Starting over at 40 with nothing (How to start over with no money)

Starting over at 40 with nothing, on the one hand, may be a nice place to reset things. Personally, professionally, socially and environmentally.

However, it may also be a personal and professional nightmare.

Starting over at 40 can seem daunting, but it’s not impossible. If you’re starting from scratch, here are a few things to keep in mind. First, set simple goals and be realistic about what you can achieve. Don’t try to do too much too soon. Second, take advantage of the resources around you. There are likely people who can help guide you and give you advice. Finally, stay positive and dont give up on yourself. With hard work and determination, you can achieve anything.

In this article we will cover how you can set your finances and life after a setback.

Figure out the big picture

In the immortal words from the Spice girls

Ha ha ha ha ha

Yo, I’ll tell you what I want, what I really, really want

So tell me what you want, what you really, really want

I’ll tell you what I want, what I really, really want

So tell me what you want, what you really, really want

I wanna, (ha) I wanna, (ha) I wanna, (ha) I wanna, (ha)

I wanna really, really, really wanna zigazig ah

Wise words I hear you say.

Now that you have this chance to reset, what do you really really want and what is it going to take to get there? In time, money and energy? And are you prepared to pay this price?

Some people say they want to be a highflying CEO, ok then are you prepared to work the 60+hours a week and spend a lot of time away from home (ok not right now but when things return to whatever normal is then)

What sort of life would you like? Do you want or for that matter need any of the below?

- To own your own place?

- Regular holidays (staycations for the millennia by the looks of it)?

- A new car every three or so years?

- To feel safe, stress-free, financially independent?

- Able to spend time with friends and family without worrying about work all the time?

- Free from money worries and financial anxiety?

- Able to retire in dignity or make work optional asap?

- Do you know what a basic, leisurely or luxury lifestyle might cost you personally?

Trade-offs are everywhere

Maybe you can have all these, perhaps you will need to choose and compromise with a few trade-offs, but can you guestimate what these needs and want might be?

You have the big house but can’t sleep at night because of the mortgage.

You don’t own you rent but have a decent amount saved, knowing that you can afford everything and move if needed.

These are all trade-offs. You have to choose yours.

Whatever your big picture is it’s likely going to cost some money. If you have no money right now, then you need to get some.

The best way to do that is to keep most of the money that comes your way rather than spending it.

The most significant trade-off is what you want right now vs what you want most. Make sure when you make decisions, especially spending decisions, you know which one this current move is heading towards.

You now have the first bit of data; where are you trying to get to. In envisioning your ideal life, you should also uncover your why.

Why do you want such a big house or to make work optional? And do you really, really, really want it zigazigah?

Gather all the data you will need

You need to gather a few key numbers to help you understand what, where and how to restart your finances.

How much do you spend?

Do you know how much you spend? Apart from all of it.

Knowing how much you spend and where you spend it will help you determine if it is going on the right things.

It might also help you understand how and where you could make some changes, cutting down or cutting out the less important things.

Using this saving to save or spend more on essential things, like time with friends and family.

If you use a money app like MoneyDashboard* it will do a lot of the tracking for you.

Figure out your net worth

So, what’s your financial baseline or where are you restarting from?

Do you know what your net worth is?

Everything you own minus everything you owe. This will help you figure out where you are starting from.

Hopefully, you are not starting from zero or minus zero but if you are you need to make your way back to broke.

What is your savings rate?

How much of the money that you earn do you get to keep?

Tracking your finances to understand how much of the money you earn is left over at the end of the month will show you your savings rate.

The higher your savings rate, the better your chances of growing your wealth.

Remember it’s not what you earn but what you keep that matters.

Once you review your spending, you might see if you can increase your savings rate without much lifestyle change.

Of course, you can see how frugal you want to go to maximise your savings rate. As far as you can comfortably but may not much further.

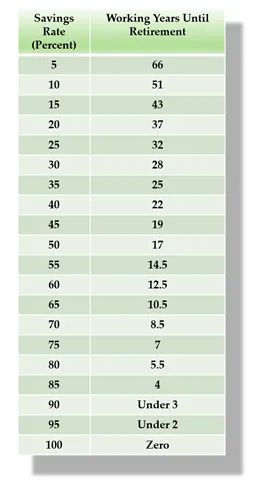

Your savings rate will have a significant effect on reaching your financial goals and financial freedom.

Here’s a great table and article from Mr Money Mustache explaining the savings rate vs year to retirement.

What’s your financial freedom number?

I know what you’re thinking “If I knew that I wouldn’t be here, would I, I would be on the beach”

This is the number when reached means work has probably become optional.

The way you work this out is.

How much do you spend a month X that by 25 or 30 if you want to be more conservative.

So, let’s say you spend £3000 per month x 12 is £36,000 per year.

£36,000 x 25 is £900,000 If you had this amount in income-producing assets and withdrew between 3-4% a year, work would likely be optional.

or

£36,000 X 30 is £1,080,000. If you had this amount in income-producing assets and withdrew between 3-4%, work would likely be optional

Now I know a few of you have already checked out because I started talking big numbers that seem ridiculous.

But you can adjust these numbers to more or less of the amount of lifestyle you want; the less you want, the smaller the number.

The more savings or investments you already have, the smaller the gap you need to bridge.

The more time you have to let compound interest work in your favour, the easier it will be to reach your financial freedom number.

If you want to talk about how this might work for you, let’s have a free chatLets talk

Your next three moves

1. Draft your what I really really want plan.

Make it clear and make sure you want it. No point in working hard for something you don’t really want.

Make sure it’s what you want, not what other people want or what you think you should want because other people want it.

2. Start saving. Set up an emergency fund of 3-6 months. Something that will help you ride out a rough patch or two. Keep this emergency fund topped up. It’s going to get you out of an emergency one day.

3. Start your wealth-building machine. Use your savings after building up an emergency fund to set towards your other goals.

Name these goals on your bank account, whether short, medium-or longer-term goals, i.e. house deposit, round the world (staycation) or retirement.

The longer the goal, the more you can consider investing the money for potentially higher returns (but you also need to be prepared to ride out some volatility and potentially more risk in the process)

Your process is the key

After starting over at 40 with nothing, your process will determine your success or otherwise.

The little things you do every day will be the tiny building blocks of success or otherwise.

Your daily habits, even your tiny habits around money, will be what builds your wealth or watch it slip through your fingers.

- Do you know where your money is going?

- Do you save first and then spend what’s left? OR spend and then see what’s left to save.

- Do you automate your key bills?

In the excellent book Atomic Habits by James Clear, he has 4 laws of habit making which I think translate well to building wealth.

Make it obvious – Set a weekly and monthly time to review your finances. Maybe the begging of the month or week when hope is at it highest, not the end when you are tired and fed up.

Make it attractive – keep pictures up of what you want nearby so you can see what you are working towards. Have mini-goals within the bigger goals and reward yourself with something you like when you reach them. Could you get a savings buddy to join you to high five (over zoom) when you reach a milestone?

Making it easy – you could automate it so that the saving happens. Name your bank accounts with what you want so the savings head straight towards their goal. Start small and then grow the saving. Use an app if that helps with some of the number crunching.

Make it satisfying. – Set up a wall planner or graph to show your progress. The charity fundraising thermometer might give you an excellent visual to show your savings and wealth going up.

What should I do with my life after 40?

More of what you like and less of what you don’t, just an idea.

Whatever it is, it will likely need some money, even a little.

Far better to have a safety net in place, i.e. an emergency fund to catch you in case you fall.

Far better to have some savings in place to experiment with new things without them being an all-or-nothing scenario.

These financial buffers or savings are going to take time. It can’t be cheated.

Using a credit card or loans to get somewhere fast might work, but possibly only up to the point when it needs to be paid back. Then it doesn’t work anymore.

Put together a plan, use a pen and piece of paper. Sketch out what good looks like and what steps you think you will need to do.

Will you need help from anyone?

And then start one step at a time.

Starting over in your 40s

Summary table for starting again at 40

| Starting over at 40 with nothing | Description |

|---|---|

| Assess your current situation | Take stock of your current circumstances, including your financial situation, skills, experience, and personal goals. |

| Create a financial plan | Develop a budget and financial strategy to rebuild your financial foundation, considering income, expenses, and savings goals. |

| Build an emergency fund | Set aside funds for unexpected expenses or emergencies to provide a safety net while you work towards rebuilding your life. |

| Identify your skills and talents | Assess your skills, talents, and areas of expertise that can be leveraged to explore new career opportunities or business ideas. |

| Explore education and training | Determine if additional education or training is necessary to pursue new career paths or acquire skills in high-demand industries. |

| Network and seek support | Connect with others in your desired field, join professional networks, and seek support from mentors or career counseling services. |

| Set realistic goals | Establish short-term and long-term goals that are attainable and aligned with your personal and professional aspirations. |

| Embrace lifelong learning | Cultivate a growth mindset and commit to continuous learning to adapt to changing industries and enhance your skillset. |

| Consider entrepreneurship | Explore the possibilities of starting your own business, leveraging your skills and expertise to create new opportunities. |

| Take care of your well-being | Prioritize self-care, maintain a healthy work-life balance, and seek emotional support to manage the challenges of starting over. |

FAQ: Starting over at 40 with no money

Is 40 too old to start over?

Figure out what you want in life.

List the actions you need to take to make the change

Figure out what money is going to be required and how you can create it

Execute your plan, reviewing a revising as you go.

How can I start over 40 with no money?

-Figure out your Goals.

-List the Actions needed.

-Calculate the Means you currently have and might need to create.

-Execute the plan, review and revise as needed.

How do you start over in your 40s?

-Get your financial poop in a group, and know what’s going on with your money.

-Figure out what good looks like, the necessary actions, and the means to get there. -Execute the plan day after day.

How do I start a new life with no money?

-Start reading, listening and watching things that will develop your knowledge, thinking and habits.

-Pay yourself first and spend what’s left, not the other way round. This will help you start to build your wealth again.

How do you start over in your 40s?

Figure out what’s working and not and make the changes needed.

Pay yourself first.

Up your knowledge, mindset and behaviours to build wealth in every area of your life.

How to start over at 42?

Maybe you want to focus on your career, health and fitness, or relationships with friends and family. Whatever you want to achieve, write down these goals and keep them visible so that you can refer back to them as needed.

Next, make a plan for how you’re going to achieve your goals. Maybe you need to carve out more time in your schedule for self-care or attend more networking events to help advance your career. Whatever needs to be done, break the tasks down into manageable steps and create a timeline so you can stay on track.

Finally, focus on staying positive and taking things one day at a time. It’s easy to get overwhelmed when starting over, but remember that you can accomplish anything you want. Stay focused on your goals, and don’t be afraid to ask for help when needed. Before you know it, you’ll be well on your way to a fresh start.

Lost everything at 40 now what?

OK, what does good look like from here? Set some clear financial, career and relationship goals. What do you want to accomplish in the coming months or years?

Write these goals down and review them regularly.

Then, make a plan for how you’re going to achieve your goals. Break the tasks down step by step.

Keep your eyes on the life you want to move towards, remembering the one you want to move away from. With determination and perseverance, you can overcome anything and start over at 40 with confidence!

How to start over in life with no money

First, try and cut back on your expenses as much as possible. This may mean lifestyle changes, such as giving up expensive habits or moving to a cheaper area. Every little bit you can save will help you in the long run.

Second, look for ways to earn money that don’t require a lot of upfront investment. You might consider freelance work, setting up an online store or blog, or finding creative ways to monetize your talents.

Third, build a support network of family and friends who can help you financially or emotionally during tough times. These people can be a great source of strength and motivation when things get tough.

Finally, remember that starting over is never easy but possible. Stay positive and focus on your goals, and you’ll eventually get back on your feet.

How to start over in life at 40

1. Let go of the past: One of the biggest hurdles to starting anew is letting go of what’s behind us. Whether it’s a failed relationship, job loss, or setbacks in our personal lives, it’s important to remember that the past does not define us. Allowing ourselves to move on from whatever isn’t serving us anymore will open up new opportunities for happiness and growth.

2. Embrace change: Our fear of change can hold us back from starting over. But if there’s one constant thing in life, it’s changed. Embracing it can be scary but can also lead to some of the most exciting and rewarding experiences. So go ahead and take that leap into the unknown!

3. Be open to new things: One of the best things about starting over is allowing us to try new things. Whether it’s a new hobby, job, or relationship, venturing into the unknown can be scary and lead to some of the most fulfilling experiences. So go ahead and explore!

4. Don’t be afraid to ask for help: Our pride can sometimes get in the way of asking for help, but starting over can be difficult to travel alone. Asking for help from friends, family, or professionals can make the journey much easier and help us find success.

5. Belief in yourself: One of the most important things to remember when starting over is to believe in yourself. No matter what challenges or obstacles come your way, know that you have the strength and resilience to overcome them. Trusting in yourself is the first step to building a better future.

Is 40 too old to start over?

How do I restart my life with no money?

Assess your situation: Take stock of your skills, experience, and assets. Determine what you can leverage to create a new opportunity.

Create a budget: Make a realistic budget that covers your basic needs, such as housing, food, and transportation.

Cut expenses: Cut out unnecessary expenses and find ways to save money on essential expenses.

Find work: Look for any work opportunities available, including part-time, freelance, or gig work. Consider volunteering or internships to gain experience and build your network.

Build a support system: Reach out to family, friends, or community organizations for support and guidance.

Consider education or training: Look for opportunities to improve your skills and qualifications, such as taking online courses or attending vocational training.

Starting over takes time and effort. Don’t be discouraged if progress seems slow at first. With persistence and determination, you can rebuild your life and create a brighter future for yourself.

How can I start my life again at 40?

Identify your goals: Consider what you want to achieve and what you’re passionate about. Set specific goals for your personal and professional life.

Create a plan: Develop a detailed plan to achieve your goals. Break it down into actionable steps, and be flexible in adjusting your plan as needed.

Build a support system: Surround yourself with positive and supportive people who will encourage and motivate you on your journey.

Improve your skills: Consider taking courses or training to enhance your skills and qualifications in your chosen field.

Network: Attend events and connect with others in your industry or interests to build relationships and expand your opportunities.

Stay positive and persevere: Starting over can be challenging, but staying positive and persevering through setbacks and challenges is essential for success.

Remember, it’s never too late to make changes and start anew. You can create a fulfilling and rewarding life at any age with a clear plan, hard work, and determination.

Is 45 too late to start over?

Many people have successfully made major changes and achieved great things well into their 40s and beyond. It’s essential to have a clear plan, be open to learning, and remain persistent in pursuing your goals.

With determination and a positive mindset, you can make a fresh start and build a bright future for yourself.

Summary: Starting over at 40 with nothing

Figure out the bigger picture – what do you really really want? It might take time to figure this out, but it will be worth it. Ensure you are heading off in the right direction, not someone else’s.

Figure out your four numbers,

- Your networth – where you are starting from

- Your monthly and yearly saving – where its all going and if you are happy with that.

- Your savings rate – how much of your money is left after all the spending. And can you do anything to increase this gap between spending and saving?

- Your freedom number – the place you might like to head to

What are your next 3 moves? You don’t need to know every next move; you just need to figure out a few of the small ones. They could be the next one or the next three. Just move to the next one and then the next one.

Your process is vital; what are the day-to-day habits that are going to make your journey more comfortable and faster?

What are your wealth, building or destroying habits?

Can you create new ones, modify or stop bad ones to help you start over at 40 with nothing but start heading to something asap?

What should I do after starting over at 40 with nothing?

Focus on what you want most and not necessarily what you want right now.

Anyway, those are my thoughts on starting over at 40 with nothing.

Need a Helping Hand with Your Finances? 🤝💰

If you’ve made it this far, congratulations! You’re already taking steps towards a healthier financial future. But maybe you’re feeling a bit overwhelmed. Maybe the thought of budgeting, saving, and investing still makes you break out in a cold sweat. Don’t worry, you’re not alone, and help is available.

At Financially Happy Money Coaching, I understand that money isn’t just about numbers. It’s about emotions, behaviours, and life choices. That’s why we’re here to help you take the stress out of money and build wealth in a way that aligns with your values and lifestyle.

Whether you’re just starting out on your financial journey or you’re looking to take your finances to the next level, we’re here to guide you every step of the way. I’ll help you understand your financial behaviours, set realistic goals, and create a personalized plan to achieve those goals.

So, why wait? Start your journey towards financial happiness today. Remember, the best time to start was yesterday. The second best time is now.

Click here to schedule your consultation and let’s make your money work for you, not vice versa. 💪💰

Remember, financial freedom isn’t a destination; it’s a journey. And every journey is easier when you have a guide. So, let’s embark on this journey together and create a financially happy future. 🚀💸

📚 Financial Freedom Resources

- The Ultimate Guide To Building Your Savings to $100,000! 📘 is a transformative book that equips readers with principles, strategies, and the mindset 🧠 needed to reach a $100,000 savings goal 💰. It’s a journey towards financial freedom 🚀, challenging beliefs 🤔, embracing new habits 🔄, and overcoming obstacles 💪.

- How to Manage Your Finances: Your Guide to Financial Freedom 📘 is a comprehensive resource packed with practical advice on budgeting 💰, investing 📈, reducing debt 💳, and building wealth 💎. It’s an essential guide for anyone, novice or experienced, aiming to take control of their financial future and achieve financial independence 🚀.

- Mastering Budgeting in Your 40s: Your Guide to Financial Freedom 📘 is your essential roadmap to financial savvy. Packed with tips on budgeting 💰, investing 📈, and debt management 💳, it’s the perfect toolkit for anyone in their 40s looking to secure their financial future and sail towards independence 🚀.

Remember, self-study is a powerful tool for life and financial transformation. Happy reading! 🎉