How to stop living above your means. 9 ways to take back control

Are you tired of living paycheck to paycheck?

Do you feel like you’re always struggling to make ends meet?

Wondering how to stop living above your means?

If so, it’s time to start learning how to live below your means.

By making a few simple changes in your spending habits, you can start saving money and investing for the future.

So, what are you waiting for? Start reading this post and get started on your path to financial freedom!

Why do I live beyond my means?

Living beyond one’s means is an extreme example of spending more money than you make.

The most common causes are that people have either lost their job, overspent in the past, don’t have any savings built up for emergencies or simply can’t control their impulses to buy things they really want but know they shouldn’t.

Why you do, this is often about money management knowledge and skills but also a focus on what you want right now rather than what you want most.

Short term thinking, FOMO and YOLO destroy long term planning and happiness.

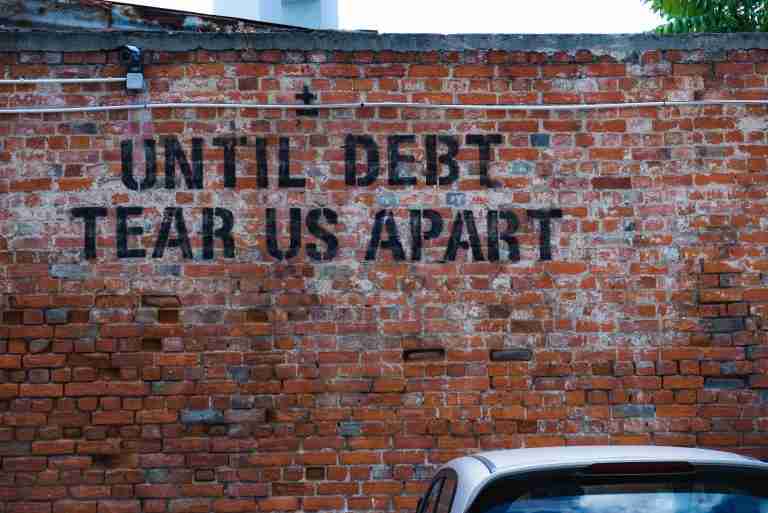

If you’re living above your means, there’s a good chance you’ll regret it later on in life when debt starts to make it harder to make everyday purchases.

What happens when you live above your means?

This will simply put you in a very bad financial situation.

People who live above their means often live outside of their budgets and try to make up for this imbalance with credit cards or loans (i.e., to cover current expenses). If this goes on long enough, one’s debt can grow exponentially until it’s impossible to keep up.

Living below our means is an often-mentioned money rule that has survived the test of time because it works!

When we don’t have much disposable income coming in each month, it suddenly becomes easier not to overspend because there’s so little left after paying our basic living expenses — heating, electricity, groceries — are covered.

And when we have more space in the budget for savings and entertainment, because our spending is in line with our income, it becomes easier to save money because we aren’t living beyond our means (this also begins to snowball).

Living below your means simply means aligning personal spending with what you take home in your paycheque. It’s important that you live within your means; if you don’t, you’ll find yourself struggling to get by and, should the amount you owe grow too large, finding yourself without savings or assets in addition to your growing debt problem.

Benefits of living within your means

There are many benefits of living within your means.

When you live within your means, you can save money, which can provide a cushion in case of hard times or unexpected expenses.

You can also avoid debt and the interest payments that come with it. Additionally, you can focus on important things, like saving for retirement or building wealth when you live within your means.

Living within your means can mean providing a better life for your family. They may be able to save money and pay down debt, so they have more financial security.

By focusing on saving rather than spending, a family can depend on themselves instead of worrying about how credit card bills will get paid.

How to stop living beyond your means

1. Make a list of financial goals and work towards them gradually

Decide on your financial goals and work towards them gradually

How often do you think about the future?

Do you like to plan ahead of time, or do you prefer to live in the moment?

Maybe it’s a place between these two extremes, but either way writing down your goals or at least best guessing what good looks like is the first step in making them happen.

Writing them down rather than just saying them forces you to think about why you want them and how you might achieve them.

Now you have a way to live within your means; you can start working on the how.

If you haven’t had any goals up until now or have not written them down, you might indicate why you are living beyond your means – you have nothing to aim for. You don’t have anything pushing or pulling you in the right direction.

Figuring out what good looks like in the very area of your life is the keystone in building and achieving your great, financially free life.

What goals do you have for your health, wealth and happiness?

Get yourself a pen and paper and start dreaming.

2. Make a budget and stick to it

Making a budget can be tough, but it’s essential if you want to start living within your means.

The first step is to sit down and figure out exactly how much money you have coming in and going out.

Be realistic about your expenses, and don’t forget to include things like groceries, utilities, and transportation. Once you have a clear picture of your finances, you can start creating a budget that fits your needs.

It’s important to be realistic when creating your budget. If you’re used to spending 500 a month on groceries, don’t expect to cut that number in half suddenly. Start by making small changes and working your way up.

Maybe you can cut back on eating out or switch to a less expensive form of transportation. By taking small steps, you’ll be able to adjust to your new budget and stick with it for good!

Three potential budgets methods

The 50 30 20 budgeting method is a great way to stay within your budget and stop living above your means. The basic idea is to allocate 50% of your income to essentials, 30% to discretionary spending, and 20% to savings.

This may not be feasible for everyone, so feel free to adjust the percentages to fit your needs.

The key is to be realistic about your expenses and only spend money on important things. If you can’t live without cable TV, then allocate more money to discretionary spending. But if you can do without, then put that money towards savings instead. By creating a budget and sticking to it, you’ll be able to live within your means and avoid overspending.

The Kakeibo method is another popular way to budget your money. It’s a simple system that can be easily customized to fit your needs. Here’s how it works:

1. Write down all of your expenses for the month. This includes everything from rent or mortgage payments to groceries and entertainment.

2. Assign each expense a category. There are many different categories to choose from, but some of the most common ones include housing, transportation, food, and entertainment.

3. Compare your total expenses with your total income. If your expenses are greater than your income, you’ll need to find ways to reduce them. On the other hand, if your income is higher than your expenses, congratulations! You’re living within your means.

4. Repeat the process every month to keep yourself on track and live within your means!

The Anti budget method – save the amount you want to save and spend the rest. Save first and spend what’s left, not the other way around.

No counting or allocating funds, just deciding what you want to save and putting that out of harm’s way, i.e., your way.

3. Stop using credit cards to cover your expenses

It can be tough to break the habit of overspending, but you can start to live within your budget with a few simple steps. One of the most important things you can do is stop using credit cards for everyday purchases like groceries and gas. It may seem helpful in the

One of the biggest reasons people struggle with living within their means is to let their credit card debt get out of control. If you’re tired of living like there’s no tomorrow, stop spending money you don’t have!

A few things you could do to cut the credit habit are

- Put your cards at a hard and inconvenient pace to reach

- Cancel and or cut up your cards

If you can afford to pay for the item with cash, think carefully about using credit, as it may mean that you will get charged even more for that item you don’t really need!

4. Pay yourself first

The key to financial success is knowing how and when you’ll get paid.

Pay yourself first and then spend what is left, not the other way around.

Automate your savings so that it just happens straight after you are paid, then focus on spending what’s left of the money from each paycheck rather than doing things backwards by paying yourself what’s left over after spending, i.e., nothing.

This is also a good way of putting yourself on a spending plan; you only spend what you have leftover from saving.

5. Pay down debt

If you’re struggling to break the habit of overspending, one of the best things you can do is pay down your debt. This will help to reduce your overall expenses and free up more money to save for the future.

There are a number of different ways to pay down debt, so find one that works best for you and stick with it. You may have to make some sacrifices along the way, but it will be worth it in the end.

Debt snowball

One popular method for paying down debt is called the “debt snowball”. With this method, you focus on paying down the smallest debts first while still making minimum payments on all of your other debts. Once the small debts are paid off, you move on to the next largest debts and so on.

This can be a motivating way to pay down debt, as you can see your progress gradually increasing over time.

Debt Avalanche

Another method is the debt avalanche. This method requires paying off your debts in order of highest interest rate to lowest. If you’re carrying multiple debts, the best way to apply extra money is towards the debt with the highest interest rate so that you can save money in the long run.

6. Find cheaper alternatives to your favourite products and services

One way to stick to your budget is to find cheaper alternatives to your favourite products and services. If you can’t live without your daily Starbucks latte, try making it at home instead.

If you’re used to going out for dinner every night, try cooking at home instead. You may find that you enjoy these activities just as much, or even more when you’re not spending so much money.

– find cheaper supermarket alternatives

– cooking at home instead of eating out

– Getter better deals on utilities, mobile phones and internet

– Use cashback websites when you are renewing contracts

7. Sell unused items online or at a garage sale

If you’re having a hard time living within your budget, one easy way to cut back is to sell some of your unused items online or at a garage sale. This can be anything from clothes to furniture to appliances.

By getting rid of unwanted items, you’ll free up some extra money that can be put towards savings or debt repayment.

Remember, the more stuff you get rid of, the more money you’ll save! So take a look around your house and see what you can sell. You may be surprised at how much money you can make.

8. Don’t buy things you don’t need

One of the best ways to stop living above your means is to stop buying things you don’t need. This can be tough in today’s society, where everything seems to be a must-have.

But if you can learn to say no, you’ll be able to stick to your budget much more easily.

Try not to go shopping unless you have a specific item in mind that you need. And even then, make sure you’re realistic about what you can afford. If you see something that’s on sale, it’s easy to buy it on impulse.

But if you’re not careful, those small purchases can quickly add up and blow your budget.

Instead of buying things on a whim, try waiting a few days delaying any purchases

You could try the 30-day challenge. If you’re still thinking about it after 30 days, then maybe it is something worth buying.

9. Stay disciplined and don’t give up!

It takes time but eventually, you will see results.

It can be tough to stay disciplined and live within your budget, but it’s worth it in the end. Just remember to take things one step at a time, and don’t give up! You will eventually see results if you stick with it.

Start by planning out your budget for the month. Figure out how much money you have coming in, what costs need to be paid, and how much you should save each week. Then try to stick with this plan as closely as possible

Don’t give up if you slip up and spend more than planned! Just pick yourself back up again and try to do better next time. Living within your budget takes time, but eventually, you’ll see results!

Conclusion: how to stop living above your means.

To live below your means, you must understand what’s currently going on with your money.

This will give you a clear idea of the problem areas and how much money is being spent on these items or habits that contribute to living above one’s means.

After doing this exercise, it might be easier for you to identify the root causes of overspending so that they can be addressed head-on. It may also help to establish limits around certain expenses like dining out or shopping trips.

The key here is following through with them! You’ll need to make some sacrifices along the way, but if done consistently enough, living within one’s budget should be achievable after a few months- especially when considering all the benefits associated with having more savings available at the end of the month.

If you’re struggling to live below your means, don’t worry – you’re not alone. With a little bit of effort, though, you can break the habit and start living within your budget.

Make a plan, set some limits, and stick to them! You may have to make some sacrifices along the way, but it will be worth it in the end.

If you would like some help figuring out how to stop living above your means, click below to find out more.