Money stress is killing me! 5 ways to take the stress out of money.

Money stress is killing me. How can I stop stressing about money?

Money is a widespread source of anxiety in any household. How to get more of it, how to keep it and what to do with what you have. And of course, paying for all the things you need and want.

Money stress can be a major killer, both figuratively and literally. Money stress can lead to all sorts of problems in your personal life, including depression, anxiety, relationship difficulties, and health problems. Stressing over money can increase your risk for heart attack and stroke literally killing you!

There are many ways to reduce the amount of money stress in your life. Some people find it helpful to create and stick to a budget religiously. Others find it helpful to cut back on their expenses bit by bit until they have more breathing room in their budget. Still others find it helpful to take on additional work or start a side hustle to make more money. Whatever route you choose, just remember there is no need to let money stress take over your life.

Putting a few key systems in place can ease many of your money stresses helping you live a Financially Happy life.

In this article, we will cover some of the ways to manage it and still live a happy, healthy life.

1. Begin with the end in mind

Imagine you wake up tomorrow and all your financial stress has gone.

What has happened overnight? Has your financial situation become clearer, have your debts been paid off or have you had a massive pay rise?

When you begin to think about what you want your life to look like and in particular what you want your financial situation to look like you can often figure out what you need to do.

I’m not saying that is necessarily going to be easy or that you will even like doing it, but it is often quite simple to see what you need to do.

Having a vision of what you want your life to look like instead of what you don’t want it to look like could help you monitor and manage your money habits to your advantage.

What would someone who has their finances under control look like? Or in this case, what would someone who doesn’t suffer from money stress look like? What would they be doing with the money that you are not?

Would they be

- saving regularly

- managing and monitoring their spending daily weekly or monthly

- managing and or minimising their debts?

- planning their spending

- Spending money they don’t have

- trying to keep up with friends and neighbours with Instagram lifestyles

Living within their means is the most significant thing that anyone or family is doing to try and reduce their money stress or financial anxiety. They have some sort of plan for their money right now and for things they need or want in the medium to long term. Whether that is a house, car, Holidays or having enough money to deal with unexpected emergencies.

Ultimately people with less money stress or financial anxiety have an idea when they want work to become optional and have a plan for better or worse to reach that goal as soon as possible or within a given time frame.

Could you begin to come up with a plan for yourself and all your family that would help you get your finances in order and help to reduce your money stress?

2. Get your sh*t together

I know what you’re thinking, you’re thinking whaaaat! I’m too cool for school I’m not doing any admin that’s for somebody else to do.

OK so point me towards the person that’s doing your admin? Hmm, should be you really, shouldn’t it?

So let’s start with your paperwork what sort of order is it in?

Maybe your answer to this is it’s all in one draw/shoebox/pile on the floor.

How has that been working out for you then? I imagine it’s not been that clear where or what is going on in any of your finances.

So let’s start with a clean slate and try and establish a system that works for you and makes it easy to find critical documents.

you could file things by

- bank or provider name

- house car or other items

- by service insurance utility’s loans

- whatever way makes sense to you an easy your management of those things

Putting your poop in a group will help ease the spaghetti junction of documents and papers that add to your money stress.

Take control of your paperwork, and you should feel your money stress dropping a little now that it is clear what is going on.

3. Build an emergency fund

A crucial part of removing money stressed and financial anxiety is to know that you have a safety net in place. A financial safety net that will help you avoid financial ruin if or when things go wrong.

An emergency fund is a stash of cash to help you overcome most financial difficulties.

It’s generally three to six months’ worth of spending. Still, you might want to adjust this to your circumstances or your desire to avoid risk or have greater financial safety uncertainty.

For instance, if you are in a sector or job which you think will be challenging to find another job or contracts are very uncertain maybe you need something like 6 to 12 months savings put aside in an emergency fund.

How do I build an emergency fund? Well, first you need to calculate what does one month’s living costs look like to you. Then you need to time this number by three or six.

Remember to take into account or at least think about those months that are more expensive than others. You might also want to think about Holidays and birthdays and how these might affect your monthly expenses and how you might want to factor these into your emergency fund.

Now you need to act like your emergency fund is an emergency and scrimp and save everything you can to get to your emergency fund amount.

Keep this emergency fund in a separate account from your day to day expenses. Come up with some rules about how and when you can access this money. For instance, an unexpected weekend away is not an emergency. Therefore something like this needs to be saved for in its own right, raiding the emergency fund for non-emergencies should not be allowed.

4. Automate your finances

Put the robots in charge.

You can set your finances up now for nearly everything to happen automatically. Bills and that’s can be paid on time savings can be automatically transferred to your emergency fund or day to day accounts with just a small bit of admin to set it all up.

Automating your finances probably takes out the weakest link in your financial system, i.e. you.

Automating your finances will help take out the endless and tiring decision-making around money. It will just happen in the background without you needing to get involved or make day to day decisions around money.

This should help with bills being paid on time and your savings starting to grow even if only little by little.

The fact that you are now not needing to make every single payment going into your account transferring the money should help with reducing your money stress.

You can also use some money apps that are out there now that will help you budget and track you’re spending on a real-time basis. This will help you keep on top of your money so that you know how much money you have in all your accounts and if you need to make any immediate, short or long term changes to your finances.

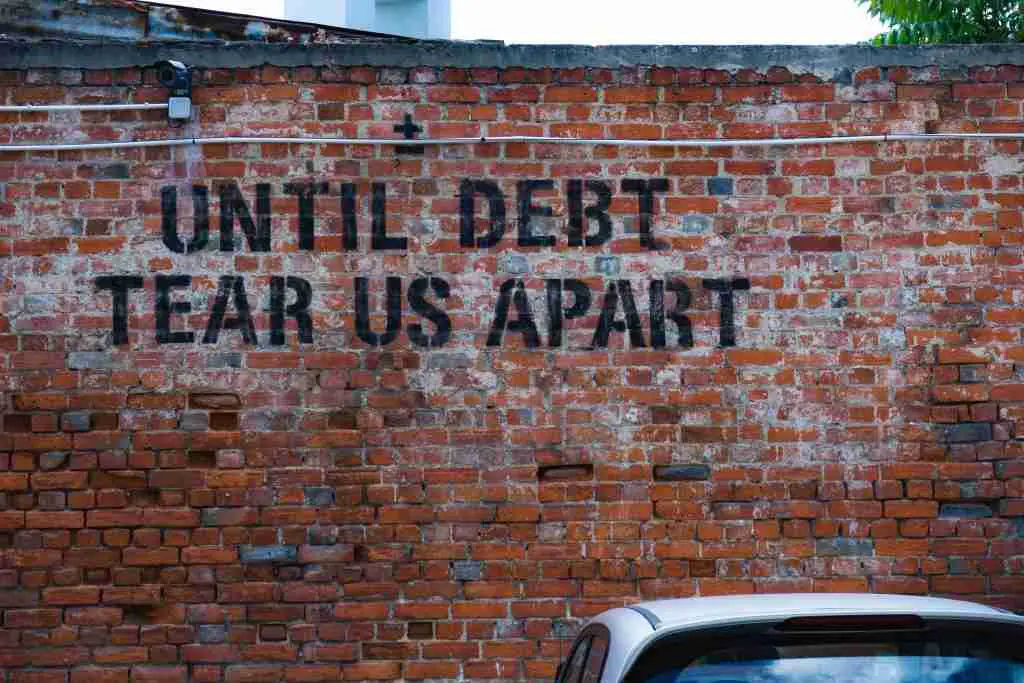

5. Dealing with debt

If you are dealing with debt, this can have a significant effect on your anxiety and stress around money.

Here we are mainly talking about high-interest debt such as credit cards, payday, or car loans. Of course, your mortgage debt may also be causing you problems if you are struggling to cope with it.

The best way to deal with debt is to accept the reality and come up with a plan to deal with it and then stay out of debt.

You need to make sure you are always paying the minimum amount required on any debt to avoid growing interest charges, but you then need to think about what is your plan for this debt.

Is it to keep paying it forever and ever or is it actually to get rid of that debt?

How to pay off debt

There are two well-known ways to pay off debt. One is called a debt snowball, and the other is called the debt avalanche.

The debt snowball is where you start with the smallest debt paid off and then move to the next one and then the next one and the next one slowly building up to paying off the most significant debt.

The psychology behind the debt snowball is that the quicker you can make progress on paying off debts, the more motivated you will be to keep going. As you chalk off each debt repaid, you will find more energy to move to the next and then the next.

The debt snowball is a way at chipping away at your debts rather than trying to pay them all off at once, which might be too big a debt snowball to eat at once.

The 2nd way to pay off debts is called a debt avalanche. This is where you start with the debt with the highest interest rate and throw everything you have at that trying to pay this one off as quickly as you can.

With the debt avalanche method, you make minimum payments on all your debts and then work hard to pay off the highest interest rate debt as quickly as possible.

How to stay out of debt

The key with any debts that you have, whether they be credit cards car loans or store cards is also to spend a little bit of time reviewing how and why you got them.

Spending a little time just thinking about why you bought the thing you purchased, how much joy or use it has brought you might help you reflect on whether you want to buy that again.

Given how these purchases may have added to your money stress, maybe avoiding other items like this and only buying what you have the money for might help reduce your financial anxiety.

If you are dealing with crippling debt, then you might need outside professional help which you can get from either step-change or the money advice service. These are both free services offering debt advice.

FAQ: Stressing about money

How to not let debt stress you out

You can do a few things to stop debt from stressing you out.

First, make a budget and stick to it. This will help you stay on top of your bills and avoid overspending.

Second, set up a system to automated your payments so you don’t have to worry about forgetting to pay a bill.

Third, keep an emergency fund so you have money set aside in case of an unexpected expense.

Fourth, talk to someone who is knowledgeable about personal finance to get advice on how to better manage your money.

Taking these steps will help reduce the amount of stress you feel about debt and help you take control of your finances.

How do I stop stressing about money?

Get organized.

One of the best ways to reduce stress is to get your finances in order.

This means keeping track of your income, expenses, and debts to clearly understand your financial situation. This can help you Identify areas where you may need to cut back or make adjustments in order to free up some money.

Once you know whats going on you can set a course to start saving and building wealth.

How to deal with money stress

There are a few things you can do to help reduce money stress:

-Create a budget and stick to it.

-Make a plan for how you will pay off your debts.

-Invest in yourself by taking courses and learning about financial planning and investing.

-Talk to a financial planner or therapist who can help you develop a plan and provide support.

-Live below your means so you can save more money each month.

-Remove the temptation to spend money by freezing your credit cards or limiting your spending to essentials only.

-Reward yourself for meeting financial goals by treating yourself to something special (within reason)

How to get rid of financial stress

There are a few things you can do to get rid of financial stress:

-Make a budget and stick to it.

-Cut down on expenses wherever possible.

-Invest in yourself by taking courses and learning new skills that will help you get ahead financially.

-Stay positive and don’t dwell on the negative aspects of your financial situation.

-Take action and make changes rather than waiting for things to happen.

Is it normal to stress over money?

It’s normal to stress over money because money is a big part of our lives. We need money to pay for basic necessities like food and shelter, and we use money to buy things that make us happy.

Some people worry about money more than others, and there are lots of different reasons why someone might stress about money.

Maybe they grew up in a family that didn’t have much money, so they’re worried about not being able to provide for their own family in the future.

Or maybe they’ve had some bad experiences with money in the past, like losing a job or going into debt.

No matter what your reason for stressing over money, there are ways to manage your anxiety, make peace with and improve your financial situation with a few simple steps.

Is money the biggest stress in life?

Money probably close to one of the biggest stressers in life.

However, many other things can cause stress, from personal relationships to work responsibilities.

That said, money can certainly be a major source of stress for many people. Whether it’s worrying about making ends meet or feeling like you’re never able to get ahead, financial concerns can take a toll on your mental and emotional health.

If money is something that’s stressing you out, there are steps you can take to ease your anxiety and get your finances under control.

Getting yourself financially organised is a great first step to figuring out whats going on. And remember, no one has perfect finances—we all have ups and downs.

Can financial stress kill you?

Financial stress can take a toll on your mental and physical health. It can lead to feelings of anxiety, depression, and hopelessness.

Unmanaged financial stress can cause an array of physical symptoms, from headaches and insomnia to digestive issues and heart palpitations.

Over time, these symptoms can contribute to a weakened immune system, leaving you more vulnerable to illnesses and disease. In extreme cases, this could contribute to a shortened life.

The best way to manage financial stress is to create a budget, make a plan to pay off debt, and create a savings plan.

Additionally, setting a realistic financial goal and taking steps each day to reach it can help you build a more stable financial future.

How do I stop stressing over money?

Money can be a major source of stress, especially when it feels like there’s not enough of it.

To reduce stress around money, it’s important to take a step back and evaluate how much you do have and how much you need.

To start, set a budget and make sure to stick to it. By creating a budget and tracking your spending, you can better understand where your money is going and what things you can cut back on.

Additionally, try to find ways to increase your income. This can include working extra hours, taking on a side job, or looking into sources of grants or scholarships.

Finally, explore options to reduce or eliminate your debt. Consider consolidating your debt with a loan or transferring it to a credit card with lower interest rates.

Taking the time to plan and manage your finances will help you feel more secure and decrease stress.

Why does money make me so stressed?

It is understandable that money can be a source of stress for many people.

Money can be an important source of security, but it can also be a source of tremendous pressure and anxiety.

Many people feel a lot of responsibility to make good financial decisions, and the fear of failure can be quite overwhelming.

Furthermore, financial instability can lead to feelings of insecurity and fear. It is important to understand why money is such a source of stress and to develop coping strategies to help manage any anxiety or worry.

Taking a step back to assess your finances and create a plan of action can help to alleviate some of the stress associated with money.

Additionally, seeking professional help or advice may be beneficial if the stress is overwhelming.

What is money dysmorphia?

Money dysmorphia is a condition in which people associate their self-worth and/or personal value to their financial wealth or status.

It can manifest as either an obsession with acquiring or maintaining wealth, or conversely, as a fear of ever-increasing debt or becoming financially unstable.

In both cases, it can lead to a range of psychological issues such as depression, anxiety, and worry.

Money dysmorphia can also lead to compulsive behavior, such as excessive hoarding or overspending, as well as an inability to make rational decisions when it comes to personal finances.

Those affected often lack the ability to adequately assess risks and rewards when making financial decisions, leading to even greater difficulties in the long run.

Final thoughts on Money stress is killing me

Begin with the end in mind of what you want your life to look like can help set you they cleared the direction to head in and help you decide which path will get you there either the quickest or the smoothest.

Getting your paperwork sorted will help remove some confusion and anxiety around where or what your money is doing. Get yourself a file some dividers and start ordering your paperwork.

Build yourself an emergency fund of three to six months or whatever size seems appropriate to you to ride out any likely financial challenges. This way, you can sleep at night easily knowing you have enough money to cover your lifestyle costs until hopefully, you can find another income.

Automate your finances. This will reduce the amount of time you need to spend jumping in and out of your bank accounts to set things up he should make sure that bills are paid on time and that savings happen automatically. You can also find apps that will give you real-time information on when and where you’re spending your money.

Dealing with debt. Make sure you make minimum payments on all your debts to avoid further interest adding to your debt. Decide on a plan for dealing with your debt, whether using methods like the debt snowball or the debt avalanche, to start freeing yourself of this financial and money stress source.

Money stress is killing me table

| Area | Action |

|---|---|

| Begin with the End in Mind | Define your financial goals and envision the life you want. Develop a clear vision to motivate and guide your actions. |

| Get Your Sh*t Together | Take control of your finances by organizing and assessing your financial situation. Create a comprehensive financial plan. |

| Build an Emergency Fund | Establish a safety net by saving money to cover unexpected expenses and emergencies. |

| Automate Your Finances | Simplify your financial management by setting up automatic payments, transfers, and savings contributions. |

| Dealing with Debt | Develop a strategy to manage and reduce your debt effectively. Explore debt repayment options and seek professional help if needed. |

Need a Helping Hand with Your Finances? 🤝💰

If you’ve made it this far, congratulations! You’re already taking steps towards a healthier financial future. But maybe you’re feeling a bit overwhelmed. Maybe the thought of budgeting, saving, and investing still makes you break out in a cold sweat. Don’t worry, you’re not alone, and help is available.

At Financially Happy Money Coaching, I understand that money isn’t just about numbers. It’s about emotions, behaviours, and life choices. That’s why we’re here to help you take the stress out of money and build wealth in a way that aligns with your values and lifestyle.

Whether you’re just starting out on your financial journey or you’re looking to take your finances to the next level, we’re here to guide you every step of the way. I’ll help you understand your financial behaviours, set realistic goals, and create a personalized plan to achieve those goals.

So, why wait? Start your journey towards financial happiness today. Remember, the best time to start was yesterday. The second best time is now.

Click here to schedule your consultation and let’s make your money work for you, not vice versa. 💪💰

Remember, financial freedom isn’t a destination; it’s a journey. And every journey is easier when you have a guide. So, let’s embark on this journey together and create a financially happy future. 🚀💸