Where should I be financially at 40? Take these key actions at 40 before you regret them.

Where should I be financially at 40?

Ideally, you want to be in a position where most of your financial pressures are starting to ease and a comfortable work optional life is beginning to come into view.

The opposite of that, i.e., growing financial pressures and a limitless work horizon, will probably be suboptimal.

Act now to ensure regret minimization. Save, invest and protect yourself from bumps in the road and especially a difficult later life.

Maybe you thought you would never be 40!

Well, suck it up as it will be a blink of an eye before you are double that.

Read on to hear how to improve your financial situation at 40—taking you from where you are to where you should be financially at 40.

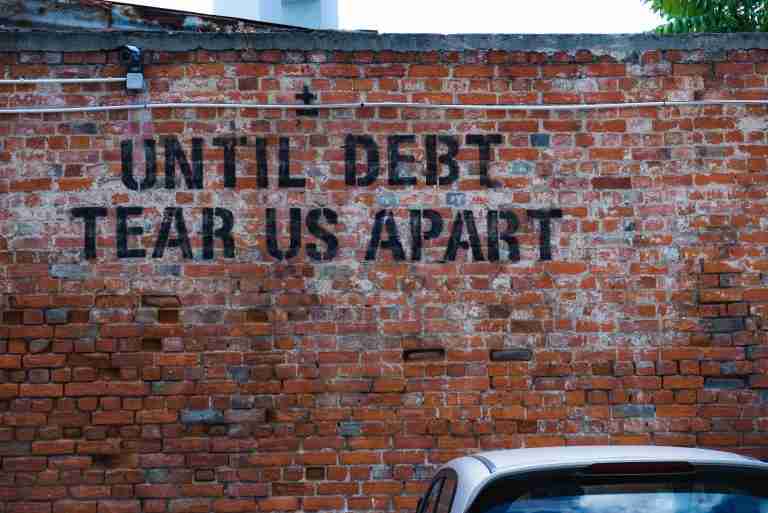

In as little debt as possible

What’s your poison, and how much more do you want to take of it?

- Credit and store card debt

- Payday loans

- Car loans

- A massive mortgage

- Etc etc

These are financial poison eating away at your wealth from the inside.

You will find it nearly impossible to get anywhere financially if you are dragging some or all of these debts around.

The more you can do to pay off and become independent from the need for debt, the better.

How you decide to get rid of them might be the main challenge.

The first suggestion is to stop digging and don’t take on any more debt.

The second suggestion would be to figure out your method for getting rid of your debts.

You could use the snowball method – paying off the smallest debt first and then moving to the next

Or

You could use the avalanche method, starting with the biggest or most expensive debt first and then moving to the next.

The snowball method possibly has some psychological benefits, and you should see your small debts getting paid off and off your books pretty quickly.

The avalanche method has some mathematical advantages as this will probably see you save the most debt payments as you are getting rid of the costliest ones first.

So you just have to figure out the feelings or numbers you are most motivated and rewarded by?

Dragging around any weight in your 40’s which you may have gathered around your waist or as debt, will not be much good for you in the long term.

And debt is terrible for making work optional one day.

Collecting more assets than liabilities

In short, this means collecting more things that pay you, and you pay them.

The collection of stuff, TVs, cars, clothes, gadgets etc., are all things that take money away from you and often need more money to maintain, fix and store than year after year.

Things are nice but in moderation.

Assets, on the other hand, pay you.

- Rental property

- Stocks and shares

- Businesses

- Physical and digital assets like books and courses you produced.

If one or more of these can pay you an ongoing income, they might one day help to make full time and then all paid work optional, which would be nice.

Collecting assets can take time, money and energy to happen, but they are far more effective at freeing you from the need to work than collecting stuff that are just liabilities.

The dream scenario is that you collect assets that provide you with a passive income.

Passive meaning you don’t have to do much to keep the money coming in. It’s something you can produce once but keep selling it over and over.

Full disclosure, even passive assets require some active actions to get them set up.

You might need to:

- Write that book or course

- Film and produce those YouTube videos

- Record those songs

- Manage the rental property/s

But with the right design, passive income should mean a lot fewer work hours than a 9-5, if that’s what you want.

Well protected from disaster

Now you have reached 40; you are probably starting to realize that you’re not going to live forever and that life can become complicated quickly.

By 40, a lot may have happened that has smoothed and ruffled your feathers

- Marriages coming and going

- Kids arriving and destroying most of your dreams

- Parents needing care and or passing away

- Good and bad jobs, bosses and opportunities coming and going

- Good and bad health experiences, including death (but not your own, yet)

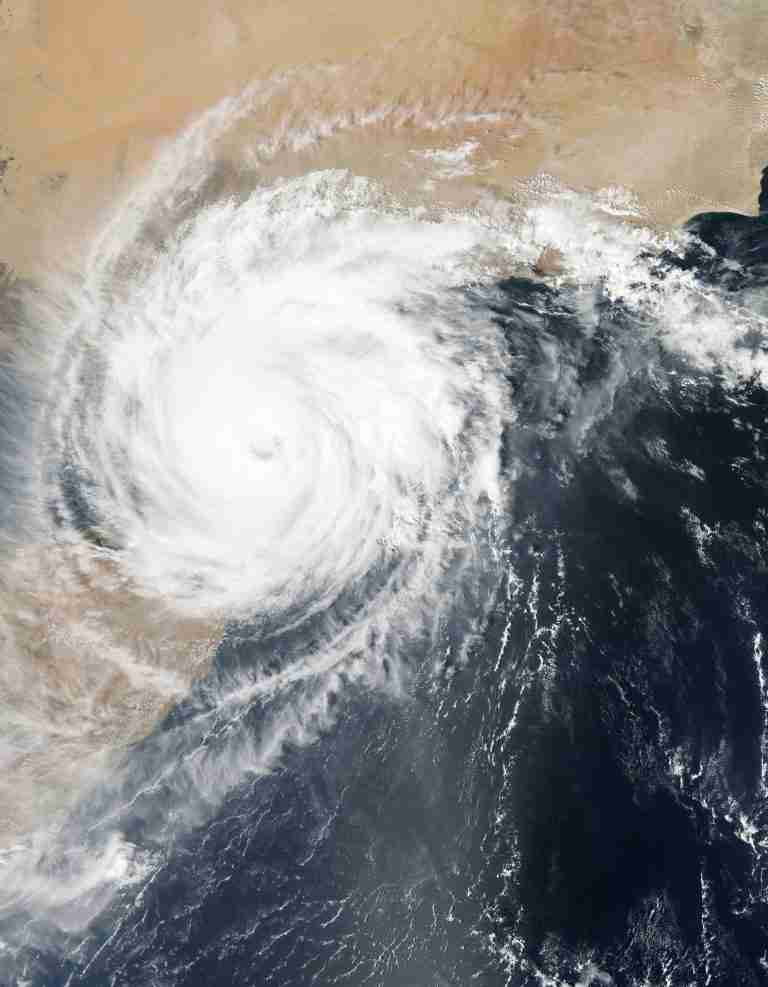

All these experiences can, without the right protections in place, cause a crisis to turn into a disaster.

Protecting yourself from misfortune also ruining your finances is a key action to take in your 40’s.

Many types of insurance can mitigate, prevent and help you recover from some of the financial shocks.

Income protection – protecting you from a loss in income through ill health or injury. This provides you with a proportion of your income for a set period.

Critical illness – paying out a lump sum if you are diagnosed with something nasty.

Life insurance – in case you or someone you love loses their life. This is usually paid out a lump sum to cover the loss of income over a set number of years. Remember when someone dies that was an income source you have lost that income for all the years they would have worked!!

You may get some of the above through your workplace, so you just need to check if it would be useful to top this up with some of your cover.

It’s not just the shock of losing an income that you are thinking about but also the cost of caring or coping without someone you need to consider in protection for you and your family.

One key component of protecting yourself will be your won emergency fund.

An emergency fund is at least 3-6 months of livings costs easily available in cash to deal with shocks that need money to cope with them.

- House or car repairs

- Medical bills

- Unexpected travel

- Loss of an income

Your emergency fund is to help prevent you from taking on debt to deal with a short-term crisis.

Whether you feel 3-6 months or more is needed in your circumstances, what would help you sleep at night knowing you could cope with nearly anything?

Imagine if, all of a sudden, most businesses shut down for about a year. Could you cope without an income for that long?

With a will in place

Now you’re in your 40’sits possible that you will have some people that need you around.

It might be a partner, children and or older parents all who rely on you in some way and likewise for you relying on them.

If the worst was to happen, does anyone know:

- Where your assets and liabilities are and what you would like to happen to them.

- Bank account details?

- How do you hope your children or loved ones will be looked after?

- Your business or other commitments and what to do with them?

Don’t leave this to chance, as rumoured wishes or half promises will only leave big problems for those left behind to pick through the mess.

Get a will to make sure it’s all clear and legal what you want to happen when you are no longer around.

Maxing out your free money offers

Once you have crossed 40, you are probably starting to realize you are not immortal anymore.

You may also be starting to think about when work can become optional.

All the money you can save towards making work optional will speed up that journey and make your later life a lot more comfortable, dignified and full of options in retirement. Whatever retirement means to you.

If you want to avoid being poor in your old age, now is the time to do it before it’s to late.

If you are employed, you will likely have a workplace pension, otherwise known as FREE MONEY.

Make sure you are getting as much FREE MONEY as you can.

If you are self-employed, then YOU are in charge of your pension savings. Don’t cheat your future self of a dignified retirement.

Cheeping out on yourself for short term gain will only end up with long term pain when you have nothing to make work optional saved up.

Remember the difference between what you want most, i.e., comfortable and dignified in later life, and what you want right now, i.e. to consume stuff.

Creating more income at 40

With your skills and experience, could you create more or additional sources of income?

Creating more income is going to be your greatest accelerator in reaching a optional work lifestyle.

- Ask for more money

- Get qualified

- Start a side hustle

If you rely on just one or two sources of income in your household, you might find it’s a shaky place to be if one of you has a disruption in your income.

Could you use your unique skills, experience, knowledge and or interests to create another source of income?

Would a side hustle that you can do for fun or money create another source of income that you could grow over the long term?

Creating content to solve a problem or entertain could be turned into an income source, either selling the product or putting adverts where people can see them that you get paid for.

With the internet, there are several low-cost ways to start a side hustle.

- YouTube videos

- Blogs

- Informational products

- Books

- Facebook or Google My Business pages

All the above can be started at no or low cost to attract people to your offer and sell face-to-face or just online.

It’s probably going to take time to make money, especially serious money, but as time passes, why not use it to earn and learn on the way.

Creating your own freedom business might be the way you break out of the daily commute and 9-5 lifestyle.

At least it will add a little extra money to the pot and might well become your main income with time.

Everything compounds even small bits of income here and there.

If you would like to talk about starting your own freedom business, find out more here.

Planning for a long life

Although life may feel like it’s over at 40, you probably have at least the same amount of life ahead of you unless you know better!

So planning for the long term will help make sure now and later are both as comfortable as they can be.

What sort of life do you want at different stages of your life? At 50, 60, 70, 80 and 100!!

Probably better not relying on the kindness of strangers or the state.

Who knows what the future will look like this or that party will be in power, and will they have your best interest at heart?

No, the only one that has your best interests at heart is you; when you’re not sabotaging your future, that is, though.

This isn’t about saving up all your fun for old age.

It’s about being kind to your current and as yet unknown future self and family.

In planning for the longer term, you might well want to look at

- What are you good at and want to do more of?

- What do you like doing?

- What do other people need?

- What will people pay you for?

Finding the right combination of these might help you better plan for the long term rather than just head down for 40 years and hope you come out the other end with enough money to retire.

Here at Financially Happy, we help people plan for a great long life. Creating wealth in every area of your life, not just your bank balance.

Designing your own GAME Plan might be the best investment you have ever made.

FAQ: Where should I be financially at 40

How much should a 40 year old have in savings?

Probably more than you have got, but that all depends on what you want to do with the money.

Enough so that full-time work looks like it will be optional one day; the sooner, the better.

At least enough to fill your 3-6 months emergency fund.

And more if you want to have options like changing careers, taking time off for travel, studies, or caring responsibilities.

Enough that you don’t feel the need to constantly work to earn more and more money.

What can I do financially in my 40s?

Start saving, if you haven’t already

Start investing

Pay off debt

Protect yourself and your loved ones

Plan or the life you do want rather than what you’re going to have to accept

How wealthy should you be at 40?

This all depends on what you want to do with the wealth, i.e. when do you want work to become optional?

Wealthy enough that a work-optional life is coming into view.

Having more assets than liabilities.

Can I be a millionaire by 40?

You could, but it’s going to take a fair amount of action in your 20’s and 30’s.

Saving, investing and growing your income.

You will need to become financially literate and understand the difference between assets and liabilities.

You will need to invest in your development and things that can make and grow your money; these could be property, shares and or businesses.

How to be financially free by 40?

Save first and spend what’s left.

Upgrade your financial literacy with books and podcasts

Invest spare cash in income-producing assets like property, stocks, or businesses.

Start a plan and keep to it.

Summary: Where should I be financially at 40?

Yep, if you have already, then it’s time to take action at 40 to build your financially free life.

Getting out of debt will go a long way to make your finances a lot healthier and increase your net worth, never mind getting rid of that dragging feeling.

Protecting yourself and the ones around you will give you some serious peace of mind knowing those left behind will be able to cope with the shock of a loss.

Having a will in place will make it clear what your wishes were and what to do for everyone. Don’t leave a mess behind for others to clear up.

Max out your retirement savings to get as much free money as possible and fits in with your work optional goals.

Start planning for a great life and take the actions needed now before you start regreatting what you could have done in your 40’s.

Even at 40, although it may feel like it’s all downhill from here, you may still have 40+ years of life to live.

Making sure it’s a comfortable, dignified and secure lifestyle will be well worth the investment and cost right now. Poverty and old age is not a good mix.

Anyway, those are my thoughts on Where should I be financially at 40; let me know yours in the comments below.

Thanks for dropping by.

If you’ve made it this far, congratulations! You’re already taking steps towards a healthier financial future. But maybe you’re feeling a bit overwhelmed. Maybe the of budgeting, saving, and investing still makes you break out in a cold sweat. Don’t worry, you’re not alone, and help is available.

At Financially Happy Money Coaching, I understand money isn’t just about numbers. It’s about emotions, behaviours, and life choices. That’s why we’re here to help you take the stress out of money and build wealth that aligns with your values and lifestyle.

Whether you’re just starting out on your financial journey or you’re looking to take your finances to the next level, we’re here to guide you every step of the way. I’ll help you understand your financial behaviours, set realistic goals, and create a personalized plan to achieve those goals.

So, why wait? Start your journey towards financial happiness today. Remember, the best time to start was yesterday. The second best time is now.

Click here to schedule your consultation and let’s make your money work for you, not vice versa. 💪💰

Remember, financial freedom isn’t a destination; it’s a journey. And every journey is easier when you have a guide. So, let’s embark on this journey together and create a financially happy future. 🚀💸

📚 Financial Freedom Resources

- The Ultimate Guide To Building Your Savings to $100,000! 📘 is a transformative book that equips readers with principles, strategies, and the mindset 🧠 needed to reach a $100,000 savings goal 💰. It’s a journey towards financial freedom 🚀, challenging beliefs 🤔, embracing new habits 🔄, and overcoming obstacles 💪.

- How to Manage Your Finances: Your Guide to Financial Freedom 📘 is a comprehensive resource packed with practical advice on budgeting 💰, investing 📈, reducing debt 💳, and building wealth 💎. It’s an essential guide for anyone, novice or experienced, aiming to take control of their financial future and achieve financial independence 🚀.

Remember, self-study is a powerful tool for life and financial transformation. Happy reading! 🎉