Planuary: Kickstarting Your New Year Planning

January marks a new beginning, and what better way to start your new year planning than by setting your financial compass right?

Welcome to Planuary, a month dedicated to laying the groundwork for a prosperous financial future. Whether you’re in your 30s, 40s, or 50s, this comprehensive guide is tailored to help you confidently navigate the complexities of personal finance.

New Year Planning: Week 1: Mindfulness in Money Matters

Mindful Monday: The Power of Financial Awareness

Embarking on a financial journey without understanding your current status is like setting off on a hike without a map. You might have a great pair of boots (or a solid paycheck), but without direction, you could end up going round in circles! 🔄🧭

As a financial coach, I often see clients initially overwhelmed by the mere thought of numbers and budgets. But fear not! Embracing financial mindfulness is your first step towards a stress-free, financially happy life.

1. Conducting a Self-Assessment: Your Financial Selfie 📸

Start by taking a ‘financial selfie’. This isn’t about snapping a pic with your latest purchase. It’s about capturing a clear, honest image of your current financial state.

Here’s how to do it:

- List Your Assets: These are things you own that have value. Think savings accounts, property, investments, and that vintage vinyl collection (if it’s valuable!).

- Identify Your Liabilities: These are debts or obligations. Credit card balances, student loans, that money you owe your mate from last weekend… it all counts.

- Calculate Your Net Worth: Simply subtract your liabilities from your assets. This number is your financial baseline – your starting point on the map.

2. Creating a Financial Vision Board: Dream Big, Plan Smart 🌟

Next, let’s get creative! A financial vision board is like your personal finance Pinterest.

- Gather Your Materials: Magazines, printouts, or just a digital board.

- Visualise Your Goals: Whether it’s a dream holiday, home ownership, or simply being debt-free, put it on the board.

- Place It Somewhere Visible: Daily reminders of your financial goals can be incredibly motivating.

3. Mindful Spending: Every Penny Tells a Story 💷

Finally, start becoming more mindful about where your money goes. Each expense should be a conscious decision.

- Track Your Spending: For a week, jot down every purchase, no matter how small. You’ll be surprised where the money goes (looking at you, daily latte!).

- Ask the Big Question: Before buying, ask yourself, “Do I need this, or do I just want this?” It’s okay to treat yourself, but make sure it aligns with your bigger financial picture.

By the end of Mindful Monday, you’ll have a clearer understanding of your financial position and goals. You’re now ready to navigate the wilds of your financial landscape with confidence. And remember, it’s not just about reaching the destination, but also enjoying the journey. So, lace up those boots and let’s get trekking! 🥾💼💚

Thrifty Thursday: Smart Spending Habits

Welcome to Thrifty Thursday, where we transform our spending habits to align them beautifully with our financial goals and values. It’s like tuning a guitar to make sure every note contributes to a harmonious melody – but in this case, the melody is your financial well-being. 🎸💰

1. Embrace Needs vs. Wants: The Savvy Shopper’s Mantra 🛍️

The key to mindful spending is distinguishing between ‘needs’ and ‘wants’. Needs are essentials for living – think food, rent, utilities. Wants, on the other hand, are those nice-to-haves, like the latest smartphone or designer shoes.

- Action Point: Next time you’re about to make a purchase, pause and ask yourself, “Is this a need or a want?” If it’s a want, consider if it aligns with your financial goals before proceeding.

2. The 30-Day Rule: Taming Impulse Buying 📅

Impulse buying is the financial equivalent of a sugar rush – instant gratification followed by potential regret. The 30-day rule is a simple yet effective way to curb this.

- How It Works: If you see something you want, wait 30 days. If after 30 days you still feel it’s necessary, and it fits within your budget, then consider purchasing it.

- The Benefit: More often than not, the urge to buy fades, saving you money and keeping you aligned with your financial goals.

3. Smart Grocery Shopping: Cart Over Cash 💳

Grocery shopping can be a minefield for overspending. However, with a few tweaks, you can turn it into a field of financial opportunity.

- Make a List: Plan your meals and make a list before hitting the supermarket. Stick to it!

- Avoid Shopping on an Empty Stomach: You’re less likely to buy unnecessary snacks.

- Compare Prices: Look for deals and consider generic brands – they often offer the same quality at a lower price.

4. Embracing Second-Hand and DIY: The Charm of Being Thrifty 🛠️

There’s something incredibly satisfying about scoring a great deal on a second-hand find or fixing something yourself.

- Second-Hand Treasures: Explore charity shops or online marketplaces for pre-loved items. It’s kinder to your wallet and the planet.

- DIY Projects: Before hiring someone for a small fix or home improvement, see if it’s something you can do yourself. There are tons of tutorials online.

5. Review Regular Subscriptions: Are They Really Necessary? 📝

Subscriptions can add up. Do you really watch all those streaming services?

- Audit Your Subscriptions: Make a list of all your monthly subscriptions and evaluate their necessity.

- Trim the Fat: Cancel those you don’t use often. Your bank account will thank you.

By adopting these smart spending habits, you’ll be tuning your financial instrument to play the sweetest tunes. Remember, being thrifty doesn’t mean being stingy – it’s about spending wisely and enjoying the benefits of a financially balanced life. So, let’s turn those pennies into pounds of financial success! 💷✨🎉

Week 2: Laying the Foundations of Sustainability

Week 2 is all about building a robust financial structure. Think of it as constructing a house where your future self will live comfortably. First, we lay the foundation with a solid budget, and then we start building our savings, brick by brick.

Wealth-building Wednesday: Drafting a Robust Budget

A well-planned budget is like a roadmap for your finances. It helps you navigate through your income and expenses without getting lost in the maze of overspending.

Key Components of a Sustainable Budget:

1. Income: Count Every Penny 💷

- Include all sources of income: salaries, bonuses, freelance work, and any passive income streams like rental income or dividends.

- Tip: If your income varies, average your last three months’ earnings to get a realistic figure.

2. Expenses: Know Where Your Money Goes 💸

- Categorize your expenses. Common categories include housing (rent or mortgage), utilities (electricity, water, internet), food, transportation, insurance, and leisure.

- Don’t forget occasional expenses like gifts, holidays, or car maintenance.

- Tip: Use a tracking app or simply jot down expenses in a notebook for a month to get a clear picture.

3. Savings Goals: Your Financial Safety Net 🏦

- Aim to save a specific percentage of your income. Even starting with 10% can significantly impact your financial future.

- Consider different savings goals: emergency fund, retirement, holiday fund, or a deposit for a house.

- Tip: Treat your savings like a bill that must be paid each month.

Savings Saturday: Kick-start Your Savings Plan

Consistent savings, no matter how small, can accumulate into a substantial sum over time, much like how a steady drip can fill a bucket.

Action Points:

1. Set Realistic Savings Goals: Every Little Helps 🐷

- Start with a manageable amount. It could be £20 a week or £100 a month. The key is to start somewhere and stick to it.

- Tip: Automate your savings. Set up a direct debit to transfer a fixed amount to your savings account each payday.

2. Success Story: Meet James 🚗

- James started saving £50 a month. In five years, that turned into enough for a down payment on a car.

- His secret? Patience and consistency. He treated his savings like a non-negotiable expense.

By the end of Week 2, you’ll have a clear budget in place and a growing savings account. It’s like watching your financial garden start to bloom – a little bit of effort now for a beautiful, flourishing future! 🌼📈🏡

Week 3: Flexibility in Finance

In Week 3, we’re focusing on building financial resilience. It’s all about preparing for life’s unexpected twists and turns. Think of it as packing an umbrella – you might not need it every day, but you’ll be glad to have it when the rain comes.

Flexible Finance Friday: Building an Emergency Fund

An emergency fund is like a financial life jacket. It keeps you afloat during unexpected financial storms, whether it’s a sudden job loss, car repairs, or an unexpected medical bill.

Steps to Create an Emergency Fund:

1. Calculate Your Monthly Expenses: Know Your Numbers 📊

- List all your essential monthly expenses: rent/mortgage, utilities, food, transport, and minimum debt payments.

- Tip: Aim for an emergency fund that covers 3-6 months of these expenses. This gives you a buffer to handle life’s surprises without financial stress.

2. Start Small, Aim High: Baby Steps to Big Savings 💰

- Begin with a manageable amount. Even £20 a week adds up to over £1,000 in a year.

- Gradually increase the amount as your financial situation improves.

- Tip: Treat your emergency fund contribution like a fixed expense in your budget.

3. Keep It Accessible But Separate: Out of Sight, But Reachable 🏦

- Your emergency fund should be easily accessible, but not too easy. Avoid keeping it in your regular checking account where you might be tempted to dip into it.

- Consider a separate savings account or a money market account that offers a balance of accessibility and growth.

Insurance Insights Sunday: Reviewing Your Insurance Policies

Insurance is the unsung hero of financial planning. It quietly works in the background, providing a safety net for when life throws curveballs.

Essential Policies:

1. Income Protection Insurance: Your Financial Safety Net 🌐

Income protection insurance is an essential component of financial planning, providing a secure safety net if you’re unable to work due to illness or injury. It’s like having a financial guardian angel watching over you, ensuring your income stream continues even when the unexpected happens.

Understanding Income Protection Insurance:

- Coverage: This insurance typically replaces a significant portion of your income if you’re unable to work due to illness or injury. Payments are made regularly, similar to receiving a salary.

- Duration: Policies vary in how long they’ll pay out – some until you return to work, others until retirement, or for a set period.

Selecting the Right Policy:

- Percentage of Income Covered: Most policies cover up to a certain percentage of your regular income, often around 50-70%. Consider how much you would realistically need to maintain your lifestyle.

- Deferred Period: The deferred period is the time between stopping work and when the payments start. Choosing a longer deferred period can reduce premiums, but you’ll need to ensure you have other financial resources to cover this gap.

- Policy Terms: Understand the terms of what constitutes being ‘unable to work.’ Policies may vary between covering you for any job vs. your specific occupation.

Income protection insurance is about ensuring stability in turbulent times. It provides the reassurance that if your health takes an unexpected turn, your financial wellbeing continues its steady course. In a world full of uncertainties, it’s a pillar of financial security you can count on. 💼🛡️💪

2. Critical Illness Insurance: A Shield Against the Unexpected 🛡️

Critical illness insurance plays a vital role in financial planning, especially when it comes to protecting yourself and your family from the unforeseen and often substantial costs associated with serious health issues.

Understanding Critical Illness Insurance:

- Coverage: This insurance typically provides a lump sum payment if you’re diagnosed with one of the specific illnesses covered by the policy. These can include cancer, heart attack, stroke, and other major conditions.

- Use of Funds: The payout can be used for various needs, such as medical treatments not covered by traditional health insurance, living expenses during recovery, or modifications to your home due to illness.

Selecting the Right Policy:

- Range of Illnesses Covered: Look for a policy that covers a broad spectrum of critical illnesses. More comprehensive coverage means better protection.

- Policy Terms: Understand the specifics, like the waiting period (the time between diagnosis and when the benefit is paid) and whether the policy covers recurrent illnesses.

Critical illness insurance offers a financial buffer in times of medical crises, allowing you to focus on recovery rather than financial concerns. It’s an investment in peace of mind, ensuring that a health scare doesn’t turn into a financial nightmare. 🏥💷🌈

3. Life Insurance: Ensuring Peace of Mind for Your Loved Ones 🕊️

Life insurance is a cornerstone of sound financial planning, offering a safety net for your loved ones in your absence. It’s about providing security and peace of mind, ensuring that those you care about are financially protected when you’re no longer there to support them.

Understanding Life Insurance:

- Purpose: Life insurance is designed to provide financial support to your beneficiaries after your death. This can be used to cover living expenses, pay off debts, or even fund future educational needs.

- Types of Policies: The two main types are term life insurance, which provides coverage for a specific period, and whole life insurance, which includes an investment component and covers you for your entire life.

Selecting the Right Policy:

- Coverage Amount: Consider the financial needs of your dependents. This might include daily living expenses, mortgage payments, and future costs like children’s education.

- Term Length: For term life insurance, choose a term that covers your dependents during your most financially vulnerable years, such as until your children are financially independent or your mortgage is paid off.

- Premiums: Premiums can vary greatly depending on the coverage amount, term, and your age and health. It’s important to find a balance between adequate coverage and an affordable premium.

Life insurance is not just a policy; it’s a promise, a commitment to the well-being of your loved ones even when you can’t be there. It’s a selfless act of love, ensuring that your family’s financial future remains bright, no matter what. 💖💼🌟

Week 4: Pursuing Fulfilment

In the final week of Planaury, we focus on achieving a fulfilling balance between our current joys and future dreams. It’s about setting goals that not only secure our future but also allow us to savour the present.

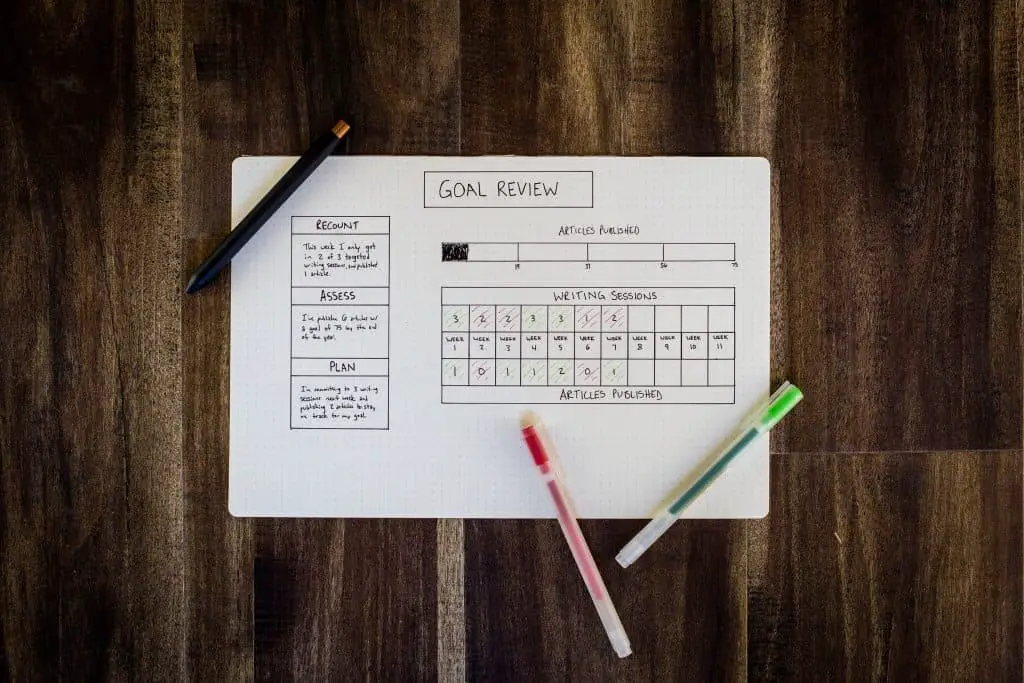

Goal-setting Tuesday: Short-term and Long-term Financial Objectives

Balancing your immediate needs with your future aspirations is the essence of effective goal setting. It’s like juggling – keeping your eyes on the balls in the air while being aware of what’s coming next.

Learn to Set SMART Goals 🎯

- Specific: Clearly define what you want to achieve. For example, “save for a vacation to Italy.”

- Measurable: Assign a number to your goal. “I want to save £2,000 for the trip.”

- Achievable: Make sure your goal is realistic. “I can save £200 a month.”

- Relevant: Ensure it aligns with your broader financial plans. “This trip won’t hinder my long-term savings goals.”

- Time-bound: Set a deadline. “I’ll reach my goal in 10 months.”

By setting SMART goals, you create a clear roadmap for both your short-term desires and long-term plans.

Fun Fund Friday: Allocating for Enjoyment

It’s crucial to balance saving for the future and enjoying the present. Your budget should allow room for a bit of fun – it’s the spice of life, after all!

Balancing Act: Laura’s Story 🎉

- Laura sets aside 5% of her monthly income for leisure activities.

- This ‘Fun Fund’ allows her to enjoy hobbies, dining out, or the occasional shopping spree without guilt or financial strain.

- By allocating a portion of her budget to enjoyment, Laura maintains a happy balance between living in the moment and planning for the future.

Conclusion: Celebrating Milestones and Staying Motivated

As Planaury comes to a close, take a moment to celebrate your achievements. Whether big or small, every step towards financial well-being is a win.

- Reflect on Your Progress: Maybe you’ve saved an extra £100, started a budget, or set a long-term financial goal. Each of these is a building block towards your financial happiness.

- Stay Motivated: Remember, personal finance is a journey, not a destination. Keep setting new goals and enjoy the process of achieving them.

Invite: Personalized Financial Coaching 📞

For tailored advice and deeper insights, join me for a free 30-minute discovery call. Together, we can fine-tune your financial strategy to align with your unique circumstances and goals.

By embracing each week’s lessons in Planaury, you’re not just aiming for financial stability; you’re crafting a life of financial happiness and fulfillment. Remember, every step you take is a step towards a brighter, more secure financial future. 🌟💼🚀