Goodbye Debt, Hello Freedom: 7 Proven Strategies to Take Control of Your Finances

Understanding Debt and Its Impact

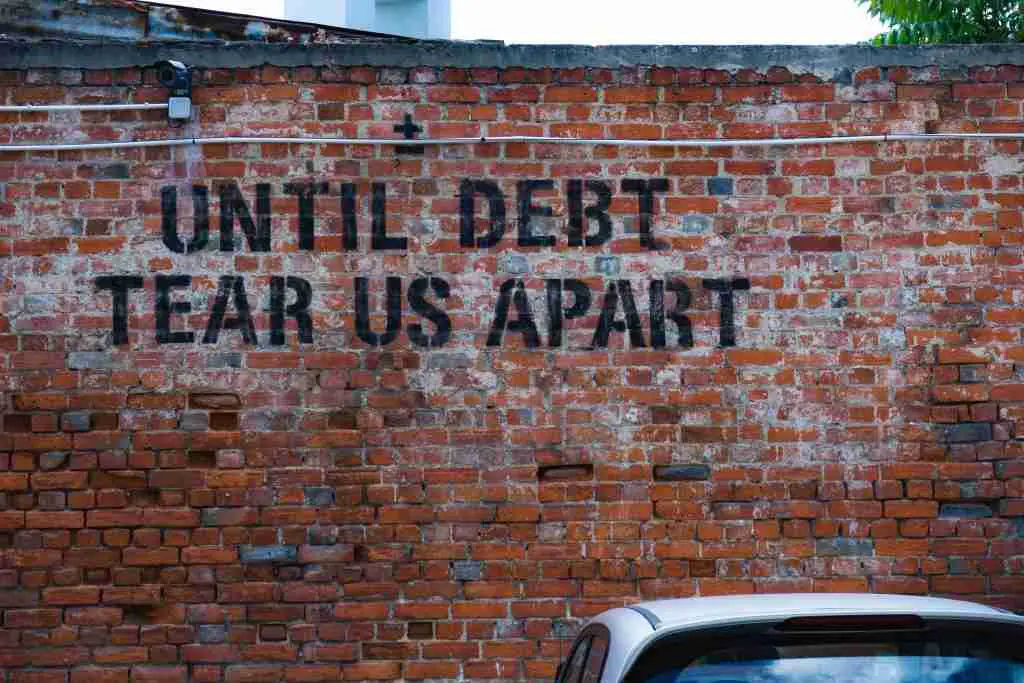

Picture this: waking up in the morning without the weight of debt dragging you down, not dreading the sight of bills and payment reminders. Sounds like a dream, right? The stress that debt can bring isn’t just about numbers on a page; it’s a cloud that affects your mental well-being, relationships, and even your sleep.

The good news is that debt isn’t a life sentence. With some practical strategies, you can start chipping away at it, bit by bit, until it’s gone. This blog will guide you through seven tried-and-tested strategies that can help you take control of your finances and start on the path to financial freedom. So, let’s dive in and say goodbye debt!

1. Assess Your Debt Situation: Know Where You Stand

The first step to getting rid of debt is understanding exactly what you’re dealing with. It can feel overwhelming, but facing your debt head-on is crucial for progress.

Start by listing all your debts—credit cards, loans, overdrafts—along with the interest rates, minimum monthly payments, and due dates. You can use a simple spreadsheet, a budgeting app, or even pen and paper, whatever works best for you.

Knowing the full picture makes it easier to create a plan and reduces the uncertainty that often makes debt feel so unmanageable. Once you have a clear overview, it becomes easier to move forward.

2. Prioritise Debts with the Avalanche or Snowball Methods

When it comes to paying off debt, you have a couple of popular strategies to choose from: the Debt Avalanche or the Debt Snowball. Each method has its strengths, so let’s break them down:

- Debt Avalanche: With this method, you focus on paying off debts with the highest interest rates first, while making minimum payments on the rest. This approach saves you money on interest in the long run, which means you’ll pay off your total debt faster. It’s perfect if you’re motivated by saving money and enjoy seeing your total costs shrink.

- Debt Snowball: This method focuses on paying off your smallest debts first. You make minimum payments on all debts but throw any extra money at the smallest balance. Once the smallest debt is paid off, you move on to the next smallest. The idea here is to build momentum—each small victory gives you motivation to keep going. If you’re someone who loves seeing progress and needs a quick win to stay motivated, this approach might be for you.

There’s no one-size-fits-all answer here—it’s all about what works for you. If seeing progress quickly helps you stay committed, go with the Snowball. If saving money is your driving force, Avalanche might be the better fit.

3. Budget Like a Boss: Make Space for Debt Payments

A solid budget is your best friend when it comes to tackling debt. Start by assessing your monthly income and expenses, and look for areas where you can cut back or adjust to make more room for debt repayment.

Focus on areas where you tend to overspend—whether it’s eating out, entertainment, or those little impulse buys that add up over time. By trimming unnecessary expenses, you can redirect those funds towards debt repayments. It’s not always easy, but the results can be incredibly rewarding.

There are plenty of tools to help you budget effectively, from old-school spreadsheets to modern apps like YNAB or SNOOP. Find a system that suits you, and make sure to build in some flexibility for unexpected expenses.

4. The Power of Side Hustles: Boosting Your Repayment Capacity

Sometimes, cutting expenses just isn’t enough, especially if you have high-interest debts or a large amount to tackle. This is where a side hustle can make a big difference.

Think about what skills you have that could be monetised. Are you good at writing? Try freelance content creation. Have a knack for crafting? Sell your creations online. From tutoring to pet sitting, side gigs can bring in a bit of extra cash each month, which can significantly speed up your debt repayment.

Even if it’s just an extra £100 a month, putting that towards your debt can reduce the amount of interest you pay overall and bring you closer to freedom. Plus, it gives you a tangible sense of progress.

5. Negotiate with Lenders: Lowering Interest Rates and Payments

You might not realise this, but lenders can sometimes be surprisingly flexible if you take the time to contact them. If you’re struggling with high interest rates or unmanageable monthly payments, consider calling your creditors to negotiate.

Be honest about your situation and let them know you’re committed to paying off your debt but need a little help to make it manageable. You might be able to get a reduced interest rate, lower minimum payments, or even have fees waived. Remember, lenders would rather receive a partial payment than nothing at all, so there’s no harm in asking.

You could start by saying something like, “I’m finding it difficult to manage my payments at the current rate. Is there anything you can do to help reduce my interest or restructure the payments?” It takes a little courage, but it could lead to a more manageable plan.

6. Consider Consolidation: Simplifying Repayment

Debt consolidation can be a great tool if you have multiple debts that you’re struggling to keep up with. It involves combining all your debts into one, often with a lower interest rate, which means you’ll have just one monthly payment to worry about.

There are a few ways to consolidate debt—using a personal loan or a balance transfer credit card are the most common. Personal loans often come with lower interest rates than credit cards, making them a good option if your debt is spread across high-interest accounts. Alternatively, a balance transfer card can offer a 0% interest period, giving you a chance to make a dent in your balance without racking up extra charges.

Be aware, though, that this option isn’t without risk. Consolidation might lead to a longer repayment period, and if you’re not careful, it could be tempting to run up more debt on those now-empty credit cards. It’s crucial to address the spending habits that led to debt in the first place.

7. Automate and Reward Yourself: Stay Consistent and Motivated

Debt repayment is a marathon, not a sprint. One way to make sure you stay on track is by automating your payments. Set up automatic payments to go out right after payday so that you’re never tempted to spend that money elsewhere. Automation helps you build consistency and takes the guesswork out of sticking to your plan.

At the same time, don’t forget to celebrate your milestones. Each time you pay off a debt, even if it’s a small one, take a moment to celebrate. Whether that means treating yourself to a favourite snack, having a mini night in, or just giving yourself a pat on the back—it’s important to acknowledge the progress you’re making. Positive reinforcement can help keep you going when things get tough.

Pitfalls to Avoid During Debt Repayment

When you’re focused on paying off debt, there are a few traps to be mindful of:

- Ignoring Interest Rates: Choosing a strategy like Snowball can be motivating, but ignoring high interest rates could cost you more in the long run. Make sure your repayment plan balances progress with cost-effectiveness.

- Taking On New Debt: It can be tempting to apply for new credit while repaying existing debt, especially during tough months. Avoid this if possible, as it can quickly undo all your progress.

- Skipping Emergency Savings: While it may seem counterintuitive, keeping a small emergency fund is crucial. Without it, you might find yourself turning to credit again when faced with an unexpected expense.

FAQ: Common Questions About Debt Repayment

1. Should I pay off my highest interest debt first or my smallest debt first?

It depends on your personal goals. Paying off the highest interest debt first (Debt Avalanche) will save you the most money, while paying off the smallest debt first (Debt Snowball) can provide quicker wins to keep you motivated.

2. How much should I budget for debt repayment each month?

This depends on your income and other expenses. Start by assessing your budget to see where you can cut costs, and then allocate as much as you can comfortably afford towards debt repayment.

3. Is debt consolidation a good idea?

Debt consolidation can be helpful if you’re struggling with multiple high-interest debts. It simplifies payments and may reduce your overall interest rate. However, it’s important to avoid taking on new debt after consolidating.

4. Can I negotiate with creditors myself, or do I need a professional?

You can absolutely negotiate with creditors yourself. Just be honest about your financial situation and express your commitment to repaying the debt. Many creditors are willing to work with you if you ask.

5. Should I still save while repaying debt?

Yes, it’s wise to maintain a small emergency fund even while repaying debt. This will help prevent you from needing to use credit again if unexpected expenses arise.

Goodbye debt: Take Action Today for a Better Tomorrow

Debt can feel like a never-ending burden, but it doesn’t have to be that way. By assessing where you stand, prioritising repayments, finding ways to increase your income, and staying consistent, you can start to turn the tide in your favour. Remember, the key is taking that first step—whether it’s writing down your debts, creating a budget, or contacting your creditors.

It may take time, but with determination and a solid plan, financial freedom is absolutely achievable. The sooner you start, the sooner you’ll be able to say goodbye to debt and hello to a future full of possibilities.

Ready to start your journey to financial freedom? Book a free discovery call today and let’s create a personalised plan to help you achieve your goals!