How much should I save each month UK? How to figure out how much to save.

How much should I save each month UK to make sure I don’t end up regretting it later?

Good question.

Finding your savings Goldie locks level might well make or break a dignified, independent, optioned filled later life.

In fact, if you don’t save “enough”, maybe work will never become optional for you! That is what is possibly at stake in getting your savings rate wrong or right.

The good news is there isn’t a “right” amount.

The bad news is there might be more or less better savings rates depending on what you are trying to achieve now or later on in your life and lifestyle.

But given all the pressure on your income, mortgages, food, transport, and some of the comforts in life make sure you are saving enough can be a struggle at the best of times.

Read on to hear how much you might think about saving and how you can figure out how much YOU could/should be if you want to make sure your lifestyle meets your expectations.

Gather these 4 numbers

If you want to figure out how much you should be saving, then it will take a combination of data to work that out.

First, you need to know where you’re starting from.

So, what is your net worth – everything you own minus everything you owe. This is your starting point. Hopefully, it’s not a minus number.

This may well include

- Savings

- Investments

- Pensions

- Equity in properties and business

- Debt

This number tells you what you are worth after all those years of work and saving!

Secondly, you need to know what life currently costs you.

What are your costs weekly, monthly and yearly?

This is your burn rate. Showing you how much money you are burning through every year.

Are you hoping or expecting your lifestyle costs to go up in the short, medium, or long term and by how much?

Even a guestimate will help you figure out how much might your ideal life cost compared to what it costs now.

Thirdly what’s your savings rate?

Of the money that comes into your life, how much of it do you get to keep?

Your income – your burn rate = your savings rate.

This is important because it tells you if you are living within your means and how quickly work might become optional with the savings rate you have.

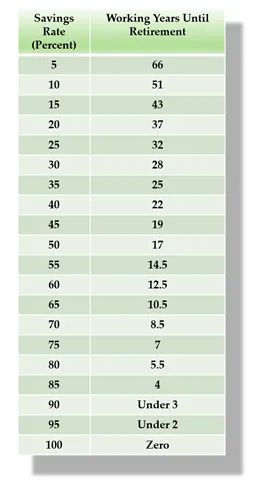

This table from Mr Money Mustache helps you see how your savings rate helps or hinders your path to making work optional / retirement.

And finally, your Freedom number

How much money would make work optional for you?

No idea how to figure this out?

Well, take your yearly spend and X it by 25.

This is also often known as the 4% rule. It’s a planning tool and more of an art than a science but at least helps give you a broad figure to work with.

So, let’s say your lifestyle costs you £25k. So £25k X 25 = £625,000.

If you had £625k invested in low cost, globally diversified index trackers, it wouldn’t be unreasonable to think it could grow by 4% a year.

£625K X 4% = £25K in theory providing you an income of this level forever

(remembering that forever is a long time and all sorts of good and bad things can happen in that time).

Once you have these numbers, you can understand where are you and what you might need and what actions are needed to close the gap.

The way to accelerate your journey to a work optional lifestyle would be to increase your savings and income and reduce your expenses.

Simples, sort of.

At least 20% (but it depends)

So, from the table above, if you wanted to work for 40 0r so years and then retire – a fairly traditional working like – you would need to be saving something like 20%

Massive caveat: but it all depends on what you want good to look like, how old you are, when and what you want to spend your savings on, and your current/future needs vs wants.

20% is a chunky enough amount that it could start to build you some decent savings in not too long a period.

It’s also likely to be enough to start feeling it, ensuring that it is enough for short- and longer-term needs.

But be careful benchmarking yourself against this figure; maybe it’s good enough for you or maybe not.

Remember that if you put in little effort, it will likely have very little effect on the amount of money you have and the impact this money could have had on your future self.

Little effort = little reward

High effort or savings rate = more reward and more impact.

Choose the reward and impact you would like to have now and in the future.

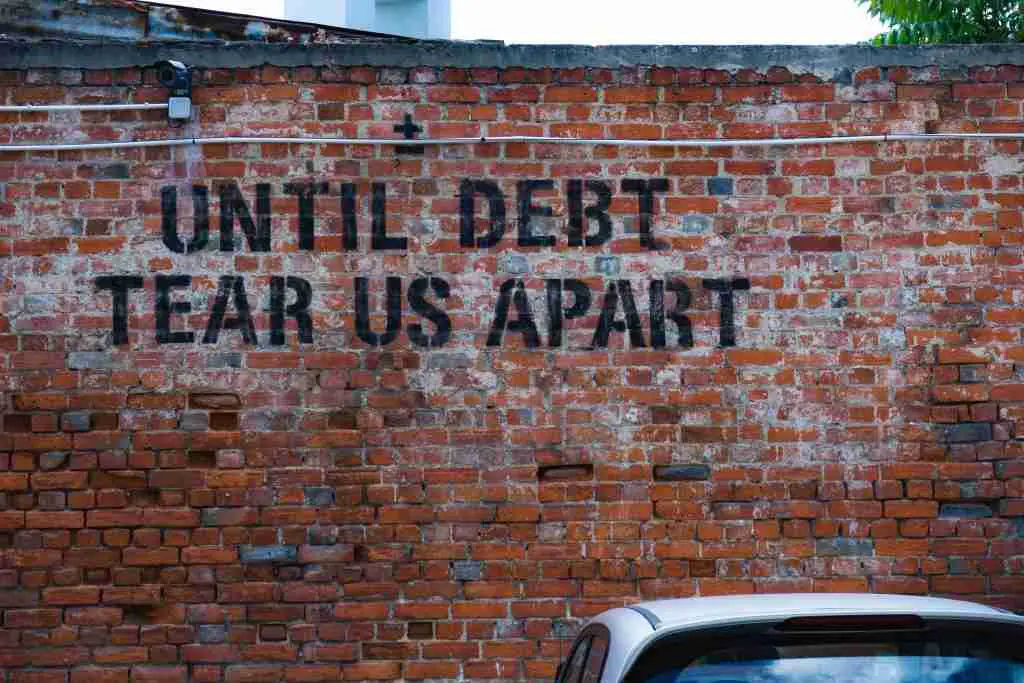

Pay off debt

There isn’t going to be much point in saving money if you have high-interest debt.

High-interest debt is going to be sucking away your hard-earned cash faster than you can save it.

- Car loans

- Credit and store cards

- Payday loans

All of these are financial cancer for your current and future self.

You are going to find it very difficult to go forwards while being dragged back by debt.

Maybe you might earn 0.01 interest on your bank account while you are paying 19%+ on debt.

Here you can see you are going in reverse at warp speed.

So set yourself up a plan to tackle the debt asap.

First, stop digging the hole any deeper. Find a way to stop taking on more debt

- Get rid of the things helping you get into debt

- Make it harder

- More inconvenient

- More costly (fine yourself)

Make the means, the mechanisms, the vehicles and the processes to get into debt more difficult for you.

This might mean

- Credit cards – get rid of them

- Store cards – hide them

- Email and social media updates – block and unsubscribe

- Subscriptions – unsubscribe

- Routines – walking past shops, shopping as a hobby – do something different

- Bad habits like internet shopping when bored, tired or as a comfort mechanism – do something less boring instead

- Hanging around big spenders – modify who or how you hang out with those friends

- Whatever story you tell yourself to spend money you don’t have.

Expensive debt might well be your biggest obstacle to get over to start making your savings count and get you back into profit.

Set up an emergency fund

One of the first things to do with your newfound savings is to build an emergency fund.

Ideally, 3-6 months livings costs, if not more, to ride out the bumps in the road.

When the bumps come, not if.

The whole purpose of an emergency fund is to prevent a crisis from turning into a disaster.

Gaps in employment, emergency repairs, unexpected costs could all or even just one of them tip you back into debt.

But with an emergency fund, it should help prevent, mitigate and recover from a shock without going into debt.

Whether it’s 1-3 months or more, it will be a little bit about what helps you sleep at night and what sort of risk you are happy taking giving your circumstances.

Make a plan for your short, medium and long-term goals.

When you cast your mind into the next 12 months, 2, 5 and 10 years, what do you see

- House deposit

- Round that world trip

- Kids arriving or going to school/university

- Retirement or making work optional one day!

- Rebuilding, retraining, resetting your career life or health.

Having even the most basic plan will help you get there quicker or more comfortably.

Think about it for all things you have a plan or at least ask someone – what’s the plan?

- Holidays

- Nights out

- Nights in

Then how come you don’t have a plan for your life and finances.

Without this, you are hoping for a chance or luck to get you where you want or need to be.

Having a Game Plan is the number one way to reach all your meaningful goals.

By the way, this is exactly what we do at Financially Happy – we create with you plans to reach all your most important goals. Find out more here

Surviving vs thriving it’s your choice

When you get older, do you want to be eating lentils or something more varied every meal?

It’s harsh, but it may be the type of choices you are making that will affect your future choices.

If you want to just about survive, you just need to save the minimum if anything and just hope your luck changes somehow – but that’s a very risky strategy—lots of downsides and not much of an upside.

The best way to start thriving is to pay yourself first.

Save first and then spend what’s left, not the other way around.

You may be surprised how this simple trick ends up with you saving money each month.

Be your greatest ally

Your current self is either your greatest ally or greatest enemy.

Right now, you can be your most selfish self and least likely to help your future self. But it’s who you and your future self are most dependent on.

The fact that your younger self may not have saved much is partly why you may be in a poor financial situation now.

And unless you act now, YOU are doing this again for your future self.

When it comes to saving, you need to think long term and remember this money is being saved for you in the future. It’s not just disappearing.

Your money is being stored for future spending.

The things you do right now will compound positively or negatively.

And both of these will be felt by your future self.

Do you want to thank or blame yourself for what you did or didn’t do in the past?

Think of your goldilocks life & retirement

In your planning process, thinking about what retirement might look like might help inform and inspire you to determine your saving rates needs.

According to WHICH:

- An essential (read basic) lifestyle with few frills will cost £18k for a couple and £13k for an individual.

- A comfortable lifestyle for a couple would be £26k and £19k for an individual.

- A luxury lifestyle (why not?) would cost £41k for a couple and £31k for an individual

So, in short, what would you prefer?

Basic, comfortable or luxury?

Not what do you think is possible, but which do you want?

Once you know what you want, you can start putting together your GAME Plan to make it happen.

The figures above do include the state pension, but they show you that each of us has to put in some effort ourselves to make a comfortable and or luxury lifestyle a reality.

Are you currently putting that effort in?

If you are not or not sure, why not set up a call with us to get you on the right track.

Start investing as well as saving

Saving is often associated with just stashing cash in bank accounts and here there, and everywhere.

The thing with cash is that it is losing money all the time from inflation – the price of goods and services going up all the time.

So as part of your savings strategy, you need to have an investing one also.

You do need cash to day-to-day costs, short term things and events you can foresee and an emergency fund.

But beyond that, you need to consider longer-term wealth-building options like investing in the great companies of the world, property and or businesses.

You don’t need to be the next Warren Buffet and pick the next google to make investing work for you, but you do need to arm yourself with some knowledge how investments work.

To name a few areas:

- What does to go to be true look like

- The difference between investing and speculating

- Temporary decline vs permanent loss

- The power of compounding

- Diversification

- Behavioural finance.

Of the above list, the one that might have the biggest impact is behavioural finance.

How not to be your own financial enemy and start becoming your own financial ally.

Create passive income or be someone else’s

One of the things you are trying to do with saving and investing and might be a motivator for you is to create passive or nocturnal income.

This is income you do little for and comes in whether you are asleep or awake.

A couple of the most common passive income vehicles people use are rental properties and pensions.

Most of us are saving into a pension at work or privately to one day, we hope, provide us with a comfortable or luxury lifestyle.

The more you can do to create passive income now and in retirement, the more comfortable you are likely to make work optional at a time that suits you rather than just when you can access your pension.

If you don’t create your own passive income, you will be someone else’s passive income.

If you want to learn more about creating your own passive income, saving and investing, set up a call here.

FAQ: How much should I save every month

What is a good amount to save each month?

If you want to make work optional one day sooner than later you need to be looking to save 15-20% of your income. But how much you need to save is also dependent on what you are saving for and when you want to reach that figure.

Save as much as you can across easy-to-access and more restricted accounts like pensions and allow the power of compounding to start happening asap.

How many months salary should you save?

After getting out of expensive debt saving for an emergency fund should be your priority. Traditional advice is that you should think about having an emergency fund for 3-6 months of living expenses. Depending on your circumstances you may want a smaller or larger emergency fund.

Summary: How much should I save each month UK?

How much you should be saving each month depends on what you want to do with that money and what good looks like to you.

The way to figure that out is to plan everything you want to achieve in that compelling vision.

What do you want to do in the short, medium, and long term?

What does a good retirement look like, and when do you want work to become optional?

Once you know this gathering these four numbers is going to give you an idea of what you might need to save to make it happen.

- Your net worth

- Your cost of living

- Your savings rate

- Your freedom number

Now you can set out your plan, how much you need to save, and where it might come from.

Here you need to be your greatest ally making sure you take the actions that are needed and prevent or mitigate any self-sabotage on spending sprees.

Investing likely needs to be part of your savings strategy to help your wealth grow.

Keep an emergency fund in near reach when the wolf comes to the door to prevent a crisis from turning into a disaster.

Figure out how you might create your own passive income so that one day that income makes work optional for you.

Use your talents, experience and contacts to invest in something that will create an income for you well into the future.

Anyway, those are my thoughts on how much should I save each month UK; let me know yours in the comments below.

Life and Financial Planning

Get ahead in money and life

Life not going quite as you expected?

Would having a Life and financial plan in place help bring clarity on what’s most important to you and how to achieve it?

- Life, job and finances not heading in the direction you hoped?

- One or two months away from financial disaster?

- Not enough time or money to achieve what’s most important to you?

- No idea how to plan, save and invest to lead a great life?

What’s likely to be the outcome if you don’t make some serious plans asap?

More of the same?

Without making some clear plans you are at real risk of repeating what has gone before and or falling into someone else’s plan.

And guess what they have planned for you?

Not much!

Life and financial planning will give you the support, guidance, and accountability you need to succeed with money and life, building wealth in every area of your life.

- Get your life and money organised

- Build your savings cushion to create more life options.

- Help you figure out what’s most important to you and how much money is enough.

- Help you understand and build wealth so you don’t have to worry about money anymore.

Start building your life and money confidence now because waiting will only make it more expensive and painful to achieve later.

Plan, build and enjoy your life and money.

Taking you from life and financial crisis to happiness.

Contact us here for a chat about building your life and money confidence.