Life Planning for Couples: How to Plan Together and Find the right Balance in Life and money

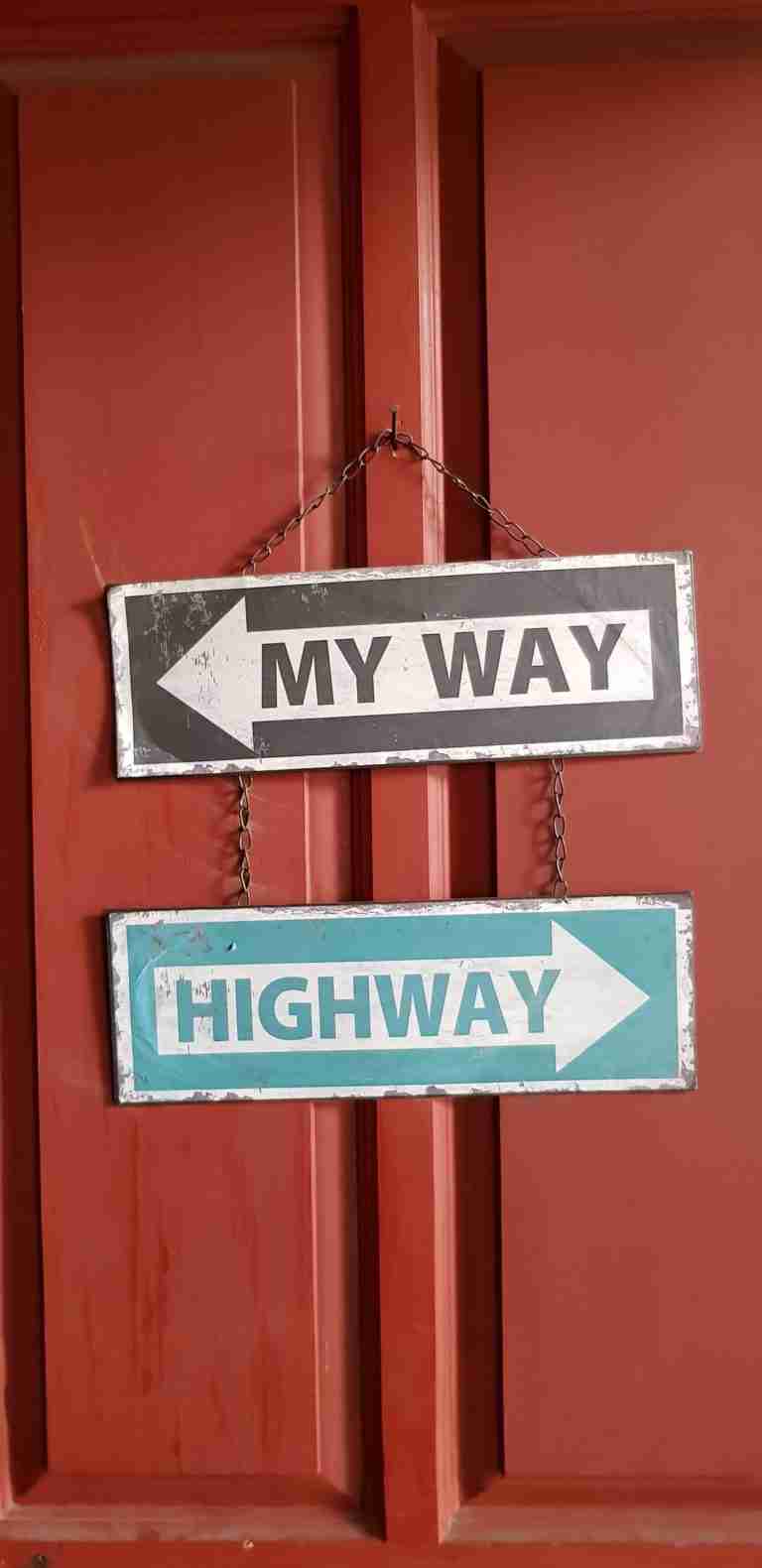

We’ve all seen life partners who seem to be following life on two different paths.

This remains one of the key challenges when life planning for couples. How to have both partners heading in the same or at least similar directions.

One partner is the spender and one is the saver (The never-ending battle between good and evil, you decide which one you are)

One wants to buy a house while the other wants to wait until they have more money saved up first.

This type of life planning or the lack of it can lead to arguments, frustration, and stress in life partnerships.

Planning for life is hard, especially when you’re trying to do it as a couple. Money is often a source of tension and conflict, and it can be tough to find the balance between what you want right now and what you want most in life.

But it doesn’t need to be this way! This blog post will discuss how life planning with your spouse can help you find the right life balance.

The challenge of life planning for couples.

When it comes to life planning, many couples find themselves at a standstill because they can’t seem to agree on anything.

One person wants to move while the other wants to stay where they are. Or one partner wants to retire at 55 while the other wants to work until they’re 70! This is the classic push me, pull you and often ends in a lot of frosty siliences if not divorce.

One of the first things you’ll need to do is sit down with your partner and figure out what you both want most in life.

What are your shared goals?

Are there any areas where you disagree?

What does good look like for both of you separately and together?

Once you understand what each other needs and wants, it’s time to start creating a plan that balances these desires.

This may mean one person has to rethink their life path. For example, if you want a baby and your partner doesn’t, it may mean that you need to wait until the timing is right for both of you.

Putting money in the mix

As life partners, you can also rely on each other for financial advice too!

Should I do this or that is often bounced off our nearest and dearest or you’re the type of person that does first and then asks for forgiveness.

Talking about money can be helpful at times, there are also times when it can lead to more tension and worry.

One partner may be a saver while the other is a spender, which can create some financial anxiety. It’s important to remember that these differences are okay! As long as you’re communicating openly with each other, you can find ways to work through any money-related tensions.

Finding out how the saver can save and the spender can spend without either being worried or feeling constrained will be a key to a happy balanced life.

How to find balance in life and finances

When it comes to life and money, balance is key.

You want to have enough time for work, family, friends, and yourself – without feeling overwhelmed or stretched too thin. And when it comes to finances, the same principle applies: you want to be able to save for your future while enjoying life today.

So how can you find balance in life when it comes to finances? Here are a few tips:

-Start by sitting down and creating a budget together. This will help you see where your money is going and identify areas where you can make easy savings without to much compromise.

-Think about your short-term and long-term life goals. The more you can align your life and money plan with these, the better off financially (and emotionally) you’ll be.

-Make sure that achieving both life and financial goals is on your to-do list every day – if not twice a day! That way it will always stay at the top of your mind.

How to remove financial anxiety from your life.

Anxiety about money is one of the leading causes of stress in marriages partnerships.

It can cause tension and conflict in relationships, and it can keep you from achieving your most important goals.

But it doesn’t have to be that way.

There are steps you can take to remove financial anxiety from your life and to achieve a more peaceful relationship with money.

The first step is to identify the sources of your anxiety.

What are you worried about?

- Are you afraid you won’t have enough money to live on?

- Are you concerned that you’ll never be able to retire?

- Do you worry that a financial emergency will ruin your life?

Once you know what’s causing your anxiety, you can start to address it.

The next step is to create a financial life plan.

This doesn’t have to be a complicated process, but it should include a goal for your money and a strategy for reaching that goal. It’s also important to establish some boundaries when it comes to spending and saving.

You don’t want to worry about money all the time, so it’s important to make this a priority.

For life planning for couples, you need to consider your goals and dreams together. It might be easy enough when it comes to deciding what kind of house or car you want in the future but other things can get more complicated like whether or how many kids you want in the long run and how you want to spend your life.

In life planning for couples, it’s also important to take into account the differences between each person and how they view money differently which can lead to a lot of stress in different areas of life whether it be related to spending or saving. In most cases, this is where life plans tend to break down

Understanding where your money mindsets come from might be a good starting point.

How was money managed and viewed when you were a child – it’s likely this is affecting how you view money now.

What things are you carrying over from your childhood that are and are not helpful?

What is your money for?

How you use your money for material and non-material things is often the key to finding happiness and balance in life.

- Is your money for stuff and buying more of it?

- How are you balancing your short terms needs with your long-term needs?

- Food, water, shelter, medical, enjoyment, and luxuries now and in the future?

Material things are fairly easy to quantify, I either have the latest TV or I don’t.

But how do you quantity less material things that your money can help buy like, freedom, time, security, and peace of mind?

The difficult trade-offs often between material and non-material i.e. I have the plasma TV but I don’t have the freedom.

Financial planning tips for couples

Live within your means or spend less than you earn. One of the most important tenets of financial planning is to live within your means.

This means that you should not be spending more money than you have coming in each month. It may be tough at first, but over time, you will find it easier to stick to this rule.

Paying yourselves first is the key foundation to building wealth. This means setting aside money for yourselves before you pay any other bills. It can be a difficult habit to get into, but it’s one that will pay off in the long run.

Have a shared budget. One of the most important things you can do as a couple is to have a shared budget. This will help you stay on track with your finances and give every dollar or pound a job to do for you.

Nobody cares about your money more than you.

Deal with your debt. If you have high-interest credit card debt, it’s best to pay that off as soon as possible. If you have student loans or other types of debt with low-interest rates, those can be paid off later. High-interest debt is the most important to pay down first because it’s costing you more money in interest, which means it’s a great drag on your time, money, and energy until it’s gone.

If you are in debt crisis, speaking to CAP or STEP Change might be your next step.

Know your numbers. Figure out your net worth, savings rate, and freedom number. You should be tracking these numbers to know if you are heading in the right direction.

Ideally, your network is growing and your savings rate is a high one. Both of these will help accelerate you towards your freedom number.

Don’t compare yourself with others – this is the fast track to misery. You never know who is actually up to their ears in debt, is being subsidized or actually has the money for the celeb lifestyle.

Play your own money and life game not someone else’s

Get creative with your income. Instead of seeing your only option as working for someone else, get creative and think about ways to make money on the side.

You could start a small business in which you get paid directly from customers using the talents, skills, and interests you already have.

Have a think about what you are good at, enjoy doing and people might pay you for?

Addressing tensions that can occur when planning together.

Tips:

- communication with each other about life plans needs to happen regularly in order to make progress together

- life planning for couples should be a lifelong process – things may change along the way.

- If your life plan is starting to drift off track when it comes to saving money or spending too much then it’s important that you

- Don’t forget your sense of humor after all you married each other so must have had one once! Differences are okay, as long as you’re communicating openly.

- Life is always changing, so it’s important to stay flexible, reviewing and revising things as life and circumstances change.

FAQ: Life planning for couples

How to create a relationship plan for couples?

A good relationship plan for couples should include the following:

1. Communication – Be sure to communicate openly and honestly with your partner about your finances. This includes discussing your goals, your budget, and your spending habits.

2. Transparency – Be transparent with each other about your financial situation. This means sharing your income, debts, and expenses.

3. Teamwork – Work together as a team to reach your financial goals. This includes setting a budget, sticking to it, and making decisions together about your spending and saving.

4. Professional help – Seek professional help when needed in order to achieve financial stability and security. This could include meeting with a financial planner oraccountant.

5. Trust – Lastly, trust is essential in any relationship, especially when it comes to finances. Be sure you trust your partner with your financial information and feel comfortable discussing money matters.

Summary: Life Planning for Couples: How to Plan and Find Balance in your lives together.

Many couples find themselves at a standstill when it comes to life planning. One partner wants to do one thing, while the other partner wants to do something completely different. This can lead to tension and arguments over money and goals. But with a little bit of work and compromise, you can find balance in life planning as a couple. Here are some tips:

– Work together to come up with a plan that fits both of your needs and wants.

– Balance your short-term and long-term goals.

– Plan for bumps in the road, so you’re prepared for any unexpected challenges that may arise.

– Take action! The only way to make progress is by taking steps towards your goals.

Do you have any questions about life planning for couples? Let us know in the comments below! We’ll be happy to help! And don’t forget you can set up your free clarity call here.