Life insurance at 40. Do I really need it? (how to be safe and not sorry)

Life insurance at 40 is one of the most important decisions you’ll ever make.

It’s also one of the most misunderstood decisions people make in their lifetime, and as a result, many don’t buy it when they should or get enough coverage to protect themselves in case something goes wrong.

When you turn 40, one of the best things you can do for your family is to buy life insurance. This will help your loved ones be financially safe if something happens to you. Life is unpredictable, but you can provide financial security for your loved ones with a little planning and a lot of love.

The truth is, nearly everyone should have life insurance. No one knows when their time will come.

This article will help clarify some misconceptions about life insurance to make an informed decision about whether life insurance at 40 is right for you.

Should I get life insurance in my 40s

Yes, getting life insurance in your 40s can be a wise decision, especially if you have financial dependents such as a spouse, children, or aging parents. At this age, you might have significant financial responsibilities like a mortgage, car loans, or your children’s future college expenses. Life insurance can provide a financial safety net to cover these costs in the event of your untimely death.

Additionally, while life insurance premiums are generally lower when you’re younger, they are still relatively affordable in your 40s, especially if you’re in good health. The cost of premiums tends to increase significantly as you age, so it’s advantageous to secure a policy sooner rather than later.

However, the decision to get life insurance should be based on your individual circumstances. You might not need life insurance if you have sufficient savings, investments, or other assets that can cover your financial responsibilities and provide for your dependents. It’s advisable to consult with a financial planner to make the best decision for your situation.

1. What is life insurance, and why do I need it

No one knows when their time will come, and you never know when you might need it. That’s why it’s important to have life insurance

– What is life insurance

Life insurance is a type of policy that pays out a sum of money to the beneficiary if the policyholder dies while the policy is in effect.

There are two main types of life insurance: term and permanent

Term life insurance is a policy that lasts for a certain amount of time, typically 10, 20, or 30 years

Permanent life insurance is a policy that lasts for the policyholder’s life.

– Why do I need life insurance

Most people need life insurance because they have dependents who rely on them financially. If something happens to you, life insurance can help your loved ones stay afloat financially.

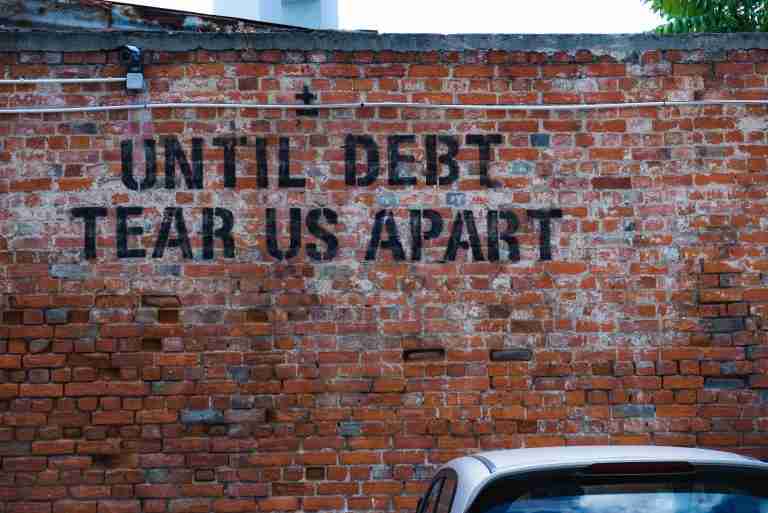

Two main reasons to buy life insurance are to replace your income or to pay off debts and final expenses.

– The purpose of life insurance

The purpose of life insurance is to provide financial security for your loved ones in the event of your death. It can help pay off debts and final expenses or provide a lump sum of money to help your loved ones get by financially.

– How life insurance works

When you die, the life insurance company pays out the death benefit to your beneficiary/s. This money can be used to pay off debts and final expenses or help your loved one/s cope with the loss of your income.

– What are the benefits of life insurance

Standard benefits

– Your loved ones will be financially safe

– The policy can help pay off debts and final expenses

– The money can help your loved ones get by financially for as long as you might have worked and for longer, depending on the amount of coverage.

Emotional benefits

– You’ll be able to rest easy knowing that your loved ones are taken care of

– You’ll have peace of mind knowing that you’ve done everything you can to protect your loved ones

– You’ll be able to focus on enjoying your life knowing that your loved ones are taken care of

2. Types of life insurance

There are two main types of life insurance: term and permanent

Term life insurance and permanent life insurance.

Each type of life insurance has its own set of benefits and drawbacks, so it’s important to understand the difference between the two before you make a decision.

– Term life insurance

Term life insurance is a policy that lasts for a certain amount of time, typically 10, 20, or 30 years. The death benefit is only paid out if the policyholder dies while the policy is in effect

Benefits

– Term life insurance is the most affordable type of life insurance

– The death benefit can be used to replace your income or to pay off debts and final expenses

Drawbacks

– The death benefit is only paid out if the policyholder dies while the policy is in effect

– Permanent life insurance

Permanent life insurance is a policy that lasts for the policyholder’s life. The death benefit is paid out regardless of when the policyholder dies

Benefits

– The death benefit is paid out regardless of when the policyholder dies

– The policy builds cash value over time

Drawbacks

– Permanent life insurance is more expensive than term life insurance

3. How much life insurance do I need

Calculating how much life insurance you need can be a tricky task

The amount of life insurance you need depends on a number of factors, including your age, health, lifestyle, and dependents

– Age

Your age is one of the biggest factors in determining how much life insurance you need. The younger you are, the less life insurance you need because you have more time to build up other assets.

– Health

Your health is another important factor in determining how much life insurance you need. You may need more life insurance if you have any health conditions that could shorten your life expectancy.

– Lifestyle

Your lifestyle also plays a role in how much life insurance you need. If you have a high-risk job or hobby, poor health habits (mainly smoking), you’ll need more life insurance to offset the increased risk.

– Dependents

If you have dependents, you’ll need enough life insurance to cover their needs in the event of your death. This could be until children are fully independent or a spouse can retire.

You can use the above considerations to determine how much money you want your dependents to receive.

Would you like to help cover the cost of children until they leave home, pay off the mortgage, provide an income until retirement or all of them?

This will help you understand how much coverage you might need.

4. How to get life insurance

Work with an independent insurance agent or company is the best way to get life insurance.

An independent insurance agent/company can help you compare different policies from different insurers and find the policy that’s right for you

When shopping for life insurance, be sure to compare apples to apples. That means comparing policies with the same coverage amounts, term lengths, and riders.

Here are a few of the providers offering life insurance in the UK. You can easily get quotes and compare the offers.

Life insurance at 40 summary table

| Section | Details |

|---|---|

| What is life insurance, and why do I need it | Life insurance is a policy that pays out a sum of money to the beneficiary if the policyholder dies while the policy is in effect. It provides financial security for your loved ones, helping to pay off debts and final expenses, or provide a lump sum of money to help your loved ones get by financially. |

| Types of life insurance | There are two main types: term life insurance (lasts for a certain amount of time) and permanent life insurance (lasts for the policyholder’s life). Each has its own benefits and drawbacks. |

| Calculating how much life insurance you need | The amount of life insurance you need depends on factors like your age, health, lifestyle, and dependents. |

| How to get life insurance | The best way to get life insurance is to work with an independent insurance agent or company. They can help you compare different policies from different insurers and find the policy that’s right for you. |

| Final thoughts | Life insurance is a key safety net for your loved ones. When you’re 40, buying life insurance is one of the best ways to protect your family. |

FAQ life insurance at 40

Is life insurance worth it at age 40?

Yes, life insurance can be worth it at age 40. It can provide financial security for your dependents in case of your untimely demise. The premiums are generally still affordable at this age, and it’s a good way to ensure your family can cover expenses like mortgage payments, college tuition, and other living costs. However, the value of life insurance depends on your individual circumstances, such as your health, financial situation, and family needs. It’s advisable to consult with a financial planner or coach to make the best decision.

How much life insurance should a 40-year old have?

The amount of life insurance a 40-year-old should have can vary based on individual circumstances.

However, a common rule of thumb is to have coverage that’s 7 to 10 times your annual income.

For example, earning $50,000 a year might aim for a policy offering $350,000 to $500,000 in coverage.

This can help ensure your dependents are financially secure in the event of your death. Factors such as outstanding debts, future education costs for children, and your spouse’s earning capacity can also influence the amount of coverage you need.

Always consult with a financial planner for personalized advice.

How much is life insurance per month for a 40-year old?

The cost can vary widely based on factors such as the type of policy (term or whole life), the coverage amount, your health status, and lifestyle factors like smoking. However, as a rough estimate, a healthy 40-year-old might expect to pay between £$20 and £$50 per month for a term life insurance policy with decent coverage. It’s best to get quotes from multiple insurance providers for a more accurate estimate for your situation.

At what age do you no longer need life insurance?

There’s no specific age at which you no longer need life insurance. It depends on your personal circumstances.

Generally, you might not need life insurance if you’re retired and your dependents (like a spouse or children) are financially independent, or if you have enough savings and assets to cover any debts or final expenses.

This could be anywhere from your 60s to 80s or beyond. However, some people maintain a small policy to cover funeral costs or leave a financial gift to their heirs.

It’s best to consult with a financial planner to determine when you might no longer need life insurance.

Can you buy life insurance in your 40s?

Yes, you can definitely buy life insurance in your 40s. In fact, it’s quite common for individuals to purchase or upgrade their life insurance policies during this stage of life, especially if they have dependents, a mortgage, or other financial responsibilities.

While premiums may be higher than they would be for someone in their 20s or 30s, they are generally still affordable. It’s important to shop around and compare policies from different providers to find the best fit for your needs and budget.

5. Final thoughts Life insurance at 40

Life insurance is a key safety net for your loved ones when you’re gone.

When you’re 40, buying life insurance is one of the best ways to protect your family from the worst.

Life is unpredictable, but you can provide financial security for your loved ones with a little planning and a lot of love.

If you want help planning your life and finances, sign up for our newsletter to start your financially happy journey.

If you’ve made it this far, congratulations! You’re already taking steps towards a healthier financial future. But maybe you’re feeling a bit overwhelmed. Maybe the of budgeting, saving, and investing still makes you break out in a cold sweat. Don’t worry, you’re not alone, and help is available.

At Financially Happy Money Coaching, I understand money isn’t just about numbers. It’s about emotions, behaviours, and life choices. That’s why we’re here to help you take the stress out of money and build wealth that aligns with your values and lifestyle.

Whether you’re just starting out on your financial journey or you’re looking to take your finances to the next level, we’re here to guide you every step of the way. I’ll help you understand your financial behaviours, set realistic goals, and create a personalized plan to achieve those goals.

So, why wait? Start your journey towards financial happiness today. Remember, the best time to start was yesterday. The second best time is now.

Click here to schedule your consultation and let’s make your money work for you, not vice versa. 💪💰

Remember, financial freedom isn’t a destination; it’s a journey. And every journey is easier when you have a guide. So, let’s embark on this journey together and create a financially happy future. 🚀💸

📚 Financial Freedom Resources

- The Ultimate Guide To Building Your Savings to $100,000! 📘 is a transformative book that equips readers with principles, strategies, and the mindset 🧠 needed to reach a $100,000 savings goal 💰. It’s a journey towards financial freedom 🚀, challenging beliefs 🤔, embracing new habits 🔄, and overcoming obstacles 💪.

- How to Manage Your Finances: Your Guide to Financial Freedom 📘 is a comprehensive resource packed with practical advice on budgeting 💰, investing 📈, reducing debt 💳, and building wealth 💎. It’s an essential guide for anyone, novice or experienced, aiming to take control of their financial future and achieve financial independence 🚀.

Remember, self-study is a powerful tool for life and financial transformation. Happy reading! 🎉

📚 Financial Freedom Resources

- The Ultimate Guide To Building Your Savings to $100,000! 📘 is a transformative book that equips readers with principles, strategies, and the mindset 🧠 needed to reach a $100,000 savings goal 💰. It’s a journey towards financial freedom 🚀, challenging beliefs 🤔, embracing new habits 🔄, and overcoming obstacles 💪.

- How to Manage Your Finances: Your Guide to Financial Freedom 📘 is a comprehensive resource packed with practical advice on budgeting 💰, investing 📈, reducing debt 💳, and building wealth 💎. It’s an essential guide for anyone, novice or experienced, aiming to take control of their financial future and achieve financial independence 🚀.

- Mastering Budgeting in Your 40s: Your Guide to Financial Freedom 📘 is your essential roadmap to financial savvy. Packed with tips on budgeting 💰, investing 📈, and debt management 💳, it’s the perfect toolkit for anyone in their 40s looking to secure their financial future and sail towards independence 🚀.

Remember, self-study is a powerful tool for life and financial transformation. Happy reading! 🎉