How to create your financial freedom formula (make work optional)

When it comes to financial freedom, there is no one-size-fits-all solution.

Your financial freedom formula might include spending less, making more, saving, and avoiding debt. You also need to take control of your finances so that you are not at the mercy of your spending habits or debt repayments.

This article will discuss how to create your financial freedom plan and why it’s important.

We’ll also go over some key tips on spending less, making more, saving more, and preventing disasters from happening. Finally, we’ll provide a strategy for investing your money so that you can work towards your goal of financial freedom.

What is financial freedom and why might you want it

Reaching financial freedom is important for many reasons. Perhaps the most important reason is that it can help you take control of your finances.

When you achieve financial freedom, you are no longer at the mercy of the bank or credit card company. You can finally start getting ahead financially and building wealth.

Financial freedom also allows you to live a life of choice. You can choose to work less and spend more time with your family or pursue your hobbies. The sky is the limit when you reach financial freedom.

What is the difference between financial freedom vs financial independence

There is a lot of overlap between financial freedom and financial independence, but there is a key difference.

Financial independence refers to the state of being able to cover your monthly expenses with passive income.

Financial freedom, on the other hand, goes one step further and describes the state of having enough wealth so that you don’t have to work at all if you don’t want to

While achieving financial independence is an important goal for many people, true financial freedom involves much more than just having enough passive income to cover your expenses each month

To achieve true financial freedom, you need to build up a large amount of wealth through smart investments and savvy spending habits. This allows you to not only achieve financial independence but also gives you the freedom to pursue your passions and do what you love

How to create your own financial freedom formula

Here are the elements of financial success. You may need to adjust them to the specifics of your own personal finances and your ultimate goal of being financially free.

Know your numbers

Most people don’t know their numbers.

To have any chance at financial success, you must clearly grasp your money and where it’s going.

- Your current income

- You living expenses

- Your net worth

- The taxes that you pay and could legally avoid

- How much you are saving

- How much you are investing

- Your financial freedom number

You can earn all the money in the world, but if you don’t have any money management skills, you will soo find it slip through your fingers on stuff.

Don’t be like most people; get a grip on your monthly income and expenses, decide to get good at money and start tracking what’s going on.

Spend less money

The starting point of your financial freedom formula should be living within your means.

Or spending less than make.

If you can’t or won’t do this, not much else is going to matter.

Spending less creates a margin of safety between your monthly cash flow and your monthly expenses.

This allows for room for error and the ability to save money each month.

It also allows you to invest money each month which can grow over time and provide even more financial security.

Some key ways to spend less money include:

- Cutting back on unnecessary expenses: Take a close look at your spending habits and see where you can cut back. Perhaps you can cancel your gym membership or eat out less often. There are many ways to save money, so find what works best for you.

- Creating a budget: A budget is a tool that can help you track your spending and make sure that you are living within your means. When creating a budget, be sure to include all of your income and expenses. This will help you get a clear picture of your finances.

- Sticking to your budget: Once you have created a budget, it is important to stick to it. This can be difficult at first, but it is crucial if you want to achieve financial freedom.

Save more money

Saving money is another important part of your financial freedom formula. When you save money, you create a cushion that can help you in an emergency. It is also important to have savings so that you can invest in your future.

Some key ways to save money include:

- Many banks allow you to set up automatic transfers into your savings account. This is a great way to make sure that you are saving money each month.

- Holidays and present fund: Start setting aside money each month for holiday and birthday gifts. This will prevent you from having to put these expenses on a credit card.

- Save your windfalls: When you get a raise at work or receive a tax refund, put this money into savings instead of spending it. This will help you grow your savings account quickly.2. Take control of your finances

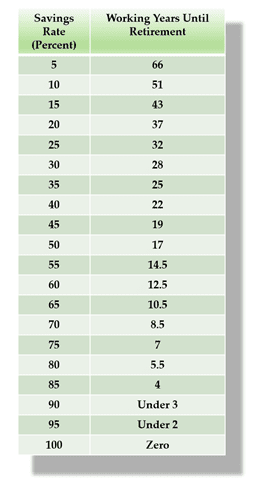

Mr Money moustaches blog, the shockingly simple math behind early retirement shows some of the savings rates that will help you reach financial freedom much earlier.

Invest your money

Investing your money is another important part of achieving financial freedom. When you invest, you are putting your money to work for you. This can help you build wealth over time and reach your financial goals sooner.

Some key ways to invest your money include:

- A personal or work-based pension. If your employer offers a pension plan, be sure to sign up and contribute as much as possible. This is a great way to save for retirement. Although you want to get access until you reach the right age/

- Invest in low-cost globally diversified index funds: Stocks are a great way to grow your money over time. When you invest in stocks, you are buying a piece of a company. As the company grows, so does the value of your investment.

- Property investment: Another great way to invest your money is in the property. You can rent it out and earn income each month when you purchase a property. This can help you reach your financial goals more quickly.

- Invest in businesses, including your own: If you are an entrepreneur, one way to invest your money is in a business that you own. This can be a great way to take control of your financial future and build wealth over time.

- Invest in yourself to develop new skills to improve your current job in the short and long run and pivot to another career or business.

Avoid debt

Avoiding debt is another important part of your financial freedom formula. When you are in debt, you are making payments to the lender each month. This can make it difficult to save money and reach your financial goals

Some key ways to avoid debt include:

- Live within your means: One of the best ways to avoid debt is to live within your means. This means spending less than you earn and only borrowing when necessary.

- Create a budget: Creating a budget can help you track your spending and make sure that you are living within your means.

- Save money: Saving money each month can help you avoid debt by giving you a cushion in case of an emergency.

- Pay off your debt: If you are already in debt, be sure to make payments on time and pay off your debt as quickly as possible.

- Have a cooling-off period before making purchases to be sure you really need and want them.

Make more money

Your financial freedom is also likely to need you to create more money.

The more you make, the more you can save and invest to make more money; it also gives you a bigger safety net between what you earn and what you spend.

Some key ways to make more money include:

- Getting a higher paying job: If you are not happy with your current salary, look for ways to increase your income. This might include asking for a raise, changing jobs, or going back to school to get a higher degree.

- Starting a side hustle: A side hustle is a great way to make extra money. There are many different ways to start a side hustle, so find something that you are passionate about and get started.

- Getting a second job: If you need some extra cash, consider getting a part-time job or freelancing.

- Creating multiple income streams that could include your day job,(active income) side hustle and property ownership. This could include creating a number of online or offline assets that earn you money (passive income).

Prevent crises from turning into disasters

One of the best ways to prevent a crisis from turning into a disaster is to have an emergency fund.

This will help you financially protect yourself and your family in case of a crisis that needs money to prevent, mitigate or solve.

It’s also important to have an emergency fund so that you can cover your expenses in case of unexpected events.

When you have both insurance and an emergency fund, you can rest assured knowing that you are prepared for anything that might happen.

You can also put a number of insurances in places such as life, health, car and home insurance. These will help protect you financially in case of an accident or emergency.

Some key ways to start an emergency fund include:

- Saving money each month

- Putting money aside when you get a raise or bonus

- Selling items you no longer need

How much do you need for financial freedom

Your financial freedom formula = 25 x your expenses

This formula will help you calculate how much money you need to have saved in order to reach your goal.

The first step is to calculate your monthly expenses. Add up all your fixed expenses, such as your mortgage or rent, car, and insurance payments. Then, add up all of your variable expenses, such as food, gas, and entertainment.

Once you have your total monthly expenses, multiply that number by 12. This will give you your annual expenses.

Next, you’ll need to multiply your annual expenses by 25. This will give you your financial freedom number.

For example, let’s say that your monthly expenses are $5,000. This means that your annual expenses would be $60,000. If you multiply that by 25, you’ll get a financial freedom number of $1.5 million.

If this figure is scary then best to start working on it now.

That figure is not what you have to save its the amount of money you need to create from saving and investing and the growth you can achieve this year and year on year.

Your savings and investments should grow by themselves through compounding interest and investment returns year after year. You just have to build up enough momentum to make your money work for you while you are asleep!

How to put your financial freedom formula into action

Set clear goals for your finances and life

The first step to putting your financial freedom formula into action is to set clear financial and life goals.

- What do you want to achieve?

- Do you want to be debt-free?

- Do you want to retire early?

- Do you want to travel the world?

- Once you know what you want, you can start working towards it.

Be clear on the actions you need to take

- Saving more

- Spending less

- When you have spare cash invest in assets

- Creating more income

- Investing in assets – things that put money into your pocket and not take it out.

- Automating your finances as much as you can

- Invest in yourself – improving your knowledge and skills

Understand your money

- Know your numbers, what you are worth, and how much you spend and save.

- What is your financial freedom number – 25 x your annual expenditure

- How will you get there, saving, investing and or entrepreneurialism?

- Improve your financial literacy year on year – Warren Buffet is a good place to start.

Put your financial freedom formula into action

Now that you have a financial freedom plan in place, it’s time to put it into action and start working towards your goal.

Track your progress

Another important aspect of achieving financial independence is tracking your progress. This means that you need to keep track of how much money you are making, how much money you are saving, and how much debt you are paying off. This information will help you stay on track and reach your goal.

Celebrate your success

Don’t forget and enjoy your success on the way to financial freedom.

You’ve worked hard to get where you are, so take the time to celebrate your success. This could mean taking a vacation, buying a new car, or simply taking a night off to relax. Whatever you do, make sure that you enjoy your journey to financial freedom!

Final thoughts on designing your financial freedom formula

Achieving financial freedom is not easy, but it is definitely worth the effort.

You need to come up with your own financial freedom formula that will work for you and then put it into action.

This might include spending less, making more money, saving more, and avoiding debt.

You also need to take control of your finances so that you are not at the mercy of the bank or credit card company.

There are many different strategies for investing your money, so find one that suits you and start investing today.

Finally, enjoy your hard-earned financial freedom!

If you want help designing your financial freedom plan, sign up for our newsletter to get our latest updates.

FAQ Financial Freedom Formula

1. What is financial freedom?

Financial freedom is the ability to live comfortably without having to worry about money. It means you have enough money saved up so you don’t have to work anymore. Financial freedom can be achieved by saving money, making more money, or avoiding debt

2. How can I achieve financial freedom?

There is no one-size-fits-all answer to this question. You need to come up with your own financially free formula that will work for you. This might include spending less, making more money, saving more, and avoiding debt. You also need to take control of your finances so that you are not at the mercy of the bank or credit card company. There are many different strategies for investing your money but low-cost globally diversified index investing is a good place to star

3. What is the best way to invest my money?

The best way to invest your money depends on your individual circumstances, such as when you want to access the money and your risk tolerance. You can invest in stocks, mutual funds, real estate, or even start your own business. Doing some research on the different methods and their pros and cons is a good place to start.

4. How can I live below my means?

Set some clear goals for what you want to achieve so you have something to aim for.

Track all your money coming in and going out. Create a budget for where you want your money to go. Look for cheaper options for what you normally buy, cut down or cut out things you don’t really need.

Automate your savings so it all happens with the least amount of work.

Review and revise how it’s going each month.

5. What should I do with my extra money?

One of the best things you can do with your extra money is to invest it in assets. This will help you reach your financial goals more quickly. You can invest in stocks, mutual funds, real estate, or even start your own business. Just find what works best for you and start investing today.

6. What should be in your financial freedom plan?

Your financial freedom plan should include your key life and financial goals, such as saving for the future, investing in your education, and living below your means. You should also make a budget and avoid spending money on things you don’t need.

Additionally, it’s important to be aware of your spending patterns and educate yourself on personal finance and investing.

Finally, when necessary, it’s a good idea to seek professional help in order to achieve financial freedom and security. With the right strategy, you can achieve financial happiness and stability.

Want help with your financial planning?

Take control of your financial future with Financially Happy!

Our financial planning coaching services will empower you to make informed decisions, set and achieve financial goals, and ultimately lead a financially happy life.

Don’t wait; schedule your consultation today and start your journey to financial freedom!