How to get rid of debt. 5 ways to make it happen

Getting rid of debt will be a significant part of having a comfortable, stable and dignified life now and later on.

If you don’t take action, you will carry this debt into your retirement – probably meaning you cant retire when you want to or in the style, you would like.

Carry debt while trying to save is like trying to run up a sand dune; every step sees you slipping a bit further backwards.

Tackling your debt before it gets to crisis levels will save you a lot of time, money and anxiety.

Read on to hear how to get rid of debt and take back control of your finances.

Have inspiring goals

You may have heard someone say they don’t have any savings because they have nothing to save.

This isn’t because of a lack of motivation but of a lack of inspiring goals to save towards.

Now there is some tension around goals, whether to have them or not. Some feel that if you have goals, they are a contract with yourself to be unhappy until you have reached them, while others think that you have nothing to focus on or work towards without goals.

Let’s lean slightly on the side, all having goals as a way to help you focus on what you want and help steer you in that direction.

Goals can be broken down into 3 broad areas.

- What you want to achieve

- Why you want to achieve it

- How you think you might do it

this loose framework will help you define your motivation and give you some ideas of what to do next.

You can have goals in many areas of your life

- Material: things you want to have or own

- Health: the lifestyle you want to live, how active you want to be

- Personal: what development do you want to see in your knowledge, mindset and behaviours

- Professional: qualifications for courses you want to complete:

- Friends and family: the time you want to spend or things you want to do with your friends and family.

- Community: if you’re going to do any volunteering or helping out in your local area

You may have goals in other areas of your life; spend a little time thinking about what you want to achieve, why, and how you might do it.

When thinking about goals, you have to make sure that these are your goals and not what other people want or what you think other people want.

From this process of writing down what you want, the reasons you want it and how you might go about it, you should be able to draft a few short lines or paragraph about your purpose statement.

What is it that you are trying to achieve either in the short term or the long term? This should be an inspiring statement to you to help pull and push you in the right direction.

If you want to get out of debt, you need to have something to aim towards; being debt-free could be one of them but will it be inspiring enough to take action.

Identifying goals in several areas of your life connected to your being debt-free may be a more inspiring way to stay focused and get out of debt.

If you are in a debt crisis, you may need specialist help from organisations like these below.

- Christians against poverty

- Step change Free expert debt advice

- Money advice service

Don’t take on more debt

When you’re in a hole, one of the top pieces of advice is to stop digging. Stop taking on any more debt.

Whatever it is, you do try as best you can not to take on any more debt.

Your crucial action at this stage is to steady the ship and at least make the minimum payments on all your debt.

If you could try and create some savings of your own, this may help prevent you from taking on further debt because you can use your savings to cover any short term needs.

If possible, you build up an emergency fund of savings, whether that’s £100 or £1000, that can help you deal with any immediate needs without going into further debt.

The way you would do this would be to start paying yourself first. Save what you can after you’ve made all your minimum payments on your debt and then spend what is left.

Don’t spend 1st and then save. This will often see you saving little or nothing.

If you need to take drastic action here, you should consider cutting up cards, putting them in hard-to-reach places or closing the accounts if this is possible to prevent you from taking on more debt.

You could also make it more difficult for you to spend money on things you don’t need by cutting your connexion to those shops or services.

Unsubscribing from email lists or alerts from the places or products you know you can’t resist my help keep you away from those opportunities to spend more money

Removing yourself from temptation may be one of the best ways to prevent taking on more debt.

Effective Ways to get out of debt

There are a few ways to tackle your debt: the snowball, the avalanche or the equal share.

The snowball is paying off your smallest debt 1st and working your way up to the final and most significant one. This method is often used as it is one way to feel the quickest progress in paying off debts.

There is some psychology in this because if you’re able to pay off small debts quickly, it will give you more motivation to carry on to the bigger ones, which will take more time and effort to pay off.

The avalanche method is about starting with the biggest or most expensive debt paying that off as quickly as you can. Sometimes this can be the more mathematically efficient in getting rid of the most costly debt first, but it can be the one that takes more time to see progress on.

A third option is to pay them all off equally so that you feel they are all being addressed at once.

You should always make the minimum payments on all your debts; otherwise, charges can quickly rack up, compounding and increasing your debt, but you can also pay more than the minimum to pay off your debt faster.

Earn or create more money

If you could earn more money or create more money; this could help pay off your debts faster.

- If you currently have a job, could you make more money in it?

- Is a pay rise or promotion possible or even desirable?

- Do you have a skill or hobby that others might pay you for?

As long as you pay the minimum on all your debts, one way to start creating more money is to pay yourself first.

Rather than pay out all your money to everybody else 1st and save what’s left, swap that process around.

Say first by automatically saving an amount or percentage as soon as you get paid and then live off what’s left. This is a trick to ensure that you save money every month and live within your means.

Could you create more money by starting a side hustle? Do you have a skill hobby or interest that others might pay you for?

There are many ways to set up a low-cost side hustle, like Facebook, YouTube or LinkedIn to advertise things to sell or services to offer. This could be a way to earn a little extra money outside of your day job.

You could also look into learning a new skill in your spare time using free resources like the library or YouTube.

Self-study like this could set you on a journey to having more marketable and valuable skills to sell at a later date.

Self-study might also be a more productive way to use your time, keeping you away from Internet shopping and social media, which is not adding much to your overall life experience.

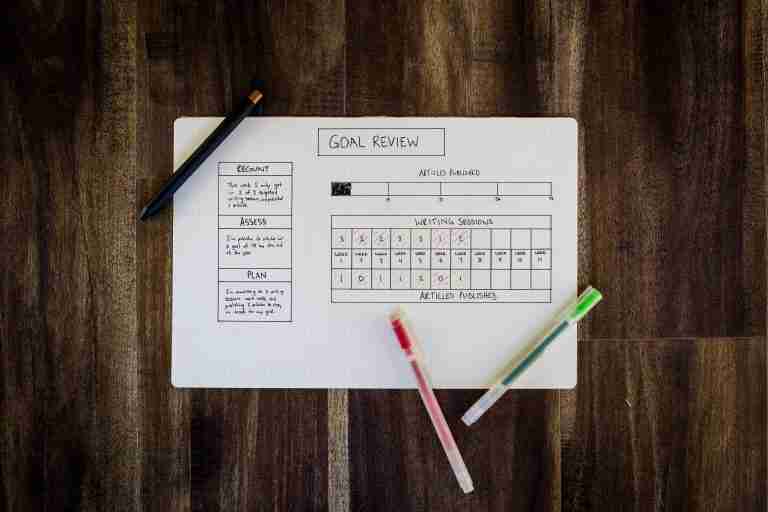

Implement your debt plan

Now comes the time to set up your plan.

Setting out your ideal week, month and year in alignment with your goals should help keep you on track and away from taking on more debt.

When you want to work on and achieve your goals, a timetable should help guide and focus you on achieving more of what’s important to you.

Planning each day and week should help you structure and keep you away from the triggers that result in you spending money you don’t have.

Understanding what caused you to go into debt and when you are most vulnerable to this should help keep you away from these occasions.

Was it a situation, a person or a thing that tempted you or forced you into using the money you didn’t have to buy the thing now costing you a lot more than the purchase price?

Once you have chosen your snowball method, the avalanche the equal share or whatever process you feel is best now you need to implement it and keep doing it.

Keep your inspiring goals on purpose statement near you and refer to it regularly to remind yourself why you are working this hard to get out of debt.

Anyway, those are my thoughts on how to get rid of debt. Let me know yours in the comments below.

If you would like to have a conversation on getting out of debt or managing your finances to reach financial freedom, click on the links below to find out more and set up your money call.

Summary Table: How to Get Rid of Debt UK

| Key Strategies | Description | Considerations |

|---|---|---|

| Have Inspiring Goals | Setting goals can motivate you to pay off debt. Goals should be personal and aligned with your values. | Goals should be realistic and achievable to avoid disappointment. |

| Don’t Take On More Debt | Stop accumulating more debt. Focus on making minimum payments on existing debts. | Consider building an emergency fund to avoid taking on more debt for unexpected expenses. |

| Ways to Pay Off Debt | Discusses methods like the snowball, avalanche, and equal share for paying off debts. | Choose a method that aligns with your financial situation and psychological needs. |

| Earn or Create More Money | Suggests increasing income through promotions, pay raises, or side hustles. | Ensure that the additional income goes towards debt repayment and not discretionary spending. |

| Implement Your Debt Plan | Create a structured plan to get out of debt and stick to it. | Regularly review and adjust the plan as needed. |

| Seek Professional Help | Recommends consulting organisations like Christians Against Poverty, Step Change, and Money Advice Service for severe debt issues. | Professional advice can be crucial for complex debt situations but may come with its own costs. |

FAQ:

What is the fastest way to get out of debt?

The fastest way to get out of debt is to prioritise paying off high-interest debts first while making minimum payments on others. This is known as the ‘debt avalanche’ method. Increasing your income through side hustles and cutting unnecessary expenses can also accelerate the process.

How can I clear my debt without money?

Clearing debt without money is challenging but not impossible. You can negotiate with creditors for reduced payments or debt forgiveness, consider debt consolidation options, or seek professional advice from debt relief agencies. Some people also turn to debt settlement as a last resort.

What are 3 ways to eliminate debt?

Debt Snowball: Pay off debts from smallest to largest to gain momentum.

Debt Avalanche: Focus on paying off high-interest debts first to save money.

Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate for easier management.

How can I stop getting debt?

To stop accumulating debt, create a budget to track income and expenses, avoid using credit cards for discretionary spending, and build an emergency fund to cover unexpected costs.

How can I get out of debt?

To get out of debt, prioritise paying off high-interest debts first, cut unnecessary expenses, and consider increasing your income through side jobs or freelance work. Create a budget and stick to it.

How to pay off debt quickly?

To pay off debt quickly, focus on high-interest debts first, increase your income through side hustles, and cut non-essential expenses to free up more money for debt repayment.

How to get rid of debt. 5 ways to focus on making it happen.

Have inspiring goals – to push and pull you towards them.

Don’t take on more debt – whatever you do, do your best to not dig any deeper into financial trouble.

Ways to pay off your debt – choose the smallest, most significant or most expensive debt and hammer it until it’s done. Then move onto the next one. Making sure you make the minimum payments on all of them.

Earn or create more money – the more money that comes in can help pay off more of your debt. Can you work more hours? Get paid more per hour? Have you got a skill, hobby or interest that others might pay you for?

Implement your debt plan – design your plan to get out of debt and then implement it: review how it’s going and course-correct as needed.

Anyway, those are my thoughts on getting rid of debt; let me know yours in the comments below.

If you would like any help with some of the above topics, drop me a line below.

If you’ve made it this far, congratulations! You’re already taking steps towards a healthier financial future. But maybe you’re feeling a bit overwhelmed. Maybe the of budgeting, saving, and investing still makes you break out in a cold sweat. Don’t worry, you’re not alone, and help is available.

At Financially Happy Money Coaching, I understand money isn’t just about numbers. It’s about emotions, behaviours, and life choices. That’s why we’re here to help you take the stress out of money and build wealth that aligns with your values and lifestyle.

Whether you’re just starting out on your financial journey or you’re looking to take your finances to the next level, we’re here to guide you every step of the way. I’ll help you understand your financial behaviours, set realistic goals, and create a personalized plan to achieve those goals.

So, why wait? Start your journey towards financial happiness today. Remember, the best time to start was yesterday. The second best time is now.

Click here to schedule your consultation and let’s make your money work for you, not vice versa. 💪💰

Remember, financial freedom isn’t a destination; it’s a journey. And every journey is easier when you have a guide. So, let’s embark on this journey together and create a financially happy future. 🚀💸

📚 Financial Freedom Resources

- The Ultimate Guide To Building Your Savings to $100,000! 📘 is a transformative book that equips readers with principles, strategies, and the mindset 🧠 needed to reach a $100,000 savings goal 💰. It’s a journey towards financial freedom 🚀, challenging beliefs 🤔, embracing new habits 🔄, and overcoming obstacles 💪.

- How to Manage Your Finances: Your Guide to Financial Freedom 📘 is a comprehensive resource packed with practical advice on budgeting 💰, investing 📈, reducing debt 💳, and building wealth 💎. It’s an essential guide for anyone, novice or experienced, aiming to take control of their financial future and achieve financial independence 🚀.

Remember, self-study is a powerful tool for life and financial transformation. Happy reading! 🎉