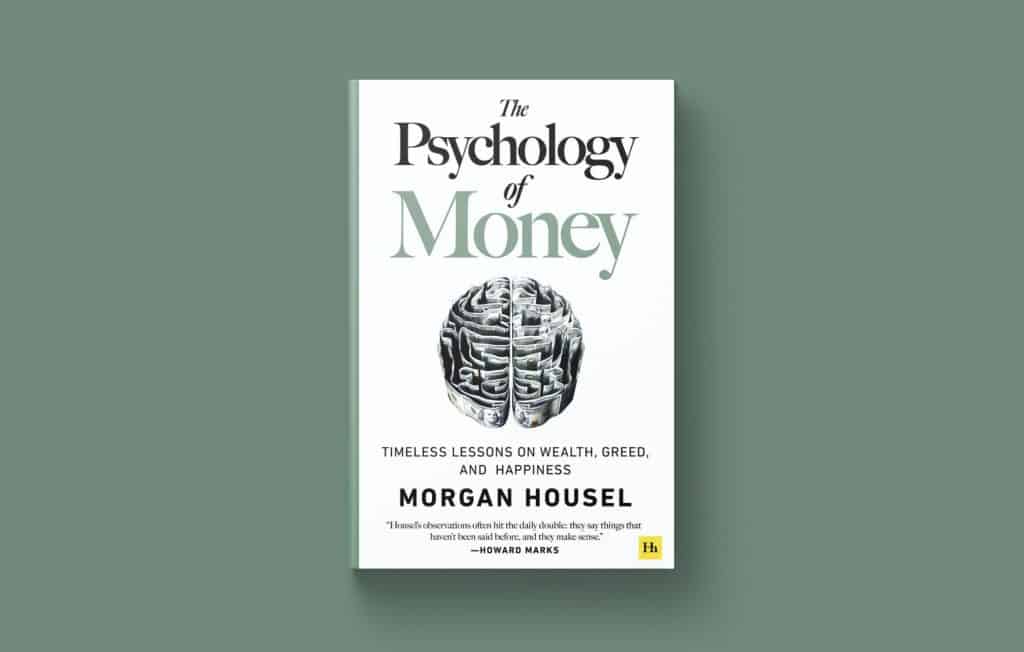

The Psychology of Money: Probably the best book about money #1💰

Hello, money enthusiasts! Today, we’re diving into the world of personal finance, but not in the way you might expect. We’re not talking about stocks, bonds, or complex financial jargon. Instead, we’re exploring the emotional side of money.

“The Psychology of Money” by Morgan Housel emphasizes that successful money management is more about behaviour and mindset than mathematical expertise. It underscores the importance of patience, frugality, and understanding one’s emotional biases in financial decision-making.

So, buckle up, grab a cup of ☕️, and let’s get started!

Money: It’s Not Just About the Math(s) 🧮➕➖

When we think about money, we often think about numbers. But here’s a fun fact: money isn’t just about math, it’s about behaviour. It’s like eating a box of chocolates 🍫. You know you should only have one or two, but you’ve eaten the whole box before you know it. Why? Because our behaviour often trumps logic.

Actionable Step: Start observing your behaviour around money. Are you spending impulsively like a kid in a sweetshop 🍭? Or are you saving like a squirrel hoarding nuts for the winter 🐿️? Try to understand your emotional triggers related to money and work and focus on improving your behaviour. Here’s a great article to help you understand impulsive vs. compulsive behaviour.

Wealth: It’s What You Don’t See 👀💼

We often equate wealth with flashy cars 🚗, big houses 🏠, and designer clothes 👠. But wealth is the money you’ve saved and invested, not the things you’ve bought. It’s like the iceberg that sank the Titanic: what you see on the surface is only a small part of the whole picture.

Actionable Step: Start saving a portion of your income every week. It doesn’t have to be a lot, even a small amount can add up over time. Think of it like a game of Monopoly 🎲. The player who buys every property they land on often ends up broke, while the player who invests wisely ends up winning the game. Here’s a simple guide on how to start saving money.

Luck and Risk: The Fraternal Twins 🎲🎰

Sometimes, people get rich because they’re lucky, like finding a $20 bill on the path🍀. And sometimes people lose money because they’re unlucky, like getting a flat tire on the way to a job interview 🚗💨. Understanding this and not getting too confident or scared is important.

Actionable Step: Don’t put all your eggs in one basket. Diversify your investments to spread the risk. It’s like eating at a buffet 🍽️. You wouldn’t fill your plate with just one type of food.

You can achieve investing diversification with just one index fund, which holds thousands fo company shares all over the world.

Save Money to Control Your Time ⏰💸

The real purpose of saving money is to have control over your time. The more money you save, the more choices you have. It’s like having a magic wand that can turn time into money and vice versa 🧙♂️.

Actionable Step: Think about what you would do with more free time. Would you travel the world 🌍? Start your own business 🏢? Then, start saving money to make that dream a reality. Here’s an inspiring article on why and how to start saving for your future.

Investing: The Long Game 🐢💰

Investing is not about getting rich quick. It’s not a sprint; it’s a marathon 🏃♂️. It’s about growing your wealth slowly over time. It’s like planting a tree 🌳. You don’t plant a seed today and expect a fully grown tree tomorrow.

Actionable Step: Start investing a small amount of money weekly or monthly. Be patient and let your investments grow over time. Here’s a beginner’s guide to investing.

Emotions: The Cloudy Lens of Financial Judgment 😄😢

It’s easy to make poor financial decisions when we’re driven by fear or greed. It’s like going grocery shopping when you’re hungry. You end up buying many things you don’t need, and you forget what you actually do need.

Actionable Step: Before making a big financial decision, take a step back and make sure you’re not being driven by emotion. Here’s a thought-provoking article on the role of emotions in financial decisions.

The best book about money in table format!!!

| Core Principle | Description | Actionable Step |

|---|---|---|

| Money: It’s Not Just About the Math | Observe and improve your behaviour around money. | Wealth is the money you’ve saved and invested, not what you’ve bought. |

| Wealth: It’s What You Don’t See | Wealth is the money you’ve saved and invested, not the things you’ve bought. | Save a portion of your income every week. |

| Luck and Risk: The Fraternal Twins | Sometimes, people get rich because they’re lucky, and sometimes people lose money because they’re unlucky. | Diversify your investments to spread the risk. |

| Save Money to Control Your Time | The real purpose of saving money is to have control over your time. | Save money to achieve your dreams and have more control over your time. |

| Investing: The Long Game | Money isn’t just about numbers; it’s about how we behave with it and how we think about it. | Start investing a small amount of money regularly and be patient. |

| Emotions: The Cloudy Lens of Financial Judgment | Emotions can often cloud our financial judgment, leading to poor decisions. | Investing is not about getting rich quickly. It’s about growing your wealth slowly over time. |

FAQ: The Psychology of money, surely the best book about money!

What is a good book to read about money?

“Your Money or Your Life” by Vicki Robin and Joe Dominguez is a great book about money.

It’s a classic in personal finance books and has guided many people seeking to transform their relationship with money.

The book provides a step-by-step program for achieving financial independence and presents a new way of thinking about money, encouraging readers to consider their earnings as life energy.

It’s an excellent choice for anyone looking to understand better their spending habits, savings, and overall financial life.

Is Psychology of Money worth reading?

Yes definitely, “The Psychology of Money” is definitely worth reading. It offers valuable insights into how our behaviours and emotions influence our financial decisions, emphasizing the importance of understanding one’s own relationship with money for long-term financial success.

How can I learn about money?

You can learn about money by reading personal finance books, taking online courses, listening to financial podcasts, following financial blogs, and seeking advice from financial advisors. It’s also helpful to regularly review your own finances to understand your spending and saving habits.

How can I be financially smart?

To be financially smart:

Budget: Track your income and expenses to understand where your money is going.

Save: Aim to save at least 20% of your income for future needs and emergencies.

Invest: Make your money work for you by investing in stocks, bonds, or real estate.

Limit Debt: Avoid unnecessary debt and always pay off high-interest debt first.

Plan for the Future: Consider your long-term financial goals and make a plan to achieve them.

Educate Yourself: Continually learn about personal finance to make informed decisions.

Insure: Protect yourself from financial disasters with appropriate insurance.

Diversify: Don’t put all your financial eggs in one basket; diversify your investments.

Live Below Your Means: Avoid lifestyle inflation by not increasing your expenses as your income grows.

Seek Professional Advice: Consult a financial planner or coach for personalized advice.

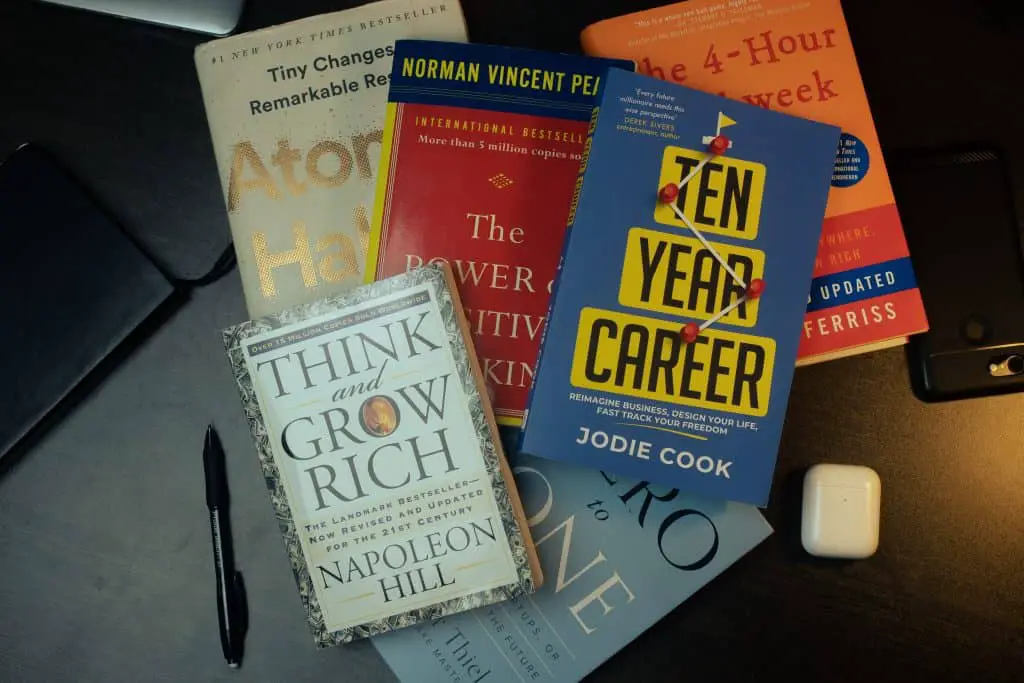

What are the best books on finance for beginners?

Some of the best finance books for beginners include:

“The Little Book of Common Sense Investing” by John C. Bogle

“Your Money or Your Life” by Vicki Robin and Joe Dominguez

“The Psychology of Money” by Morgan Housel

“I Will Teach You to Be Rich” by Ramit Sethi

“Meaningful Money” By Pete Mathew

What are the best books on making money?

Here are some of the best books that provide insights on making money:

“Think and Grow Rich” by Napoleon Hill

“Rich Dad Poor Dad” by Robert Kiyosaki

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

“The 4-Hour Workweek” by Timothy Ferriss

“The Richest Man in Babylon” by George S. Clason

“The Lean Startup” by Eric Ries

“Crushing It!” by Gary Vaynerchuk

“The $100 Startup” by Chris Guillebeau

“Side Hustle: From Idea to Income in 27 Days” by Chris Guillebeau

What are the best books about money and investing?

Here are some of the best books about money and investing:

“The Intelligent Investor” by Benjamin Graham

“A Random Walk Down Wall Street” by Burton Malkiel

“Common Stocks and Uncommon Profits” by Philip Fisher

“The Little Book of Common Sense Investing” by John C. Bogle

“Rich Dad Poor Dad” by Robert Kiyosaki

“The Essays of Warren Buffett” by Warren Buffett and Lawrence Cunningham

“The Psychology of Money” by Morgan Housel

“Thinking, Fast and Slow” by Daniel Kahneman

“The Most Important Thing: Uncommon Sense for the Thoughtful Investor” by Howard Marks

What are the top 10 books for financial literacy?

United States:

“Rich Dad Poor Dad” by Robert Kiyosaki

“The Total Money Makeover” by Dave Ramsey

“Your Money or Your Life” by Vicki Robin and Joe Dominguez

“The Automatic Millionaire” by David Bach

“The Little Book of Common Sense Investing” by John C. Bogle

United Kingdom:

“The Money Diet” by Martin Lewis

“The Financial Times Guide to Personal Finance” by Stuart Warner

“Money: A User’s Guide” by Laura Whateley

“How to Own the World” by Andrew Craig

“The Meaningful Money Handbook” by Pete Matthew

These books cover a range of topics, including budgeting, investing, debt management, and overall financial planning. They are all written in an accessible way, making them great resources for anyone looking to improve their financial literacy.

What are the best finance books of all time?

Here are some of the best finance books of all time that have shaped the field of personal finance and investing:

“The Intelligent Investor” by Benjamin Graham

“A Random Walk Down Wall Street” by Burton Malkiel

“Rich Dad Poor Dad” by Robert Kiyosaki

“Think and Grow Rich” by Napoleon Hill

“The Richest Man in Babylon” by George S. Clason

“Common Stocks and Uncommon Profits” by Philip Fisher

“The Essays of Warren Buffett” by Warren Buffett and Lawrence Cunningham

“Security Analysis” by Benjamin Graham and David Dodd

“The Little Book of Common Sense Investing” by John C. Bogle

“Your Money or Your Life” by Vicki Robin and Joe Dominguez

These books offer timeless wisdom on investing, wealth building, and financial management and are recommended reads for anyone interested in finance.

Wrapping Up 🎁💡Probably the best book about money

Understanding money is not just about understanding numbers, it’s about understanding yourself and your behaviour. It’s a journey, not a destination. So, take these steps one at a time and enjoy the process. Remember, even the wealthiest people started from zero. So, don’t be discouraged if you’re just starting out. Keep learning, growing, and laughing all the way to the bank 😄💰.

I hope you found this blog post helpful and entertaining. If you have any questions or comments, feel free to set up a call. Until next time, keep those coins jingling and those £$ stacking! 💸💸💸

At Financially Happy Money Coaching, I understand that money isn’t just about numbers. It’s about emotions, behaviours, and life choices. That’s why we’re here to help you take the stress out of money and build wealth in a way that aligns with your values and lifestyle.

Whether you’re just starting out on your financial journey or you’re looking to take your finances to the next level, we’re here to guide you every step of the way. I’ll help you understand your financial behaviours, set realistic goals, and create a personalized plan to achieve those goals.

So, why wait? Start your journey towards financial happiness today. Remember, the best time to start was yesterday. The second best time is now.

Click here to schedule your consultation and let’s make your money work for you, not vice versa. 💪💰

Remember, financial freedom isn’t a destination; it’s a journey. And every journey is easier when you have a guide. So, let’s embark on this journey together and create a financially happy future. 🚀💸

If you’ve made it this far, congratulations! You’re already taking steps towards a healthier financial future. But maybe you’re feeling a bit overwhelmed. Maybe the of budgeting, saving, and investing still makes you break out in a cold sweat. Don’t worry, you’re not alone, and help is available.

At Financially Happy Money Coaching, I understand money isn’t just about numbers. It’s about emotions, behaviours, and life choices. That’s why we’re here to help you take the stress out of money and build wealth that aligns with your values and lifestyle.

Whether you’re just starting out on your financial journey or you’re looking to take your finances to the next level, we’re here to guide you every step of the way. I’ll help you understand your financial behaviours, set realistic goals, and create a personalized plan to achieve those goals.

So, why wait? Start your journey towards financial happiness today. Remember, the best time to start was yesterday. The second best time is now.

Click here to schedule your consultation and let’s make your money work for you, not vice versa. 💪💰

Remember, financial freedom isn’t a destination; it’s a journey. And every journey is easier when you have a guide. So, let’s embark on this journey together and create a financially happy future. 🚀💸

📚 Financial Freedom Resources

- The Ultimate Guide To Building Your Savings to $100,000! 📘 is a transformative book that equips readers with principles, strategies, and the mindset 🧠 needed to reach a $100,000 savings goal 💰. It’s a journey towards financial freedom 🚀, challenging beliefs 🤔, embracing new habits 🔄, and overcoming obstacles 💪.

- How to Manage Your Finances: Your Guide to Financial Freedom 📘 is a comprehensive resource packed with practical advice on budgeting 💰, investing 📈, reducing debt 💳, and building wealth 💎. It’s an essential guide for anyone, novice or experienced, aiming to take control of their financial future and achieve financial independence 🚀.

Remember, self-study is a powerful tool for life and financial transformation. Happy reading! 🎉