How to Juggle Mortgage Payments, Savings, and Living Life in Your 40s

Welcome to the Juggling Act

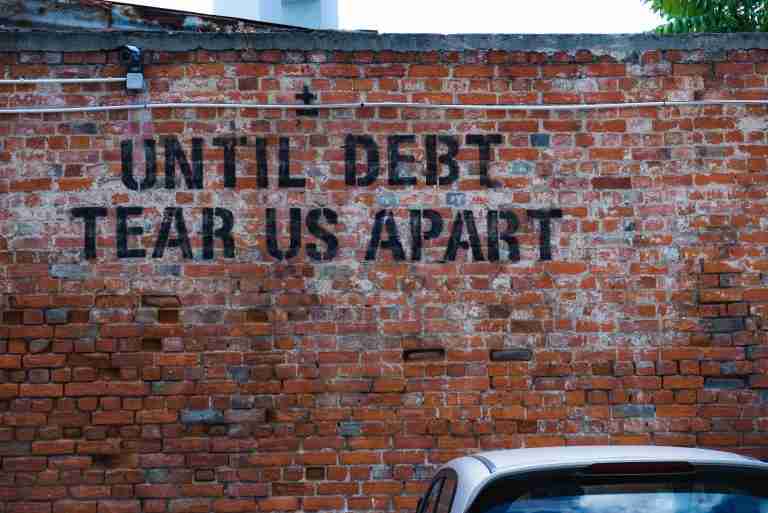

You’re in your 40s. The mortgage looms over you, savings need attention, and you still want to enjoy life. Sound familiar? 🏠💸✨

Balancing all these financial demands can feel like a circus act, with you right in the middle, trying to keep everything moving without dropping a single ball. It’s not just about paying the bills or building a nest egg—it’s about actually living, enjoying the here and now. So, how do you make it all work?

This guide will show you practical strategies how to juggle mortgage payments, savings goals, and, most importantly, living your best life.

Understanding Your Financial Priorities in Your 40s

Your 40s are a decade of transition, often defined by shifting goals and evolving responsibilities. This phase might bring career milestones, family changes, and a renewed focus on achieving true financial stability. Understanding these evolving needs is crucial for managing everything from your mortgage to savings while ensuring you don’t lose sight of your personal well-being.

By the time you reach your 40s, your financial focus often shifts. The carefree days of spending without much consequence are behind you, and now it’s all about balance—paying down that mortgage, saving for future security, and still having room for the things that make life meaningful.

It’s helpful to step back and figure out what matters most to you. Is it securing a debt-free home for your family? Retiring comfortably? Travelling and making memories while you’re still young enough to enjoy it? Having clarity on your priorities will make it easier to manage your money effectively.

Making Mortgage Payments Manageable

Review Your Mortgage

A mortgage can be one of the most significant expenses in your life, and it doesn’t need to be set in stone. Regular reviews can make a considerable difference to your financial health, and it could even reduce the term or cost of your mortgage. Here are some steps you can take:

Mortgages can feel like an unmovable mountain, but you might have more control than you think. If it’s been a few years since you last reviewed your mortgage, it’s worth checking if there’s a better deal out there. Refinancing might help you lower your interest rate or adjust your payments to better suit your situation.

Overpayment Strategies

If you’re in a stable financial position, overpaying on your mortgage can save you a lot in interest over the years. Even small overpayments can make a big difference—just make sure there aren’t any penalties from your lender.

Prioritise High-Interest Debts

If you’ve got other debts hanging over your head, particularly high-interest ones like credit cards, focus on paying those off before directing extra cash to your mortgage. You’ll save more in the long run by eliminating expensive debts first.

Building a Sensible Savings Plan

Emergency Fund First

Life happens, and having a solid emergency fund can provide much-needed peace of mind. Aim for 3-6 months’ worth of essential expenses tucked away in an easy-access account. It’s not exciting, but it’s a safety net that’ll stop unexpected bumps from turning into financial crises.

Automate Your Savings

Automation is key to keeping your financial goals on track. You want to make saving as effortless as possible, turning it into a habit rather than an occasional task. By setting up direct deposits or automatic transfers, you can consistently build up your savings without the temptation to spend elsewhere. The trick is to ‘pay yourself first’ before spending on other non-essential items.

Long-Term vs Short-Term Savings

Think about dividing your savings into different buckets. Long-term savings, like a pension or an ISA, are for future-you (hello, retirement!). Short-term savings, on the other hand, are for upcoming goals, like a family holiday or a big anniversary celebration. Having different accounts can help keep you motivated.

Enjoying Life Without Guilt

The Importance of a ‘Fun Fund’

It’s not just about the future. To stay motivated and happy, you need to enjoy the present too. Setting aside some money specifically for fun—whether that’s a date night, a hobby, or a getaway—means you can live a little without guilt.

Mindful Spending

The concept of mindful spending isn’t just about cutting costs—it’s about getting value for every pound you spend. Think of each pound as a small worker: are you deploying them in ways that genuinely add happiness to your life, or are they slipping away unnoticed? Being intentional can lead to more meaningful expenditures, and this starts with identifying what matters most to you and eliminating mindless spending habits.

Quality Over Quantity

Instead of trying to have it all, focus on quality experiences. A single, meaningful trip or a well-thought-out weekend away can bring more joy than multiple smaller, less satisfying splurges.

Strategies to Balance It All: Practical Tips

50/30/20 Rule

A simple budgeting approach that works for many is the 50/30/20 rule. Allocate 50% of your income for needs (including mortgage payments), 30% for wants (the fun stuff), and 20% for savings. It’s a good starting point, but remember, it’s just a guideline—adjust it to fit your reality.

Budget Reviews

A regular budget review ensures that your financial plan aligns with your goals and helps you adapt to any changes in income or expenses. After all, life rarely stands still—promotions, moving house, unexpected medical expenses, or even just changing interests can all affect your budget. Setting aside time each month for a quick budget check-up, and doing a deep dive once or twice a year, can make sure you stay on track.

Cut Costs Creatively

Cutting costs doesn’t always mean sacrificing what you love. Sometimes, it’s about thinking creatively. Start by taking inventory of your current spending habits and identifying areas for adjustment.

For instance, could you negotiate a better rate on your phone bill?

Switch to generic brands for household items?

Or even batch-cook meals to save both time and money?

The more creative you get, the more you can save without feeling deprived. Additionally, trying a ‘no-spend’ challenge for certain days can help you reset spending habits and appreciate the resources you already have.

FAQs: How to Juggle Mortgage Payments

Q1: Should I overpay my mortgage or save more for retirement?

This depends on your interest rates and personal goals. If your mortgage rate is low, it might make more sense to invest in your pension, especially if your employer matches contributions. However, if being debt-free is a top priority for you, overpaying could be a rewarding option.

Q2: How do I start building an emergency fund when money is tight?

Start small. Even £10 a week adds up over time. The key is consistency. Automate this process if possible, and look for ways to cut back on non-essential spending until you’ve built a cushion.

Q3: Is it okay to spend on luxuries while I still have a mortgage?

Absolutely! It’s all about balance. Life is for living, and if you budget for luxuries responsibly, they can be part of your financial plan. A ‘fun fund’ helps make sure you enjoy life without jeopardising your financial stability.

Q4: How often should I review my budget?

A good rule of thumb is to do a detailed review annually and a quick check every month. Major life changes, like switching jobs or taking on new expenses, are also great moments to revisit your budget.

You’re in Control—Not Just Surviving, But Thriving

In your 40s, you’re in a powerful position to shape your financial future. Balancing a mortgage, saving for the future, and living a fulfilling life is no easy task, but with the right approach, it’s absolutely possible. Remember, it’s all about understanding your priorities and creating a system that reflects what’s important to you. Taking control of your finances now will set the stage for not just surviving—but thriving—in the years to come.

Why not start today by making one small change? Review your mortgage, automate your savings, or plan your next fun outing. Every little step counts.

Take the First Step Towards a Stress-Free Financial Future – Let’s Chat!

Feeling overwhelmed by trying to balance your mortgage, savings, and enjoying life?

I can help you take control of your financial journey. Whether it’s making your mortgage more manageable, building a solid savings plan, or finding ways to enjoy today without sacrificing tomorrow, a free 30-minute discovery call can get you started. Let’s create a personalised plan to solve your financial challenges together.

If you’d like more personalised help in balancing your financial life, feel free to book a free 30-minute discovery call. Let’s explore how to make your finances work for you—so you can keep living life to the fullest.