a divorce.

Be resourceful: Look for ways to make extra money, such as selling items you no longer need, taking on freelance work, or finding a part-time job.

Negotiate with your spouse: If possible, try to negotiate to come to a mutually beneficial agreement on things like property division and spousal support.

Remember that surviving a divorce without money is not easy but possible. Seek help when needed, be resourceful, and take things one step at a time.

Summary: Starting over with nothing after divorce

Rebuilding financially after divorce can seem daunting, but it is a task that can be tackled and overcome day by day.

Figure out what success looks like after divorce. Figure out what a basic, leisurely and luxury lifestyle might cost and start budgeting, saving and investing towards it.

Figure out what you have got. Make a list of everything you own and owe.

Figure out where it is all going. Set up a budget and monitor where your money is going. Adjust as necessary to live within your means.

Get a debt plan. Figure out what you will do with your debt and how you will manage it and get rid of it

Build an emergency fund. Get 3-6 months of expenses saved for the next rainy day—Cos it’s coming.

Update your details. Who do you need to tell that it’s just you now, change details and separate your records?

Starting over with nothing after divorce is not going to be easy, but with a few clear steps, you can start to rebuild for a brighter financial future.

Need a Helping Hand with Your Finances? 🤝💰

If you’ve made it this far, congratulations! You’re already taking steps towards a healthier financial future. But maybe you’re feeling a bit overwhelmed. Maybe the thought of budgeting, saving, and investing still makes you break out in a cold sweat. Don’t worry, you’re not alone, and help is available.

At Financially Happy Money Coaching, I understand that money isn’t just about numbers. It’s about emotions, behaviours, and life choices. That’s why we’re here to help you take the stress out of money and build wealth in a way that aligns with your values and lifestyle.

Whether you’re just starting out on your financial journey or you’re looking to take your finances to the next level, we’re here to guide you every step of the way. I’ll help you understand your financial behaviours, set realistic goals, and create a personalized plan to achieve those goals.

So, why wait? Start your journey towards financial happiness today. Remember, the best time to start was yesterday. The second best time is now.

Click here to schedule your consultation and let’s make your money work for you, not vice versa. 💪💰

Remember, financial freedom isn’t a destination; it’s a journey. And every journey is easier when you have a guide. So, let’s embark on this journey together and create a financially happy future. 🚀💸

📚 Financial Freedom Resources

- The Ultimate Guide To Building Your Savings to $100,000! 📘 is a transformative book that equips readers with principles, strategies, and the mindset 🧠 needed to reach a $100,000 savings goal 💰. It’s a journey towards financial freedom 🚀, challenging beliefs 🤔, embracing new habits 🔄, and overcoming obstacles 💪.

- How to Manage Your Finances: Your Guide to Financial Freedom 📘 is a comprehensive resource packed with practical advice on budgeting 💰, investing 📈, reducing debt 💳, and building wealth 💎. It’s an essential guide for anyone, novice or experienced, aiming to take control of their financial future and achieve financial independence 🚀.

- Mastering Budgeting in Your 40s: Your Guide to Financial Freedom 📘 is your essential roadmap to financial savvy. Packed with tips on budgeting 💰, investing 📈, and debt management 💳, it’s the perfect toolkit for anyone in their 40s looking to secure their financial future and sail towards independence 🚀.

Remember, self-study is a powerful tool for life and financial transformation. Happy reading! 🎉