How to overcome money worries. 8 ways to take back control of your finances.

Life is often a roller coaster of emotions as things go well or not so.

One of the worries that nearly everyone has at some point is around money.

How to manage it, spend it, make more of it and hopefully keep some of it.

How to overcome money worries like this is a significant challenge throughout life.

With a little bit of planning, understanding what’s going on, and protecting ourselves from ourselves and the world, you can significantly reduce money worries.

Below we cover how simple actions can play a big part in overcoming financial worries.

You’re not alone

Everyone has money troubles at one point or another in their life.

- When you have low or no income

- When you are starting out

- Going into or coming out of education

- Caring for others

- Finding money for a deposit

- When significant changes happen, moving, having a baby and periods of ill-health.

One or all of these can lead to sleepless nights, household conflict, stress and anxiety, affecting physical and mental health.

The key to remember is that everyone can take even small steps to make their situation just a little better each day.

Start with a plan

Even the most basic of journeys has a plan.

If you were popping out to the shops, you might make a list, have a bag with you and time when you want to leave and arrive back.

You should likewise make a plan for how to overcome money worries.

What would good look like to you?

- No debt

- Growing your net worth

- Saving more

- Able to afford essential and extra things

- Not worry about money anymore.

What do you think you might have to do to get there?

- Track what’s going on

- Save first and spend later

- Spend less than you earn

- Build up an emergency fund

- What else can you think of?

Now you have a destination to aim for and a few actions to get you on your way.

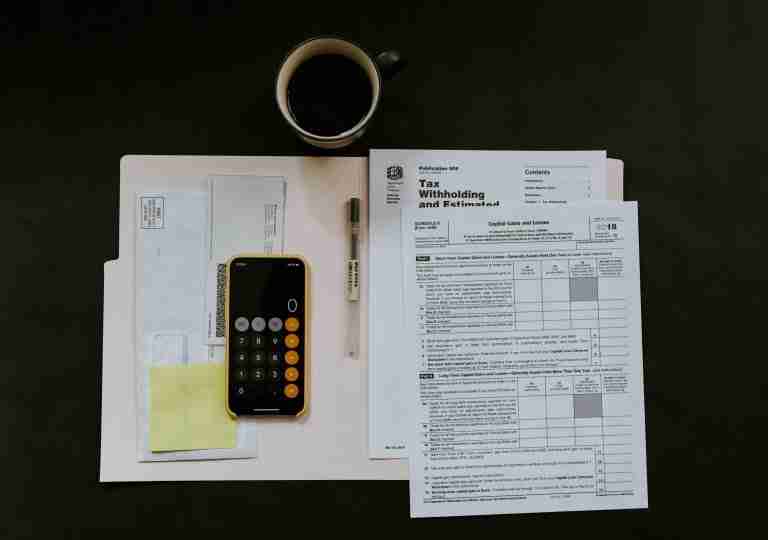

Gather your data (get your poop in a group)

First of all, we need to define what the problem is and what’s causing it.

Maybe you think that’s obvious, NOT ENOUGH.

That may be one of the problems, but why is it a problem?

Here’s where you need to gather your data and understand what’s going on.

- Figure out your net worth – everything you own vs every you owe. This tells you what you are currently worth and will be a way to see if you are improving.

- Understand your burn rate. What’s coming in minus what’s left. This indicates how much money you are spending and how much of what you earn you get to keep. It’s also your savings rate (if you have one).

- Get a picture of where all your money is going. If you ever hear yourself or a friend say, “I don’t know where it all goes”, NOW is the time to find out. Try the Kakeibo method to track every penny you spend.

You want to be striving to increase the gap between your income and outgoings, increasing your savings rate and your net worth.

Just by gathering this data, you might be able to spot some easy wins.

- Things you can cut out

- Things you can reduce

- Things you no longer need but are still paying for

If you wanted to go into further detail, you could also find out when and where you spend your money to see if any habits can be changed, broken or mitigated.

Things like late-night internet shopping or the latest email or social media sales offer.

IF you could modify your behaviour, stay off the internet, unsubscribe from sales alerts, it might be the start of turning your numbers around.

Stop or at least reduce the bleeding

Once you have all your financial data together, you can figure out where your money is bleeding away.

Apart from entertainment, subscriptions and stuff, which are possible all optional extras, you could choose to cut out reduce there may also be debt that is causing you money worries.

Deal with debt might be your most significant task.

Figuring out what debt you have and what it’s costing you might enlighten and show where a significant amount of your money is disappearing.

Then you can decide how to deal with it whilst making sure you are always making the minimum payments.

Use the snowball method – starting with the smallest and then moving on to the next.

Or

The avalanche method starts with the biggest or most expensive paying that donw and then moves to the next.

You can read more here about getting out of debt.

Put a buffer in place between you and the world

Once you have your numbers figured out, you need to think about placing a buffer between you and the world.

Stuff is going to happen even with the best plans in place.

An emergency fund might well be your best friend for when things go wrong.

Having a minimum of 3-6 months of living costs in easily assessable cash will help you ride out the most troubled waters.

This emergency fund is to help prevent you from going into debt when something goes wrong, as it surely will.

- House or car repairs

- Gaps in work

- Health care needs

Given your circumstances, you might feel 3-6 months expenses is fine, or you might want more. Whatever helps you sleep at night.

Don’t worry about what interest rate you will get; that’s not the purpose of this money.

This money is for responding to an emergency, that’s all.

Be careful to define what is an emergency, or anytime you are caught without cash, you might be tempted to rate the emergency fund.

If you have a legitimate emergency, remember the next task is to fill it back up again.

Automate what you can

Wherever you can automate your actions.

Automatically save your money, pay your bills and review what’s going on.

There are a number of apps and bank accounts that will help with this.

Automating often takes out the weakest link in your finances – you.

You will get bored, forget or tell yourself a story about why you don’t need to do it this time.

Automate it then it’s done.

Define your obstacles

As part of your action planning, you need to think about what will get in your way, including yourself.

Work or social commitments, habits or traits you know you have that will need to be overcome to keep you on track.

- The temptation to react to that sales email – unsubscribe

- Block sales pop-ups on your devices

- Ask friends and family not to tempt you with more stuff

- Avoid the shops, routes home, or places you know you will be tempted to spend.

Figure out how you will manage, mitigate and prevent situations like these from adding to your money worries.

It will probably make you do things you haven’t done before or don’t like doing.

However, what got you here isn’t going to get you there.

There being having overcome your money worries.

Find someone to accompany you

Would having someone accompany you on the way help you?

Maybe a good friend can be your accountability partner. Motivating you to keep going.

Finding someone to support, guide and challenge you might help you stay on the path to financial stability.

A coach might be another option to help you through the process, consider options and look for breakthroughs in your internal and external thinking and processes around money and life.

Measure the gains and not so much the gaps.

Each time you measure, make sure you look at your gains and how further you need to go.

If you just look at the gap between where you are now and want to be, it can be disheartening and, rather than overcome money worries lead to more.

But suppose you also measure the gains, increasing savings, networth, more control over day-to-day spending, and reducing debt. In that case, these will be a major factor in reducing your financial anxiety.

When you see progress, actions completed, feelings change, you will be inspired t carry on as you can see it starting to work.

You can be conscious there is still a way to go but not forget the progress you have already made.

Summary: How to overcome money worries. 8 ways to take back control of your finances.

Start with a plan. All transitions or journeys start with a plan. Where you’re trying to get to and how you propose to get there.

Don’t get hung up on if it is a perfect plan; it’s not and don’t worry about that; just start and readjust as you go along. Start now, get perfect later.

Gather your data so you know what’s going on with YOUR money. Once you have clarity on what’s going on, you can take appropriate action—reducing, cutting or prioritizing what you want to happen.

Put a buffer in place between you and the world. This is likely to start with an emergency fund. Enough money for you to ride out a storm for 3- 6 months or more. Whatever helps you sleep at night.

Automate it to make it happen with or without you. This way, you can be sure it gets done; otherwise, you might get in your own way.

Define your obstacles so that you can plan to get around, over, under or through them. This way, you have a way to keep moving forward.

Find a buddy that can help, support and challenge you to keep going. Even better if someone can join you on the journey.

Measure your gains, so you feel progress and want to keep going. You might well be surprised by what you have been doing when you look backwards at your action.

Anyway, those are my thoughts on how to overcome money worries; let me know yours in the comments below.

Thanks for dropping by.

Life and Financial Planning

Get ahead in money and life

Life not going quite as you expected?

Would having a Life and financial plan in place help bring clarity on what’s most important to you and how to achieve it?

- Life, job and finances not heading in the direction you hoped?

- One or two months away from financial disaster?

- Not enough time or money to achieve what’s most important to you?

- No idea how to plan, save and invest to lead a great life?

What’s likely to be the outcome if you don’t make some serious plans asap?

More of the same?

Without making some clear plans you are at real risk of repeating what has gone before and or falling into someone else’s plan.

And guess what they have planned for you?

Not much!

Life and financial planning will give you the support, guidance, and accountability you need to succeed with money and life, building wealth in every area of your life.

- Get your life and money organised

- Build your savings cushion to create more life options.

- Help you figure out what’s most important to you and how much money is enough.

- Help you understand and build wealth so you don’t have to worry about money anymore.

Start building your life and money confidence now because waiting will only make it more expensive and painful to achieve later.

Plan, build and enjoy your life and money.

Taking you from life and financial crisis to happiness.

Contact us here for a chat about building your life and money confidence.